SOL-USD Trading Predictions

1 Day Prediction

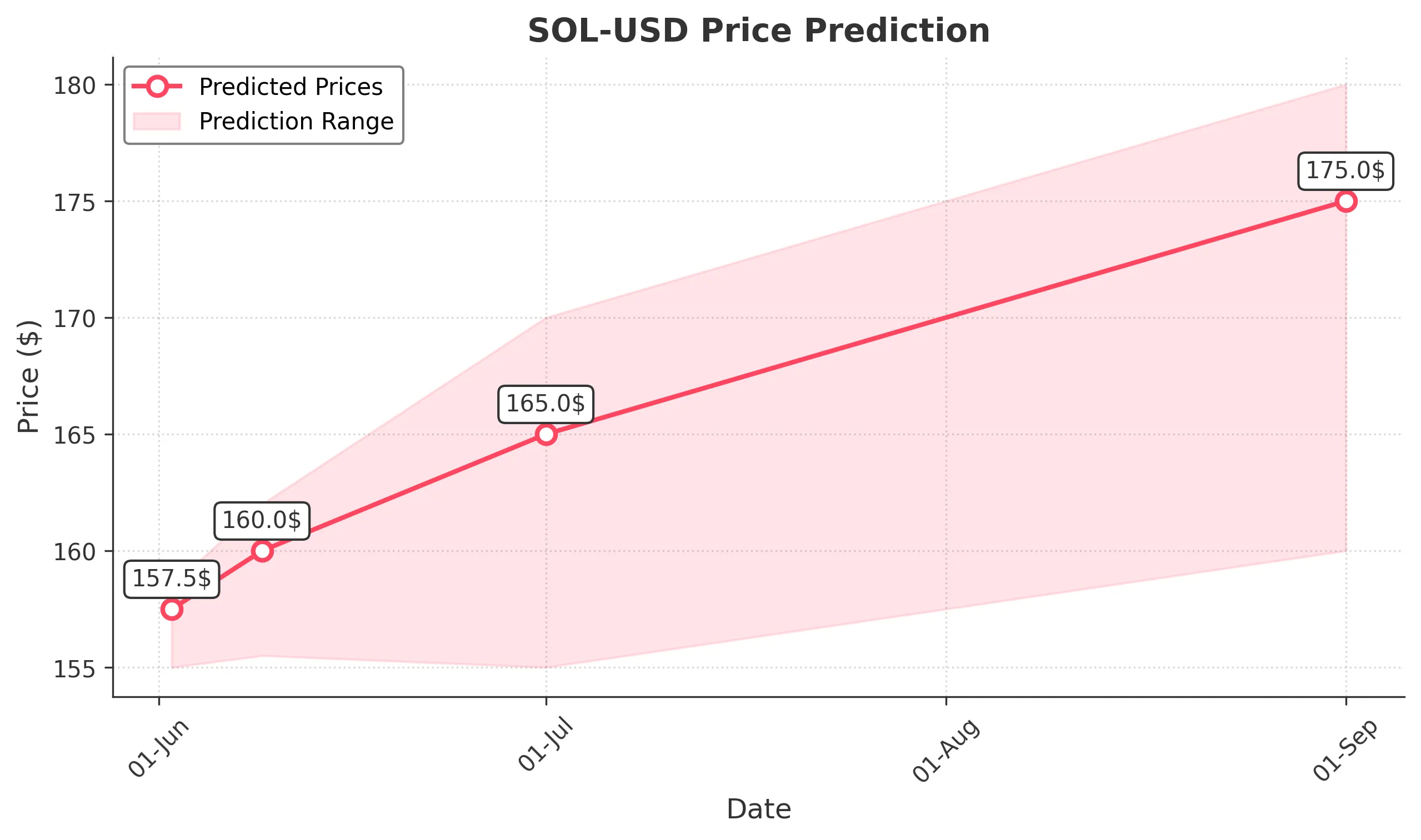

Target: June 2, 2025$157.5

$156.5

$158.5

$155

Description

The stock shows a slight bullish trend with a potential close around 157.500. The RSI is neutral, and MACD indicates a potential upward momentum. However, recent volatility suggests caution.

Analysis

Over the past 3 months, SOL-USD has shown a mix of bullish and bearish trends, with significant support at 155 and resistance around 180. Recent volume spikes indicate increased interest, but volatility remains high.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the price unexpectedly.

1 Week Prediction

Target: June 9, 2025$160

$158

$162

$155.5

Description

Expecting a gradual rise to 160.000 as bullish sentiment builds. The 50-day moving average supports this trend, but watch for potential resistance at 162.000.

Analysis

The stock has been fluctuating, with a recent bullish phase. Key support at 155.500 and resistance at 162.000 are critical. Volume trends suggest increased buying interest, but caution is warranted.

Confidence Level

Potential Risks

External factors like regulatory news or market corrections could lead to sudden price changes.

1 Month Prediction

Target: July 1, 2025$165

$160

$170

$155

Description

Aiming for a close of 165.000 as the stock consolidates. The bullish trend is supported by Fibonacci retracement levels, but resistance at 170.000 may pose challenges.

Analysis

SOL-USD has shown resilience with a bullish trend. Key support at 155.000 and resistance at 170.000 are pivotal. Volume analysis indicates strong buying pressure, but external factors could impact stability.

Confidence Level

Potential Risks

Market volatility and potential profit-taking could lead to fluctuations around this target.

3 Months Prediction

Target: September 1, 2025$175

$170

$180

$160

Description

Forecasting a close of 175.000 as the stock continues its upward trajectory. The MACD indicates sustained bullish momentum, but watch for potential resistance at 180.000.

Analysis

The stock has been on a bullish trend with significant support at 160.000 and resistance at 180.000. Volume patterns suggest strong interest, but macroeconomic factors could introduce volatility.

Confidence Level

Potential Risks

Long-term predictions are subject to market shifts and economic conditions that could alter the trajectory.