SIF Trading Predictions

1 Day Prediction

Target: June 14, 2025$36.5

$36.4

$36.8

$36.2

Description

The stock shows bullish momentum with a recent close above the 50-day moving average. RSI indicates overbought conditions, suggesting a potential pullback. However, strong volume on recent days supports upward movement.

Analysis

The stock has been in a bullish trend, recently breaking resistance levels. The 50-day moving average is trending upwards, and volume has increased, indicating strong buying interest. However, the RSI suggests caution as it approaches overbought territory.

Confidence Level

Potential Risks

Potential for a pullback due to overbought RSI levels and market volatility.

1 Week Prediction

Target: June 21, 2025$36.8

$36.6

$37.2

$36.3

Description

Continued bullish sentiment with the stock maintaining above key moving averages. The MACD shows a bullish crossover, and volume remains strong, indicating sustained interest. Watch for potential resistance at 37.00.

Analysis

The stock has shown resilience with a strong upward trend. Key support levels are holding, and the MACD indicates bullish momentum. However, external economic news could introduce volatility, and resistance at 37.00 may pose a challenge.

Confidence Level

Potential Risks

Market sentiment could shift due to external economic factors, impacting the bullish trend.

1 Month Prediction

Target: July 13, 2025$37.5

$36.9

$38

$36.8

Description

The stock is expected to continue its upward trajectory, supported by strong fundamentals and positive market sentiment. Fibonacci retracement levels suggest potential resistance at 38.00, but bullish indicators prevail.

Analysis

The stock has been on a bullish run, with key support levels holding firm. The MACD and moving averages support upward momentum, but external factors could introduce volatility. Resistance at 38.00 is a key level to watch.

Confidence Level

Potential Risks

Potential market corrections or negative news could impact the bullish outlook.

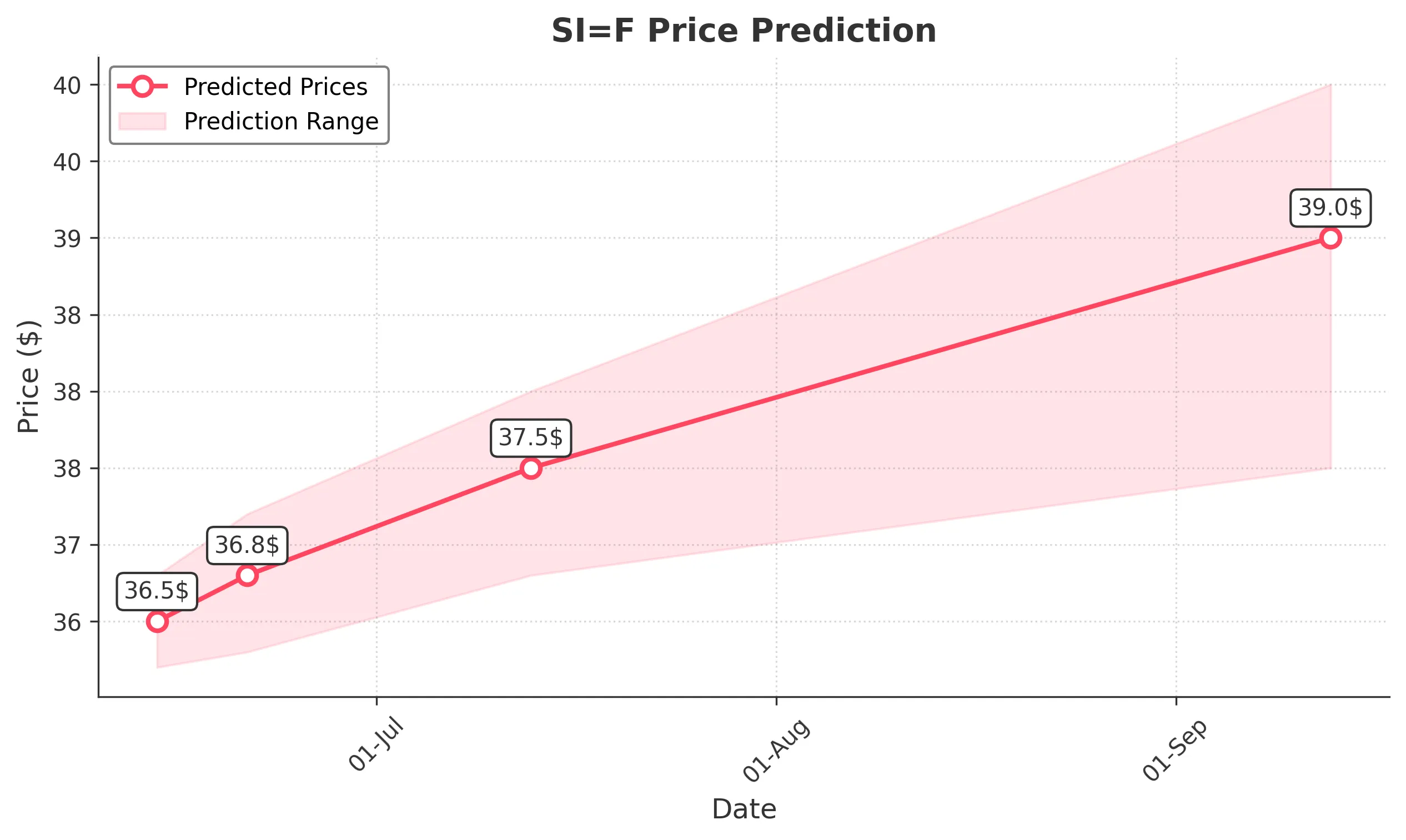

3 Months Prediction

Target: September 13, 2025$39

$38

$40

$37.5

Description

Long-term bullish outlook as the stock breaks through key resistance levels. Continued strong volume and positive market sentiment support this prediction, but watch for potential corrections.

Analysis

The stock has shown a strong upward trend, but the potential for market corrections exists. Key resistance levels are being tested, and while bullish indicators prevail, external economic factors could introduce uncertainty.

Confidence Level

Potential Risks

Market conditions can change rapidly, and unforeseen events may lead to volatility.