SOL-USD Trading Predictions

1 Day Prediction

Target: April 27, 2025$150

$150.5

$152

$148

Description

The stock shows signs of consolidation around the 150 level, with recent bullish candlestick patterns indicating potential upward movement. However, the RSI is nearing overbought territory, suggesting caution. Volume remains steady, indicating sustained interest.

Analysis

Over the past 3 months, SOL-USD has experienced significant volatility, with a recent bullish trend after a sharp decline. Key support is around 140, while resistance is near 155. The MACD shows a bullish crossover, but the RSI indicates overbought conditions, suggesting a possible pullback.

Confidence Level

Potential Risks

Potential market volatility and external news could impact the price. A reversal is possible if bearish sentiment emerges.

1 Week Prediction

Target: May 4, 2025$152.5

$150

$155

$145

Description

The stock is expected to continue its upward momentum, supported by recent bullish patterns and a favorable MACD. However, the RSI indicates potential overbought conditions, which could lead to a pullback. Volume trends suggest sustained interest.

Analysis

The last three months show a recovery from lows, with a bullish trend emerging. Key resistance at 155 and support at 140. The Bollinger Bands are tightening, indicating potential volatility. The ATR suggests increased price movement, warranting caution.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and any negative news could reverse the current trend. Watch for volume spikes that may indicate a change in direction.

1 Month Prediction

Target: June 4, 2025$155

$152

$160

$145

Description

The stock is likely to test the 155 resistance level, supported by bullish momentum and positive market sentiment. However, the RSI indicates potential overbought conditions, which could lead to a correction. Volume trends remain strong.

Analysis

SOL-USD has shown a recovery trend with significant volume spikes. The MACD remains bullish, and the RSI is approaching overbought levels. Key support at 140 and resistance at 155. The market sentiment is cautiously optimistic, but external factors could introduce volatility.

Confidence Level

Potential Risks

External factors such as macroeconomic events could impact the price. A sudden shift in market sentiment could lead to increased volatility.

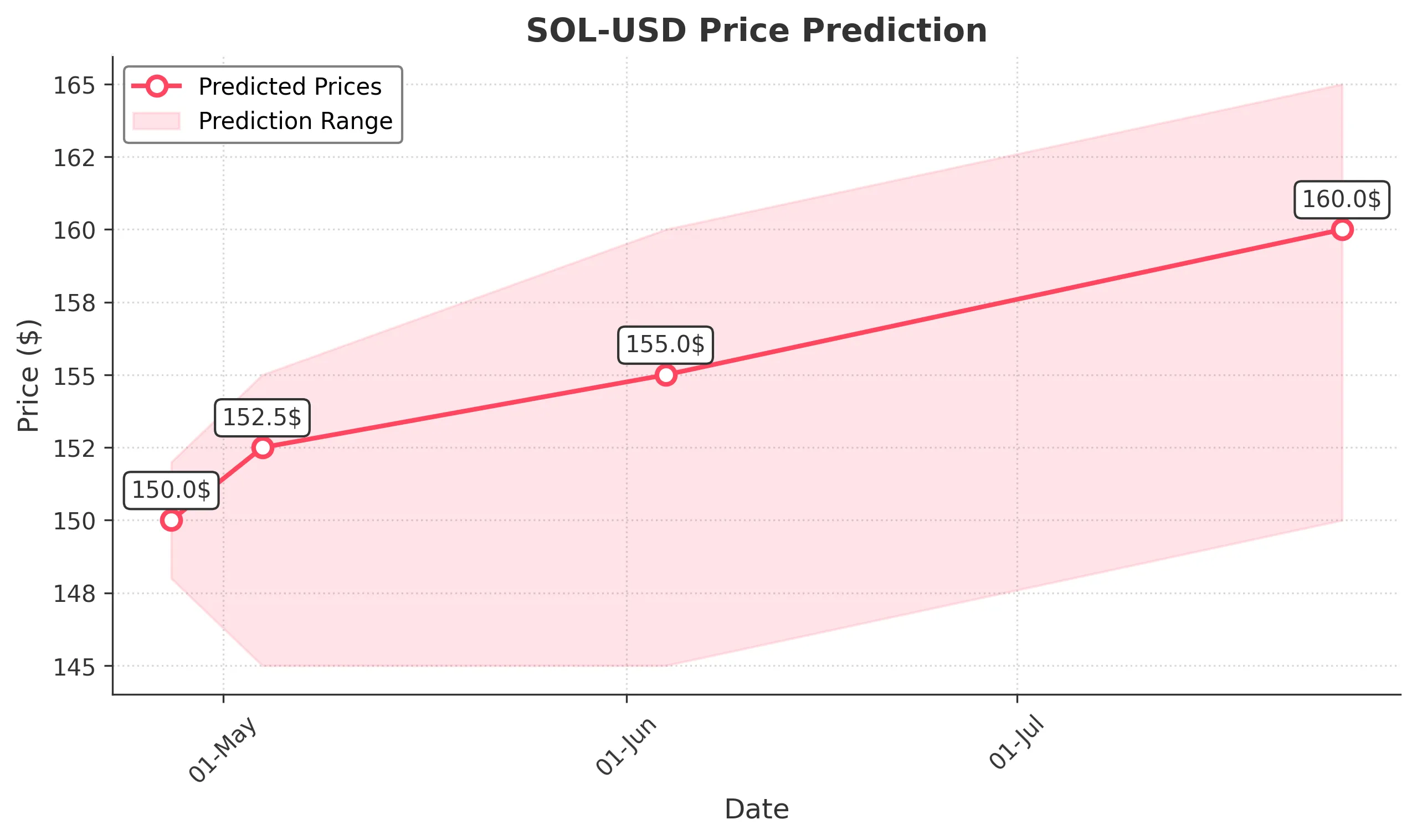

3 Months Prediction

Target: July 26, 2025$160

$155

$165

$150

Description

The stock is expected to continue its upward trajectory, potentially reaching 160. The bullish trend is supported by strong volume and positive technical indicators. However, the RSI suggests caution as it approaches overbought territory.

Analysis

The past three months show a recovery from significant lows, with a bullish trend emerging. Key resistance at 165 and support at 150. The MACD is bullish, and the RSI is nearing overbought levels, indicating potential for a pullback. Volume patterns suggest sustained interest.

Confidence Level

Potential Risks

Market volatility and external news could impact the price. A reversal is possible if bearish sentiment emerges, especially if the RSI indicates overbought conditions.