SOL-USD Trading Predictions

1 Day Prediction

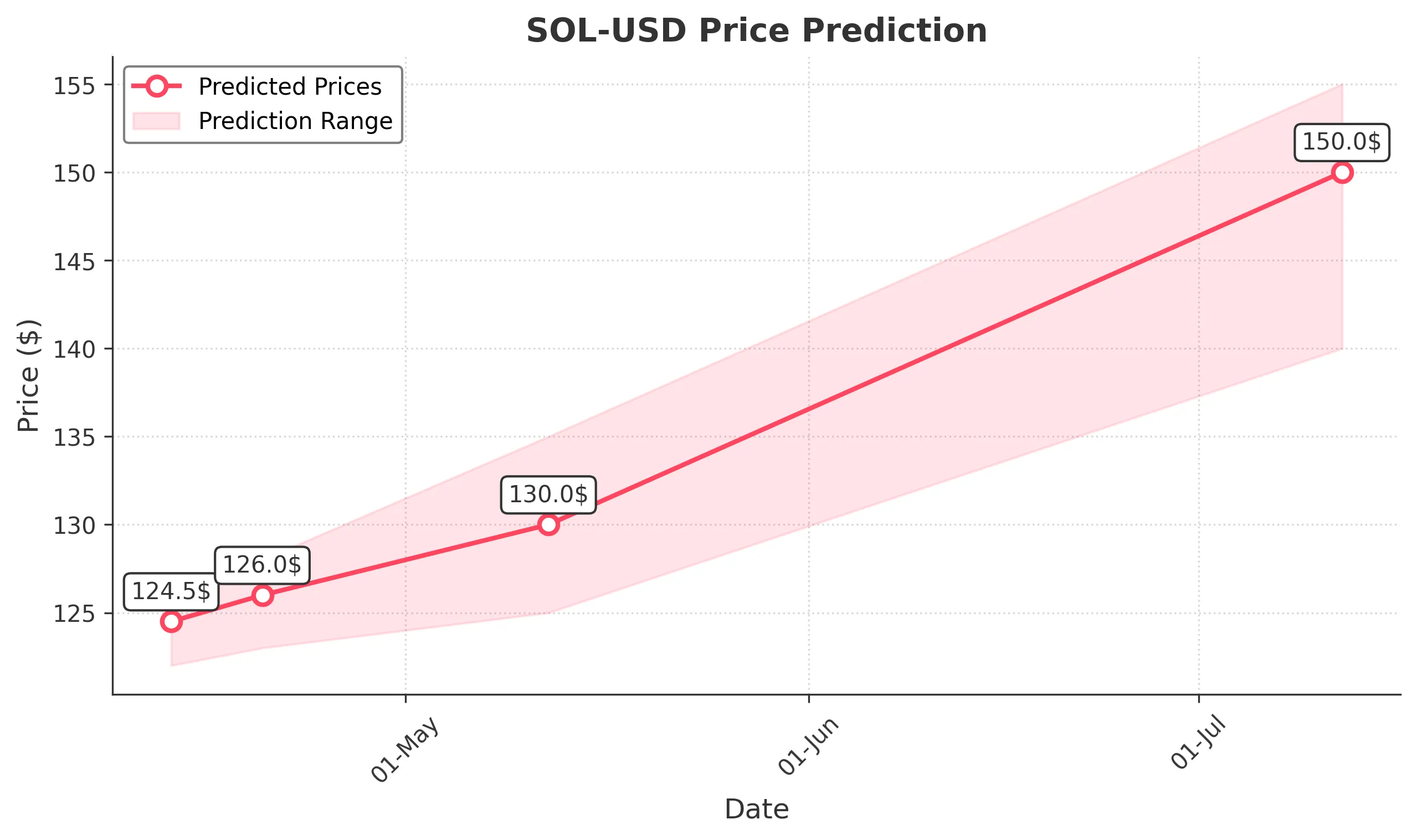

Target: April 13, 2025$124.5

$123

$126

$122

Description

The stock shows a slight bullish trend with a potential close around 124.500. Recent candlestick patterns indicate indecision, while RSI suggests a neutral stance. Volume remains moderate, indicating cautious trading.

Analysis

Over the past 3 months, SOL-USD has experienced high volatility with significant price swings. Key support is around 105, while resistance is near 130. The recent downtrend suggests caution, but a potential recovery is possible.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: April 20, 2025$126

$125.5

$128

$123

Description

A slight recovery is anticipated as the stock may close at 126.00. The MACD shows a bullish crossover, and the RSI is approaching oversold territory, indicating potential upward momentum.

Analysis

The stock has been in a bearish phase, but recent patterns suggest a possible reversal. Key resistance at 130 remains a challenge, while support at 105 is crucial. Volume spikes indicate increased interest.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could reverse the trend.

1 Month Prediction

Target: May 12, 2025$130

$128

$135

$125

Description

The stock is expected to recover to around 130.00 as bullish sentiment builds. The Fibonacci retracement levels suggest a bounce back, and the RSI indicates a potential upward trend.

Analysis

SOL-USD has shown resilience despite recent downturns. The stock is currently testing key resistance levels, and a break above 130 could signal a bullish trend. Volume analysis shows increasing interest.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, affecting the prediction.

3 Months Prediction

Target: July 12, 2025$150

$145

$155

$140

Description

A longer-term bullish outlook suggests a close around 150.00. The stock may benefit from positive market sentiment and potential macroeconomic recovery, supported by technical indicators.

Analysis

The overall trend shows potential for recovery, with key support at 140 and resistance at 155. The stock's performance will depend on broader market conditions and investor sentiment.

Confidence Level

Potential Risks

Long-term predictions are subject to greater uncertainty due to market dynamics.