SIF Trading Predictions

1 Day Prediction

Target: April 4, 2025$32.5

$32

$33.2

$31.8

Description

The stock shows a bearish trend with a recent drop. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, and volume spikes indicate selling pressure. Expect a slight recovery but remain cautious.

Analysis

Over the past 3 months, SI=F has shown a bullish trend until recently, with significant resistance around 35.0. The recent drop indicates a shift, with support at 31.8. Technical indicators show mixed signals, with RSI suggesting oversold conditions but MACD indicating bearish momentum.

Confidence Level

Potential Risks

Market volatility and potential news could impact the price significantly.

1 Week Prediction

Target: April 11, 2025$33

$32.5

$34

$31.5

Description

Expect a recovery as the stock may find support at 31.8. The RSI is improving, and a bullish divergence is forming. However, MACD remains bearish, indicating potential resistance at 34.0. Watch for volume trends for confirmation.

Analysis

The stock has experienced a recent downturn, breaking below key support levels. The overall trend is bearish, but signs of recovery are emerging. Volume analysis shows increased selling pressure, and the ATR indicates rising volatility, suggesting caution.

Confidence Level

Potential Risks

Unforeseen market events or economic data releases could alter the trend.

1 Month Prediction

Target: May 3, 2025$34.5

$33

$35.5

$32

Description

A potential recovery is anticipated as the stock stabilizes. The RSI is expected to normalize, and MACD may cross bullish. Watch for resistance at 35.0. Volume trends will be crucial in confirming this upward movement.

Analysis

The stock has shown a bearish trend recently, but with signs of stabilization. Key support at 31.8 and resistance at 35.0 are critical levels. Technical indicators suggest a potential reversal, but caution is warranted due to recent volatility.

Confidence Level

Potential Risks

Market sentiment and macroeconomic factors could lead to unexpected volatility.

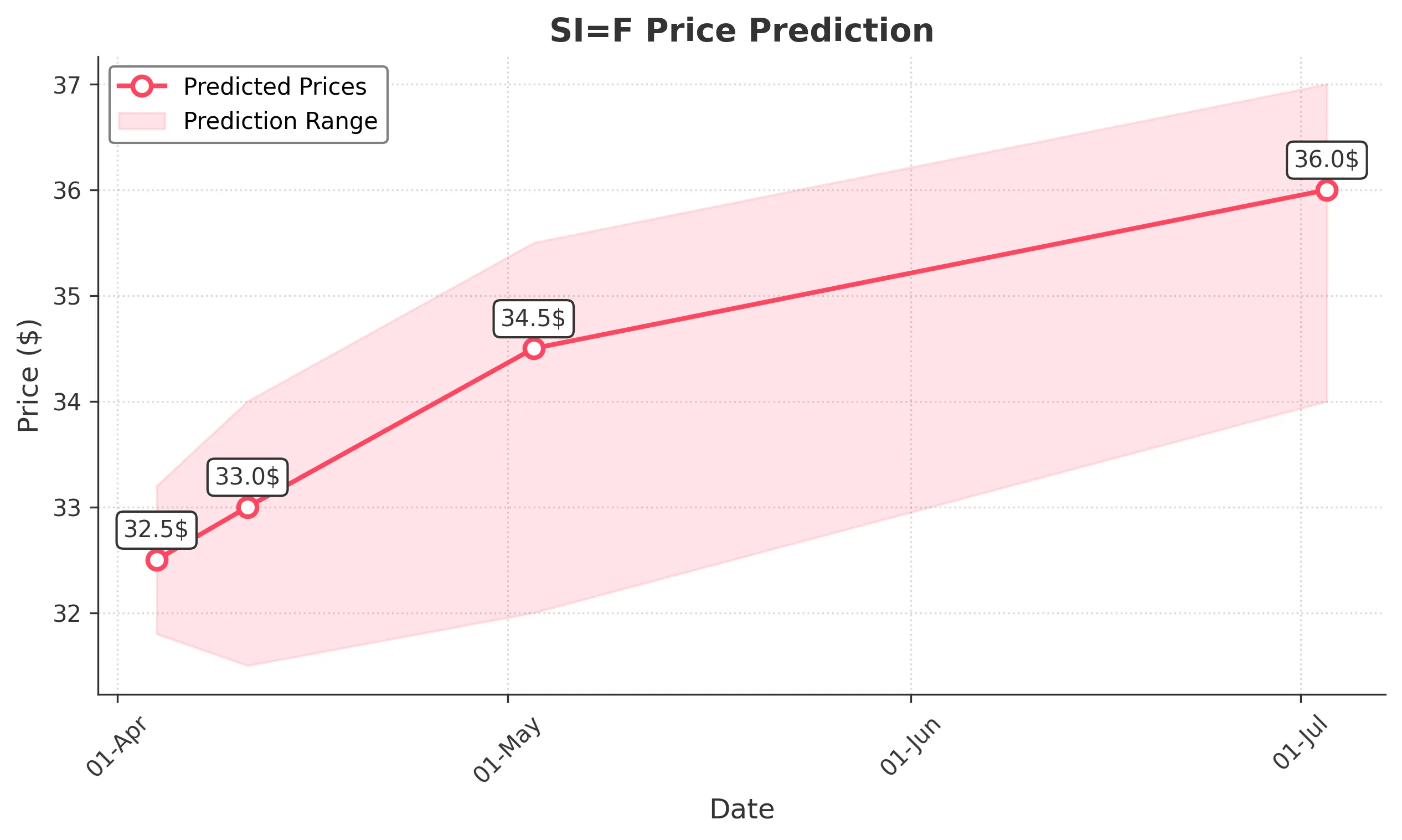

3 Months Prediction

Target: July 3, 2025$36

$35

$37

$34

Description

Long-term bullish sentiment is expected as the stock may break through resistance levels. Positive macroeconomic indicators and improved market sentiment could drive prices higher. Watch for confirmation from volume trends.

Analysis

The stock has shown a mixed performance over the past 3 months, with a recent bearish phase. However, the overall trend remains bullish, with key support at 31.8 and resistance at 35.0. Technical indicators suggest potential upward momentum, but external factors must be monitored.

Confidence Level

Potential Risks

Economic downturns or negative news could impact the bullish outlook.