SOL-USD Trading Predictions

1 Day Prediction

Target: May 6, 2025$145.5

$145

$147

$143

Description

The stock shows a slight bullish trend with a potential close around 145.5. Recent candlestick patterns indicate indecision, while RSI is neutral. Volume remains moderate, suggesting consolidation before a potential breakout.

Analysis

Over the past 3 months, SOL-USD has shown a bearish trend with significant fluctuations. Key support at 140 and resistance at 150. Recent volume spikes indicate increased interest, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: May 13, 2025$148

$145.5

$150

$144

Description

Expect a slight recovery to 148.0 as bullish momentum builds. The MACD shows a potential crossover, and RSI is approaching oversold territory, indicating a possible upward correction.

Analysis

The stock has been volatile, with recent lows around 140. Key resistance at 150 remains a challenge. Technical indicators suggest a potential reversal, but market sentiment is mixed.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could reverse this trend.

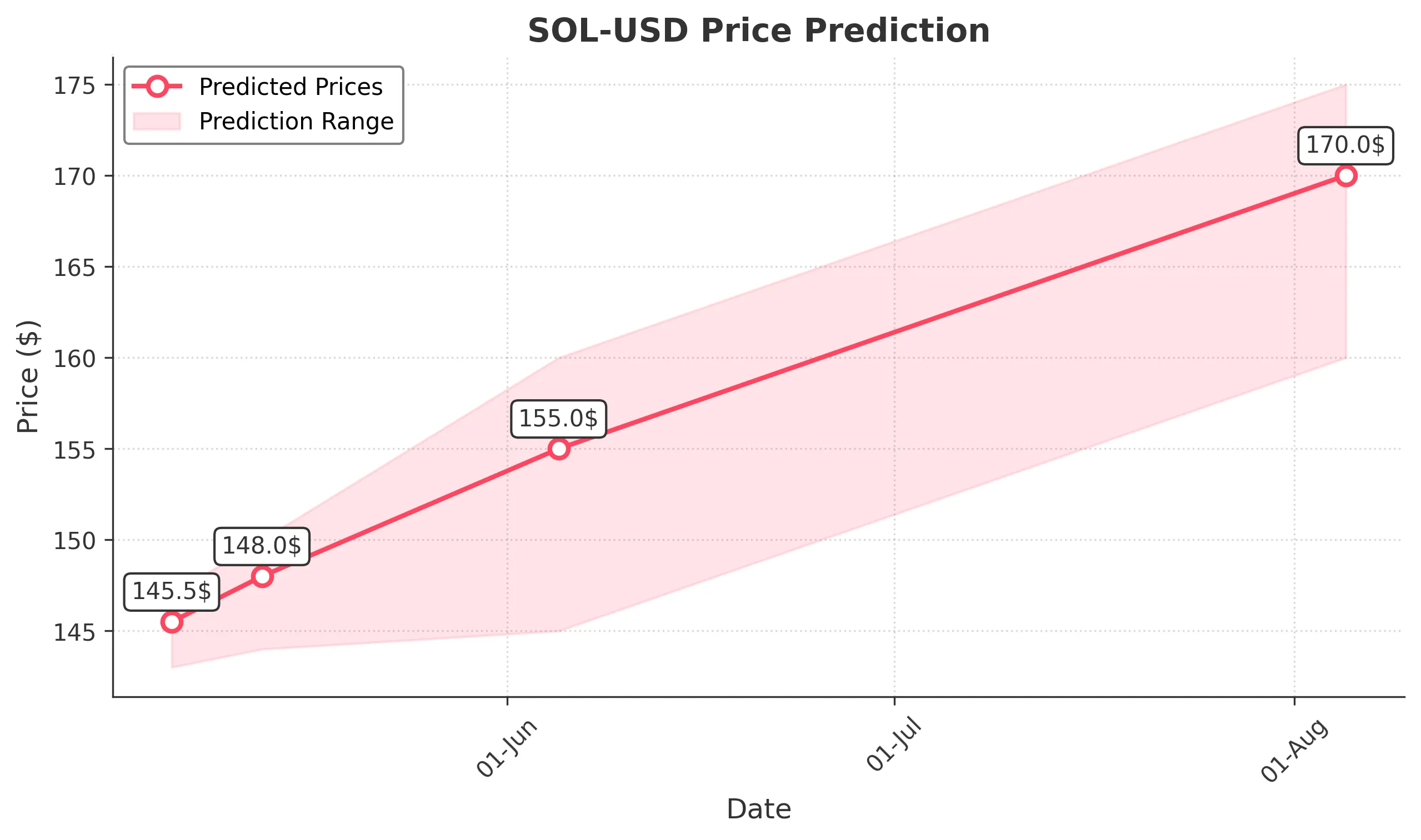

1 Month Prediction

Target: June 5, 2025$155

$150

$160

$145

Description

A bullish trend is anticipated, with a target close of 155.0. The Fibonacci retracement levels suggest a recovery towards previous highs, supported by increasing volume and positive market sentiment.

Analysis

The stock has shown resilience with a recent bounce from lows. Key support at 140 and resistance at 160 are critical. Technical indicators are turning bullish, suggesting a potential upward trend.

Confidence Level

Potential Risks

Market corrections or negative news could hinder this upward movement.

3 Months Prediction

Target: August 5, 2025$170

$165

$175

$160

Description

Long-term outlook suggests a close around 170.0, driven by bullish momentum and positive market sentiment. The MACD and RSI indicate strong upward potential, but caution is advised due to possible market corrections.

Analysis

The stock has been recovering from recent lows, with a bullish trend forming. Key resistance at 175 and support at 160 are crucial. Overall, the sentiment is cautiously optimistic, but external factors could influence performance.

Confidence Level

Potential Risks

Economic factors and market volatility could impact this prediction.