SOL-USD Trading Predictions

1 Day Prediction

Target: June 19, 2025$146.5

$146

$148

$145

Description

The stock shows a slight bearish trend with recent lower highs and lower lows. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, and volume is declining, indicating caution.

Analysis

Over the past 3 months, SOL-USD has experienced significant volatility, with a recent bearish trend. Key support at $145 and resistance at $160. Volume spikes indicate strong interest, but recent declines suggest caution. Technical indicators show mixed signals.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden bullish reversal is possible if sentiment shifts.

1 Week Prediction

Target: June 26, 2025$145

$145.5

$147

$143

Description

The bearish trend may continue, with potential support at $143. RSI remains low, indicating oversold conditions. However, MACD shows a potential bullish crossover, suggesting a possible reversal in the near term.

Analysis

The stock has been in a downtrend, with significant resistance at $150. Volume analysis shows declining interest, and technical indicators suggest a potential reversal but with risks of further declines.

Confidence Level

Potential Risks

Unforeseen market events or news could lead to volatility. The bearish trend may persist if selling pressure continues.

1 Month Prediction

Target: July 18, 2025$150

$148

$155

$145

Description

A potential recovery is anticipated as the stock approaches key support levels. RSI may recover from oversold conditions, and MACD could indicate a bullish trend. However, caution is advised due to recent volatility.

Analysis

The stock has shown significant fluctuations, with a recent bearish trend. Key support at $145 and resistance at $155. Technical indicators suggest a potential recovery, but market sentiment remains cautious.

Confidence Level

Potential Risks

Market sentiment and external factors could influence the recovery. A failure to break resistance at $155 may lead to further declines.

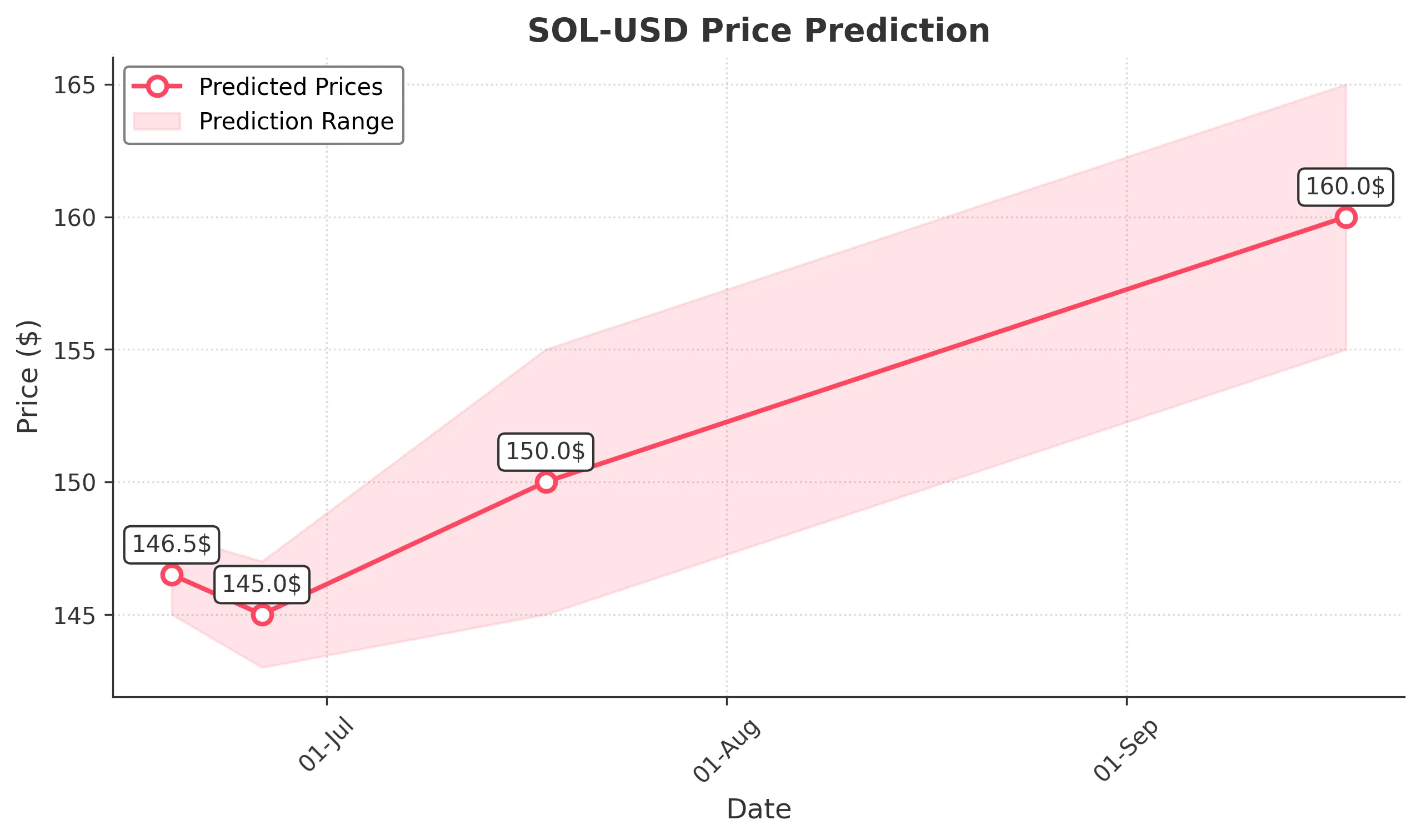

3 Months Prediction

Target: September 18, 2025$160

$158

$165

$155

Description

If the bullish reversal materializes, the stock could reach $160. Positive market sentiment and improved technical indicators may support this. However, external factors could still pose risks.

Analysis

The stock has shown a volatile pattern with a recent bearish trend. Key resistance at $165 and support at $155. Technical indicators suggest a potential recovery, but market sentiment remains mixed, indicating risks of further declines.

Confidence Level

Potential Risks

Potential market corrections or negative news could derail the bullish outlook. The stock's performance is highly dependent on broader market conditions.