SOL-USD Trading Predictions

1 Day Prediction

Target: June 16, 2025$145.5

$146.8

$147

$144

Description

The stock shows a slight bullish trend with a potential bounce from recent lows. RSI indicates oversold conditions, while MACD is showing a bullish crossover. However, volatility remains high, suggesting caution.

Analysis

Over the past 3 months, SOL-USD has experienced significant volatility, with a recent bearish trend followed by a potential reversal. Key support at 144.0 and resistance at 150.0. Volume spikes indicate strong interest, but uncertainty remains.

Confidence Level

Potential Risks

Market sentiment could shift quickly due to macroeconomic news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: June 23, 2025$148

$146.5

$150

$145

Description

A week ahead, the stock may continue to recover as bullish momentum builds. The recent candlestick patterns suggest a reversal, but external factors could introduce volatility.

Analysis

The stock has shown a recovery pattern with increasing volume. Key resistance at 150.0 may pose challenges. Technical indicators suggest a cautious bullish outlook, but external factors could influence performance.

Confidence Level

Potential Risks

Potential for market corrections or negative news could derail the upward momentum, leading to unexpected price movements.

1 Month Prediction

Target: July 16, 2025$155

$152

$160

$150

Description

In a month, the stock may stabilize around 155.0 as bullish sentiment grows. Fibonacci retracement levels support this target, but market volatility remains a concern.

Analysis

The stock has shown signs of recovery with a bullish trend. Key support at 150.0 and resistance at 160.0. Volume trends indicate strong interest, but external factors could introduce volatility.

Confidence Level

Potential Risks

Economic indicators or regulatory changes could impact the market, leading to fluctuations in price.

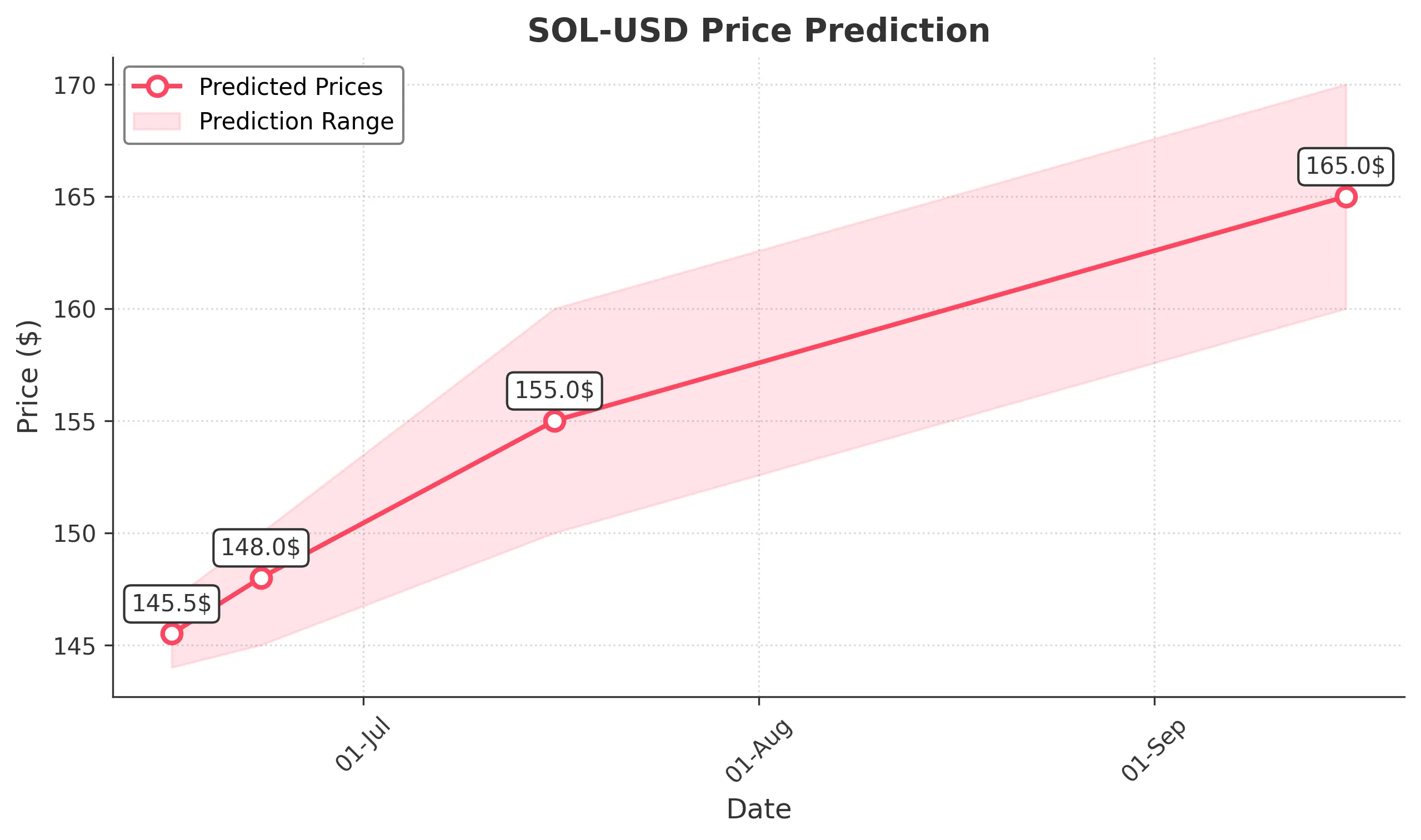

3 Months Prediction

Target: September 16, 2025$165

$162

$170

$160

Description

Three months out, the stock may reach 165.0 as it continues to recover. The overall trend appears bullish, but macroeconomic factors could introduce risks.

Analysis

The stock has shown a bullish trend with significant volume. Key support at 160.0 and resistance at 170.0. Technical indicators suggest a positive outlook, but external factors could impact performance.

Confidence Level

Potential Risks

Long-term predictions are subject to greater uncertainty due to potential market shifts and economic changes.