SOL-USD Trading Predictions

1 Day Prediction

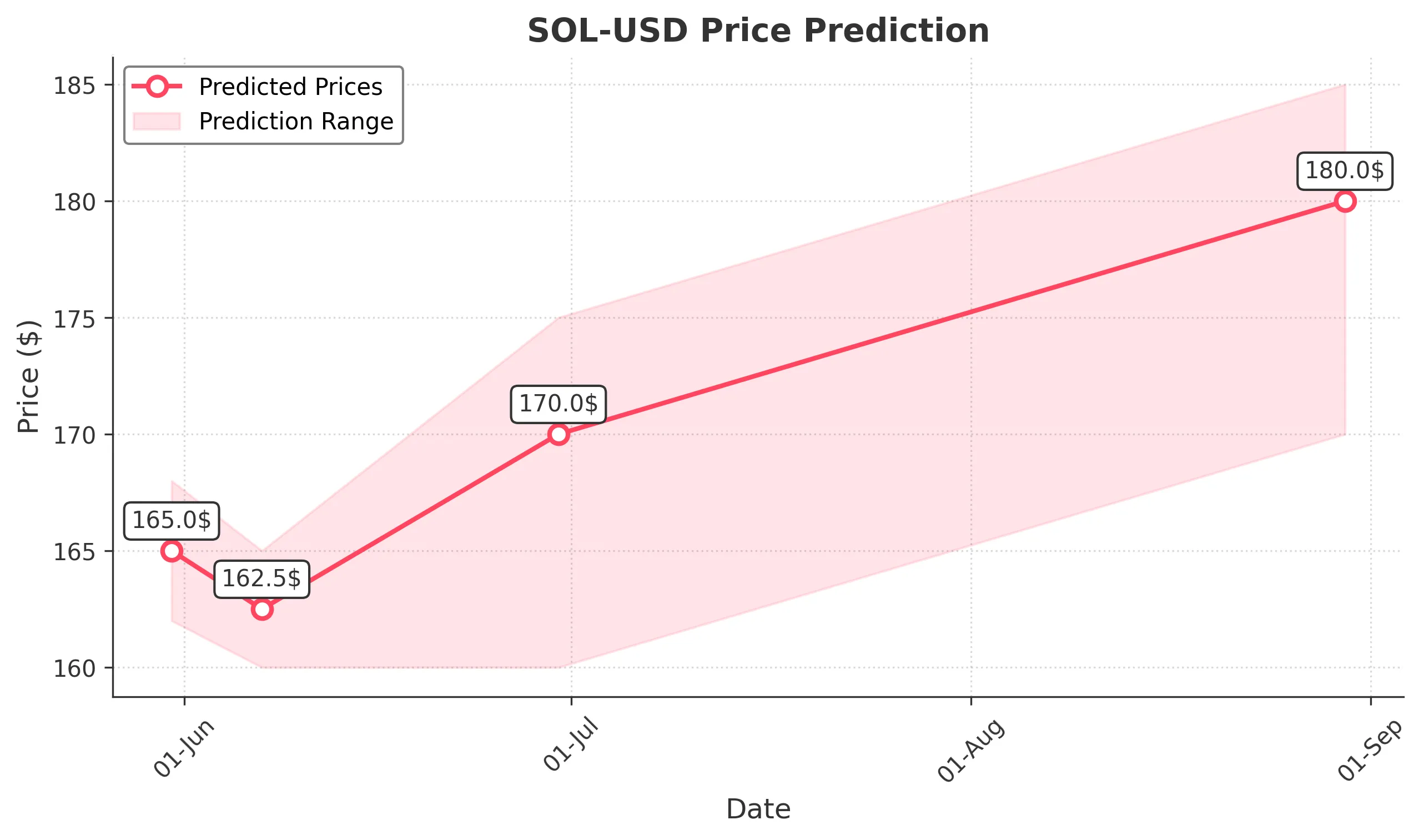

Target: May 31, 2025$165

$164.5

$168

$162

Description

The stock shows signs of a slight bearish trend with recent lower highs and lower lows. RSI indicates overbought conditions, suggesting a pullback. Volume has decreased, indicating weakening momentum. Expect a close around 165.

Analysis

Over the past 3 months, SOL-USD has experienced high volatility with significant price swings. The recent trend has been bearish, with key support around 162. Technical indicators like MACD and RSI suggest potential reversals, but market sentiment remains mixed.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: June 7, 2025$162.5

$164

$165

$160

Description

The bearish trend may continue into next week, with potential support at 160. The MACD shows a bearish crossover, and RSI indicates a potential oversold condition. Expect a close around 162.5.

Analysis

The stock has shown a bearish trend with significant resistance at 170. Volume patterns indicate decreasing interest. Technical indicators suggest a potential bounce off support levels, but overall sentiment remains cautious.

Confidence Level

Potential Risks

Unforeseen market events or news could lead to sudden price changes.

1 Month Prediction

Target: June 30, 2025$170

$165

$175

$160

Description

Expect a recovery towards the end of the month as the stock may find support at 160. A bullish divergence in RSI could signal a reversal. Anticipate a close around 170.

Analysis

The stock has been volatile, with a recent bearish phase. However, potential support levels and bullish signals from technical indicators suggest a possible recovery. Key resistance remains at 175.

Confidence Level

Potential Risks

Market sentiment and macroeconomic factors could influence the recovery.

3 Months Prediction

Target: August 30, 2025$180

$175

$185

$170

Description

Long-term outlook appears bullish as the stock may break through resistance levels. Positive market sentiment and potential macroeconomic recovery could drive prices higher. Expect a close around 180.

Analysis

The stock has shown resilience despite recent volatility. Key support levels are holding, and bullish patterns are emerging. However, external factors could influence the market, necessitating a cautious approach.

Confidence Level

Potential Risks

Economic conditions and market sentiment could shift, impacting the forecast.