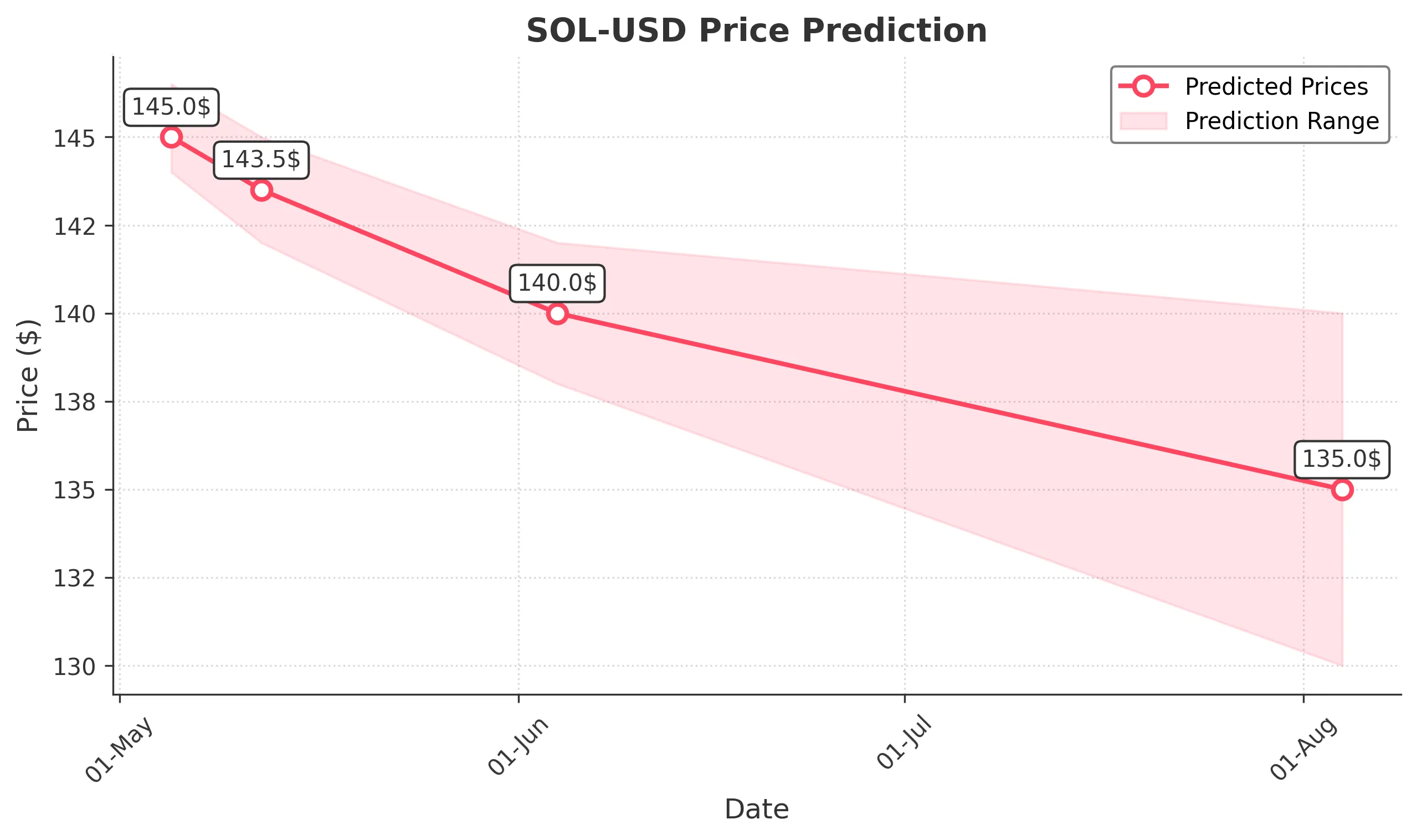

SOL-USD Trading Predictions

1 Day Prediction

Target: May 5, 2025$145

$145.5

$146.5

$144

Description

The stock shows bearish momentum with a recent downtrend. RSI indicates oversold conditions, but MACD is bearish. Expect a slight recovery, but overall sentiment remains cautious due to recent volatility.

Analysis

Over the past 3 months, SOL-USD has experienced significant volatility, with a bearish trend recently. Key support at 145.00 and resistance at 150.00. Volume spikes indicate potential reversals, but overall sentiment is bearish.

Confidence Level

Potential Risks

Market sentiment could shift rapidly, and external news may impact price unexpectedly.

1 Week Prediction

Target: May 12, 2025$143.5

$144

$145

$142

Description

Continued bearish pressure is expected as the stock struggles to maintain upward momentum. Technical indicators suggest further declines, with potential support at 142.00.

Analysis

The stock has shown a bearish trend with significant resistance at 150.00. Recent volume patterns indicate selling pressure, and technical indicators suggest further downside potential.

Confidence Level

Potential Risks

Unforeseen market events or news could lead to volatility, impacting the prediction.

1 Month Prediction

Target: June 4, 2025$140

$141

$142

$138

Description

The bearish trend is likely to continue, with potential for further declines as market sentiment remains weak. Key support at 138.00 may be tested.

Analysis

The stock has been in a downtrend, with significant resistance at 145.00. Volume analysis shows increased selling pressure, and technical indicators suggest a bearish outlook.

Confidence Level

Potential Risks

Market conditions are volatile, and any positive news could reverse the trend.

3 Months Prediction

Target: August 4, 2025$135

$136

$140

$130

Description

The overall bearish trend is expected to persist, with potential for further declines as market sentiment remains negative. Key support levels will be critical.

Analysis

The stock has shown a consistent downtrend, with significant resistance at 145.00. Volume patterns indicate ongoing selling pressure, and technical indicators suggest a bearish outlook for the coming months.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market shifts and external factors.