SOL-USD Trading Predictions

1 Day Prediction

Target: May 7, 2025$145.5

$144.8

$147

$143

Description

The stock shows a slight bullish trend with a potential bounce from recent lows. RSI indicates oversold conditions, while MACD is showing a bullish crossover. However, volatility remains high, suggesting caution.

Analysis

Over the past 3 months, SOL-USD has experienced significant volatility, with a bearish trend followed by a recent recovery. Key support at 140 and resistance at 150. Volume spikes indicate strong interest, but uncertainty remains due to macroeconomic influences.

Confidence Level

Potential Risks

Market sentiment could shift quickly due to external news or macroeconomic factors, which may impact the prediction.

1 Week Prediction

Target: May 14, 2025$148

$145.5

$150

$144

Description

The stock is expected to stabilize around current levels, with potential upward movement as bullish sentiment builds. The 50-day moving average is approaching the price, indicating possible support.

Analysis

The last three months show a recovery from lows, with key resistance at 150. Technical indicators suggest a potential bullish reversal, but high volatility and external factors could lead to sudden price changes.

Confidence Level

Potential Risks

Potential for market corrections exists, especially if broader market conditions worsen or if negative news emerges.

1 Month Prediction

Target: June 6, 2025$150.5

$148

$155

$145

Description

A gradual upward trend is anticipated as market sentiment improves. The stock may test resistance levels around 155, supported by positive technical indicators and volume trends.

Analysis

The stock has shown resilience with a bullish trend emerging after a period of decline. Key support at 145 and resistance at 155. Volume patterns indicate increasing interest, but external factors could introduce volatility.

Confidence Level

Potential Risks

Any adverse macroeconomic news could derail the upward momentum, leading to potential pullbacks.

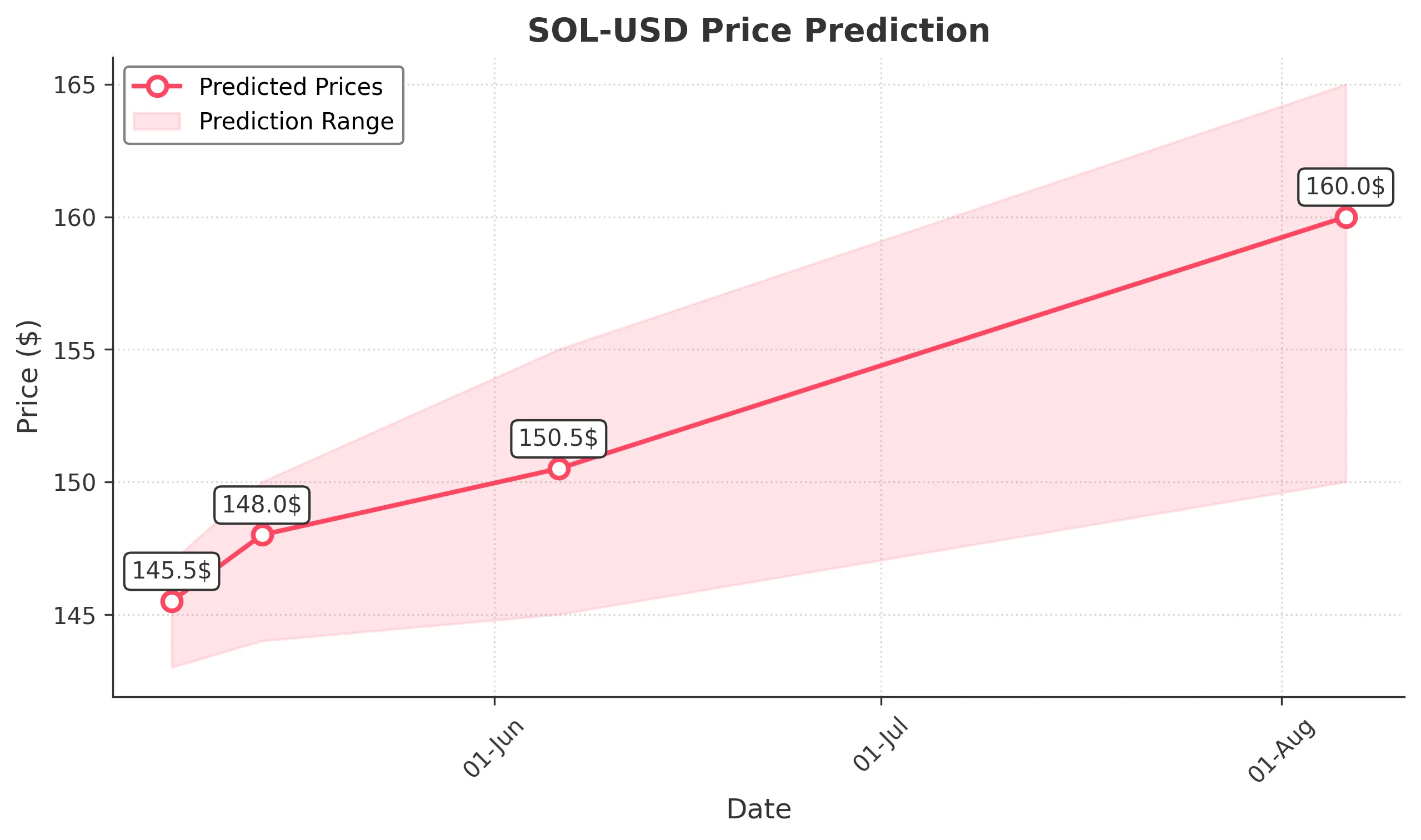

3 Months Prediction

Target: August 6, 2025$160

$155

$165

$150

Description

Long-term bullish sentiment is expected as the stock breaks through resistance levels. Positive macroeconomic indicators and strong volume could support this trend.

Analysis

The overall trend shows recovery and potential growth, with significant resistance at 155. Technical indicators suggest bullish momentum, but external factors and market sentiment could lead to fluctuations.

Confidence Level

Potential Risks

Market volatility and potential regulatory changes could impact the stock's performance, introducing risks to the prediction.