SIF Trading Predictions

1 Day Prediction

Target: June 30, 2025$36.5

$36.4

$36.8

$36.2

Description

The stock shows a bullish trend with a recent upward movement. The RSI is approaching overbought levels, indicating potential for a pullback. However, the MACD remains positive, suggesting continued upward momentum. Volume is stable, supporting the price action.

Analysis

Over the past 3 months, SI=F has shown a bullish trend, recovering from a low of 29.11 to recent highs around 37.09. Key support is at 35.00, while resistance is near 37.00. The MACD indicates bullish momentum, but RSI suggests caution as it nears overbought territory.

Confidence Level

Potential Risks

Potential market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 7, 2025$36.8

$36.6

$37.2

$36.3

Description

The stock is expected to continue its upward trajectory, supported by strong bullish momentum from the MACD. However, the RSI indicates potential overbought conditions, which could lead to a short-term pullback. Volume trends remain healthy.

Analysis

The stock has been in a bullish phase, with significant resistance at 37.00. The recent price action shows a series of higher lows, indicating strong buying interest. However, the RSI nearing overbought levels suggests caution for potential corrections.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic factors, affecting the stock's performance.

1 Month Prediction

Target: August 7, 2025$37.5

$36.9

$38

$36.8

Description

The stock is likely to reach new highs as bullish sentiment persists. The MACD remains positive, and the price is above the 50-day moving average, indicating a strong uptrend. However, watch for potential resistance at 38.00.

Analysis

The stock has shown resilience, bouncing back from previous lows. Key support is at 36.00, while resistance is at 38.00. The overall trend is bullish, but the market's reaction to economic data could influence future price movements.

Confidence Level

Potential Risks

External economic factors and earnings reports could introduce volatility.

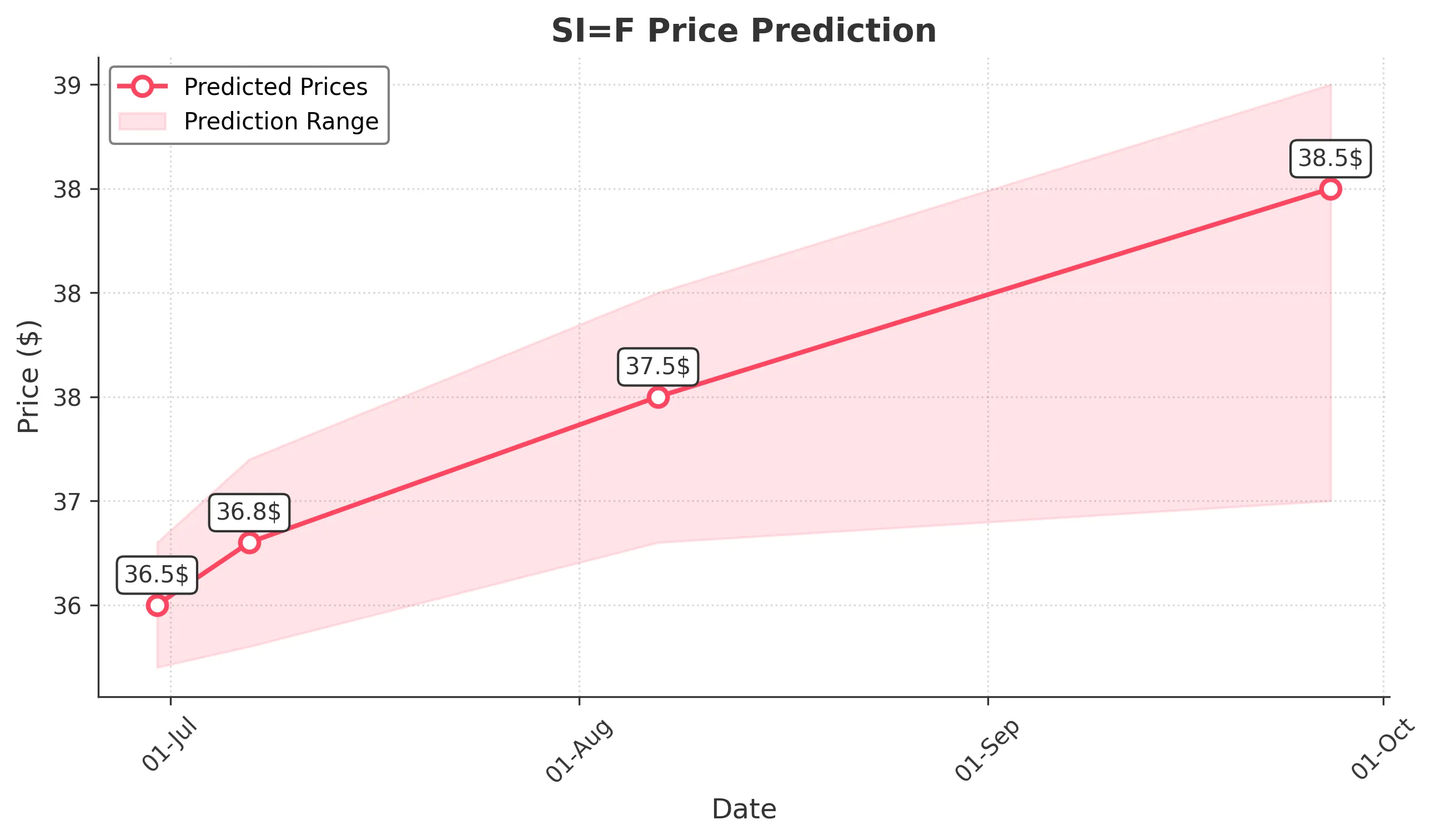

3 Months Prediction

Target: September 27, 2025$38.5

$37.8

$39

$37

Description

The stock is expected to continue its upward trend, potentially reaching 39.00. The bullish momentum is supported by strong fundamentals and positive market sentiment. However, the RSI indicates a risk of overextension.

Analysis

The stock has been on a bullish run, with significant support at 36.00 and resistance at 39.00. The MACD and moving averages indicate a strong uptrend, but the potential for market corrections remains a concern, especially with external economic pressures.

Confidence Level

Potential Risks

Market corrections and economic uncertainties could lead to price fluctuations.