SOL-USD Trading Predictions

1 Day Prediction

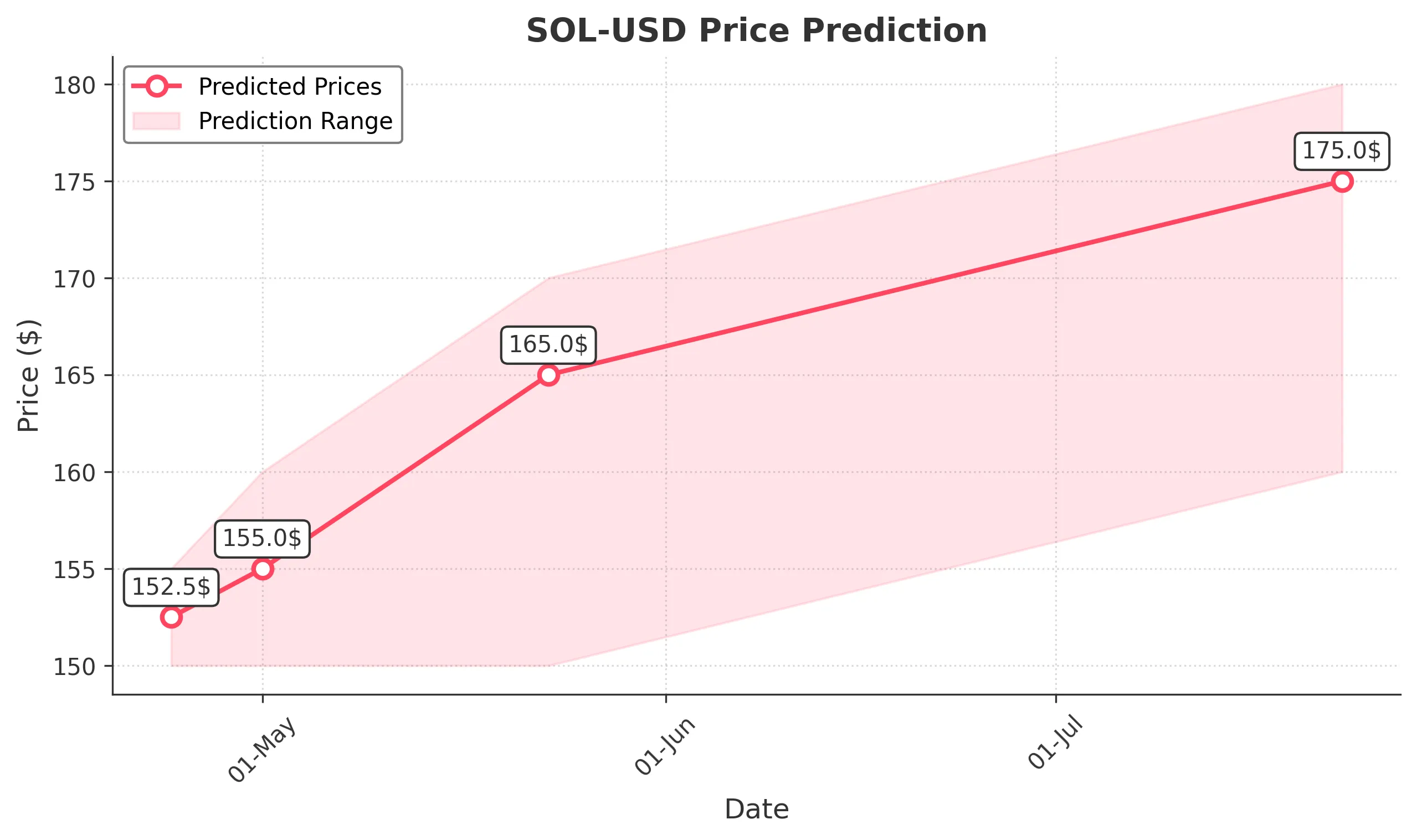

Target: April 24, 2025$152.5

$151

$155

$150

Description

The stock shows a bullish trend with a recent upward movement. The MACD is positive, and RSI indicates a slight overbought condition. A potential breakout above resistance at 150.92 could push prices higher.

Analysis

Over the past 3 months, SOL-USD has experienced significant volatility, with a bearish trend followed by a recent recovery. Key support at 120 and resistance at 150.92 are critical. Volume spikes indicate strong interest, but RSI suggests caution.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden downturn in sentiment may reverse the trend.

1 Week Prediction

Target: May 1, 2025$155

$152.5

$160

$150

Description

The bullish momentum is expected to continue as the stock breaks above recent resistance levels. The MACD remains positive, and the RSI is stabilizing, indicating potential for further gains.

Analysis

The stock has shown recovery signs after a bearish phase, with recent price action indicating a shift towards bullish sentiment. Key resistance at 160 may pose challenges, while support at 150 remains crucial.

Confidence Level

Potential Risks

Potential market corrections or negative news could hinder upward movement. Watch for volume trends to confirm bullish sentiment.

1 Month Prediction

Target: May 23, 2025$165

$155

$170

$150

Description

If the current bullish trend continues, the stock could reach 165. The MACD and moving averages suggest upward momentum, but RSI indicates potential overbought conditions.

Analysis

The stock has transitioned from a bearish to a bullish trend, with significant volume supporting the upward movement. Key resistance at 170 may limit gains, while support at 150 is critical for maintaining upward momentum.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external factors may impact performance. A correction could occur if the stock becomes overextended.

3 Months Prediction

Target: July 23, 2025$175

$165

$180

$160

Description

If the bullish trend persists, the stock could reach 175. The overall market sentiment is improving, but caution is advised as overbought conditions may lead to corrections.

Analysis

The stock has shown resilience with a shift towards bullish sentiment. However, the potential for market corrections remains, and key resistance levels will need to be monitored closely. Volume trends will be crucial in confirming the sustainability of the upward movement.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market volatility and economic factors. A downturn could reverse gains.