SOL-USD Trading Predictions

1 Day Prediction

Target: April 11, 2025$115

$115.5

$120

$110

Description

The stock shows bearish momentum with a recent downtrend. The RSI indicates oversold conditions, but a potential bounce could occur. MACD is negative, suggesting continued selling pressure. Volume remains high, indicating strong market interest.

Analysis

Over the past 3 months, SOL-USD has experienced significant volatility, with a peak around mid-January followed by a sharp decline. Key support is at $105, while resistance is near $130. The overall trend is bearish, with high volume spikes indicating strong selling pressure.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: April 18, 2025$112

$113

$115

$105

Description

The bearish trend is expected to continue, with potential for a slight recovery. The Bollinger Bands indicate a squeeze, suggesting a breakout could occur. However, the overall sentiment remains negative, and selling pressure is likely to persist.

Analysis

The stock has been in a downtrend, with significant resistance at $120. The recent price action shows lower highs and lower lows, indicating bearish sentiment. Volume analysis shows spikes during sell-offs, suggesting strong selling interest.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to increased volatility.

1 Month Prediction

Target: May 10, 2025$110

$111

$115

$100

Description

The stock is likely to stabilize around $110, with potential for further declines if bearish sentiment continues. The MACD remains negative, and the RSI is approaching oversold levels, indicating a possible reversal but with risks of further downside.

Analysis

The overall trend remains bearish, with key support at $100. The stock has shown significant volatility, and while there may be short-term recoveries, the long-term outlook appears negative. Volume patterns indicate strong selling pressure.

Confidence Level

Potential Risks

Market sentiment and external factors could lead to unexpected price movements.

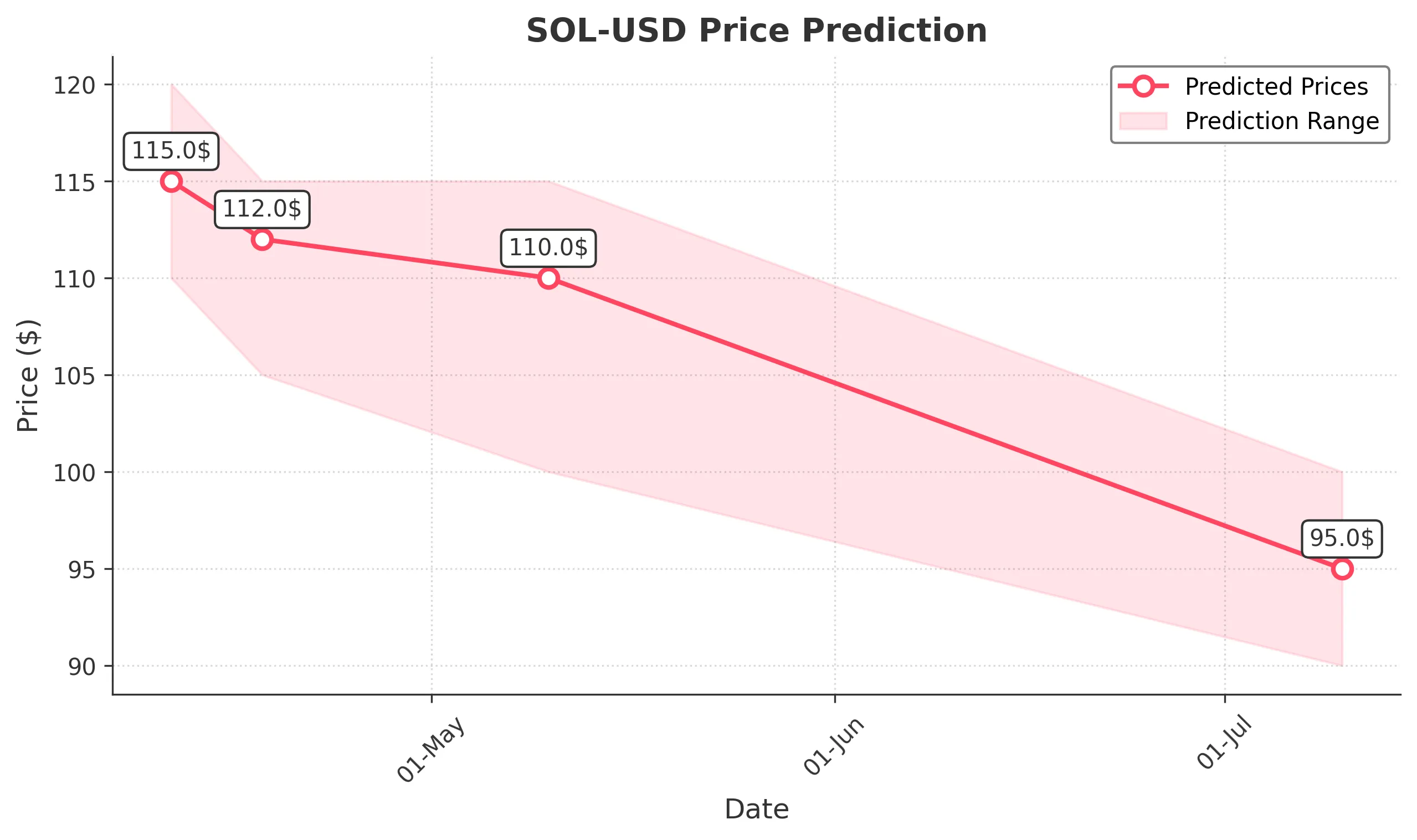

3 Months Prediction

Target: July 10, 2025$95

$96

$100

$90

Description

The bearish trend is expected to persist, with potential for further declines as market sentiment remains negative. The stock may test lower support levels, and the overall outlook is cautious due to ongoing volatility.

Analysis

The stock has been in a significant downtrend, with key resistance at $100. The overall sentiment is bearish, and while there may be short-term recoveries, the long-term outlook suggests further declines. Volume analysis indicates strong selling pressure.

Confidence Level

Potential Risks

Potential market recovery or positive news could alter the bearish outlook.