SOL-USD Trading Predictions

1 Day Prediction

Target: April 18, 2025$135

$134.5

$138

$130

Description

The stock shows a slight bullish trend with a potential close around 135. The recent candlestick patterns indicate indecision, while the RSI is near neutral. Volume remains moderate, suggesting cautious optimism.

Analysis

Over the past 3 months, SOL-USD has shown a bearish trend with significant fluctuations. Key support is around 125, while resistance is near 140. The MACD indicates a potential reversal, but the overall sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: April 25, 2025$138.5

$135

$142

$130.5

Description

Expecting a gradual recovery towards 138.5 as bullish momentum builds. The MACD shows a potential crossover, and the RSI is improving. However, resistance at 140 may limit upward movement.

Analysis

The stock has been volatile, with recent lows indicating bearish pressure. However, a potential reversal is forming, supported by volume spikes. Key levels to watch are 130 (support) and 140 (resistance).

Confidence Level

Potential Risks

Unforeseen market events or negative sentiment could reverse this trend.

1 Month Prediction

Target: May 17, 2025$145

$140

$150

$130

Description

A bullish outlook for the month with a target close of 145. The stock may break through resistance at 140, supported by improving market sentiment and technical indicators showing bullish divergence.

Analysis

The past three months have shown significant volatility, with a bearish trend recently. However, signs of recovery are emerging, with key support at 130 and resistance at 140. Volume trends suggest increasing interest.

Confidence Level

Potential Risks

Market corrections or negative news could hinder upward momentum.

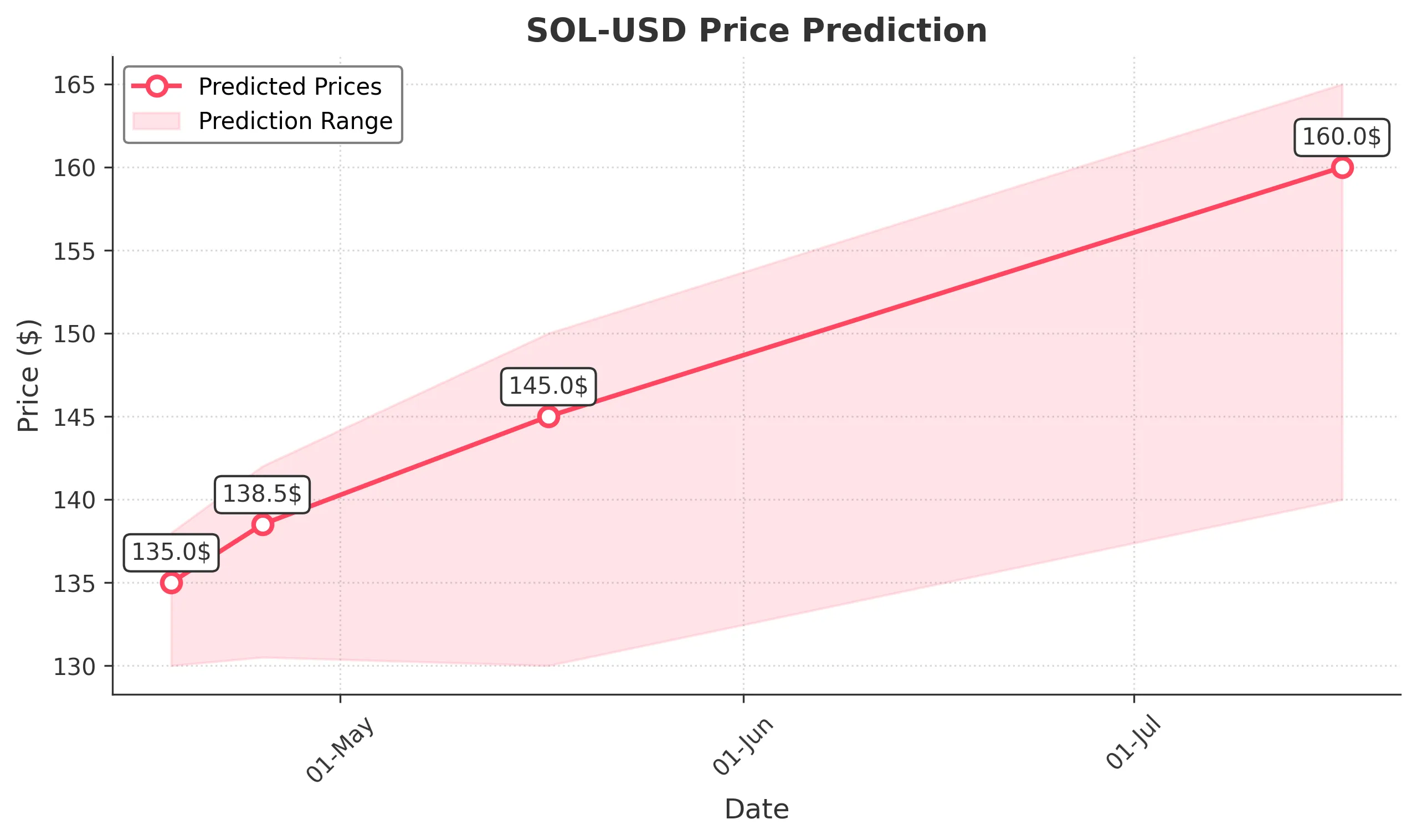

3 Months Prediction

Target: July 17, 2025$160

$150

$165

$140

Description

Long-term bullish outlook with a target close of 160. If the upward trend continues, the stock could break through key resistance levels, supported by positive market sentiment and technical indicators.

Analysis

The stock has experienced significant fluctuations, with a recent bearish trend. However, the potential for recovery exists, especially if it can maintain above 140. Key resistance levels will be critical in the coming months.

Confidence Level

Potential Risks

Potential market downturns or regulatory changes could impact the forecast.