SOL-USD Trading Predictions

1 Day Prediction

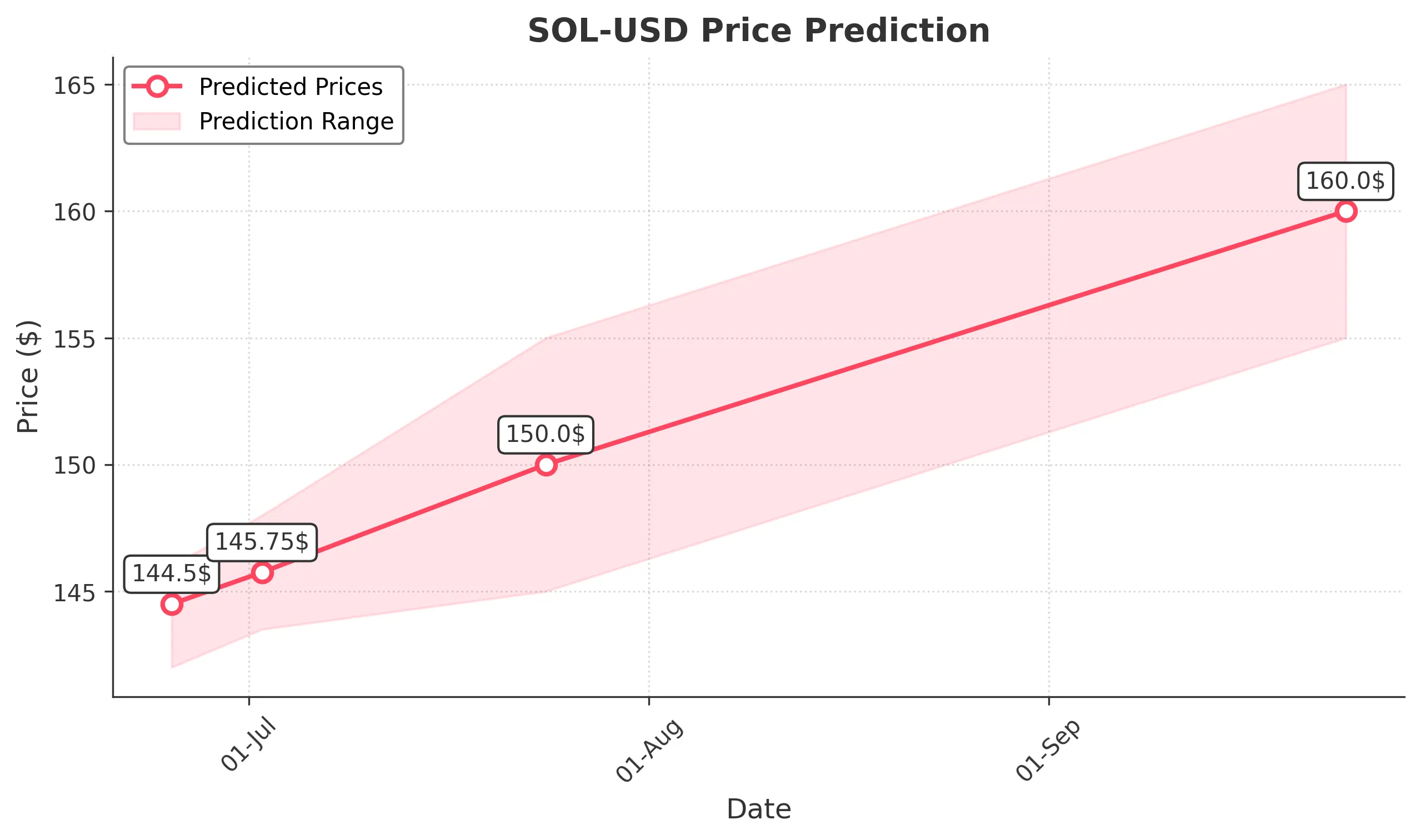

Target: June 25, 2025$144.5

$144

$146

$142

Description

The stock shows a slight bullish trend with a recent Doji pattern indicating indecision. RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, volatility remains high.

Analysis

Over the past 3 months, SOL-USD has experienced significant volatility, with a recent bullish trend after a sharp decline. Key support at 140 and resistance at 150. Volume spikes indicate strong interest, but the market remains sensitive to external factors.

Confidence Level

Potential Risks

Market sentiment could shift quickly due to macroeconomic news or earnings reports, which may impact the prediction.

1 Week Prediction

Target: July 2, 2025$145.75

$144.5

$148

$143.5

Description

The stock is expected to maintain a bullish trend with potential upward movement as the MACD shows a bullish crossover. RSI indicates a slight upward momentum, but caution is advised due to potential resistance at 150.

Analysis

The stock has shown recovery from recent lows, with a bullish engulfing pattern observed. Key resistance at 150 may limit upward movement, while support at 140 remains critical. Volume trends suggest increased interest, but macroeconomic factors could introduce volatility.

Confidence Level

Potential Risks

Potential market corrections or negative news could reverse the trend, impacting the accuracy of this prediction.

1 Month Prediction

Target: July 24, 2025$150

$148

$155

$145

Description

A bullish outlook is anticipated as the stock approaches key resistance levels. The RSI is nearing overbought territory, indicating potential for a pullback. However, strong volume suggests sustained interest.

Analysis

The stock has shown a strong recovery trend, with significant volume spikes indicating bullish sentiment. Key resistance at 150 may pose challenges, while support at 140 remains crucial. Technical indicators suggest a potential upward trajectory, but caution is warranted.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and external economic factors may influence stock performance, leading to unexpected volatility.

3 Months Prediction

Target: September 24, 2025$160

$158

$165

$155

Description

Long-term bullish sentiment is expected as the stock breaks through resistance levels. The MACD indicates strong upward momentum, and RSI suggests continued buying interest. However, overbought conditions may lead to corrections.

Analysis

The stock has shown a strong upward trend, with significant volume supporting the price increase. Key resistance levels are being tested, and while bullish patterns are evident, the market remains sensitive to external factors that could introduce volatility.

Confidence Level

Potential Risks

Potential market corrections and external economic events could impact the stock's performance, leading to volatility.