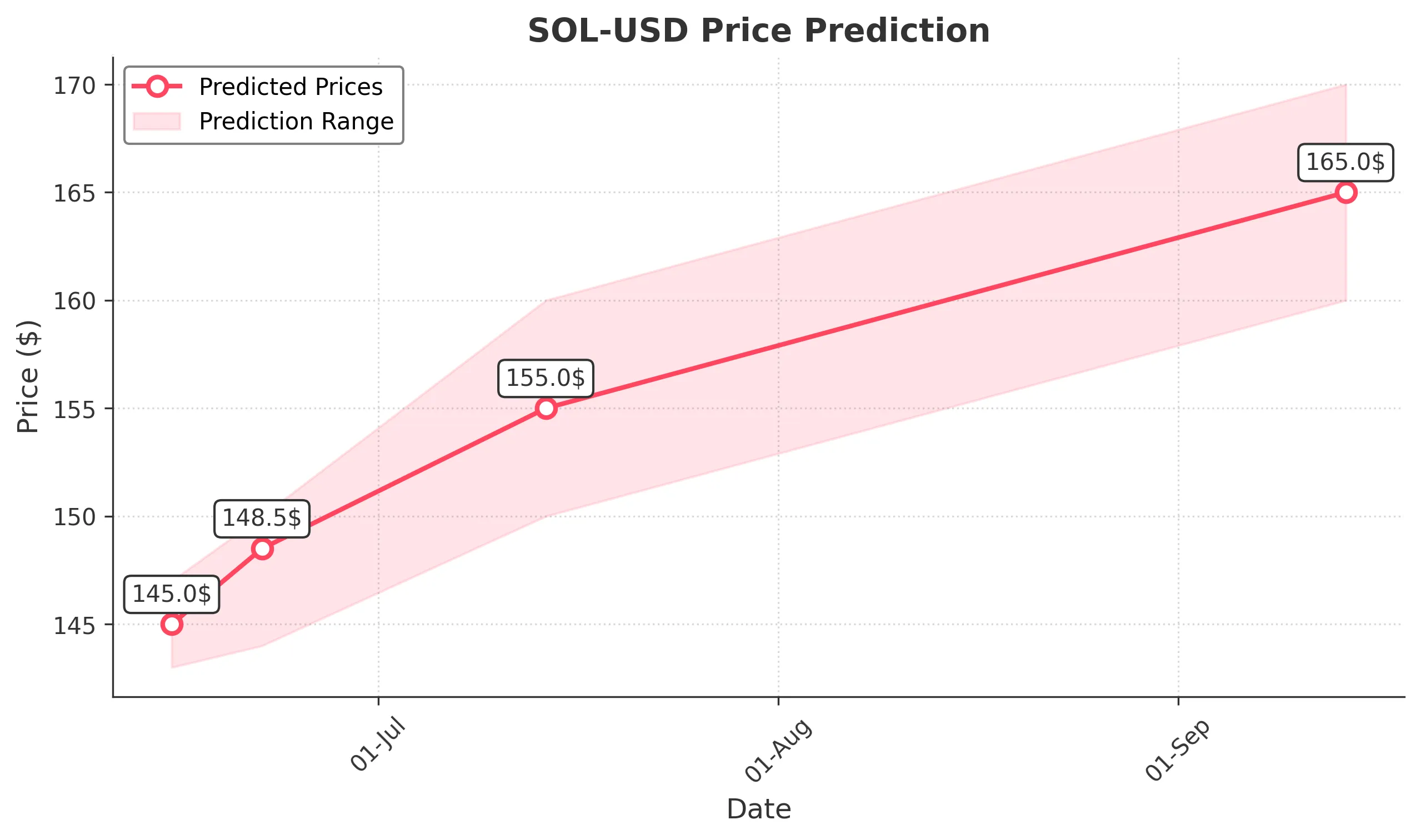

SOL-USD Trading Predictions

1 Day Prediction

Target: June 15, 2025$145

$145.5

$147

$143

Description

The stock shows bearish momentum with a recent downtrend. RSI indicates oversold conditions, but MACD is bearish. Expect a slight recovery, but volatility remains high due to recent sell-offs.

Analysis

Over the past 3 months, SOL-USD has experienced significant volatility, with a recent bearish trend. Key support at $145 is being tested. Volume spikes indicate strong selling pressure, while RSI suggests potential for a short-term bounce.

Confidence Level

Potential Risks

Market sentiment is fragile, and any negative news could lead to further declines.

1 Week Prediction

Target: June 22, 2025$148.5

$145

$150

$144

Description

A potential recovery is anticipated as the stock approaches key support levels. The RSI may stabilize, and MACD could show signs of bullish divergence, suggesting a short-term upward movement.

Analysis

The stock has shown a bearish trend recently, but support levels are holding. Technical indicators suggest a possible reversal, but caution is warranted due to high volatility and external market pressures.

Confidence Level

Potential Risks

Continued market volatility and external economic factors could hinder recovery efforts.

1 Month Prediction

Target: July 14, 2025$155

$150

$160

$150

Description

If the stock can maintain above support levels, a gradual recovery is expected. Positive market sentiment and potential bullish patterns could drive prices higher, but caution is advised.

Analysis

The stock has been volatile, with significant fluctuations. Key resistance levels are being tested, and while there are signs of potential recovery, external factors could impact performance.

Confidence Level

Potential Risks

Market sentiment remains uncertain, and any negative news could reverse gains.

3 Months Prediction

Target: September 14, 2025$165

$162

$170

$160

Description

Assuming a stable market environment, a gradual upward trend is expected as the stock breaks through resistance levels. However, macroeconomic factors could influence this trajectory.

Analysis

The stock has shown a mix of bullish and bearish trends. Key resistance levels are critical for future performance. Market sentiment and external economic factors will play a significant role in determining the stock's direction.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential market shifts and economic conditions.