SOL-USD Trading Predictions

1 Day Prediction

Target: July 25, 2025$182.5

$182

$185

$180

Description

The stock shows a slight bearish trend after a recent peak. RSI indicates overbought conditions, suggesting a potential pullback. Volume remains high, indicating strong interest. Expect a minor decline as profit-taking occurs.

Analysis

Over the past 3 months, SOL-USD has shown significant volatility with a bullish trend peaking recently. Key support at $180 and resistance at $205. High volume spikes indicate strong trading interest, but RSI suggests potential overbought conditions.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to external news or earnings reports, which may affect the prediction.

1 Week Prediction

Target: August 1, 2025$180

$181

$185

$175

Description

The stock is expected to stabilize around $180 as profit-taking continues. The MACD shows a bearish crossover, indicating potential downward momentum. Watch for support at $175.

Analysis

The stock has experienced a strong rally but is now facing resistance. The recent high volume suggests strong interest, but the RSI indicates overbought conditions. Key support at $175 may hold, but a break could lead to further declines.

Confidence Level

Potential Risks

Unforeseen market events or changes in investor sentiment could lead to volatility, impacting the accuracy of this prediction.

1 Month Prediction

Target: August 24, 2025$175

$178

$180

$170

Description

Expect a gradual decline as the market corrects itself. The stock may test support levels around $170. Volume is expected to decrease as traders reassess positions.

Analysis

The stock has shown a strong bullish trend but is now facing resistance. The MACD and RSI suggest a potential correction. Key support at $170 will be critical in the coming weeks, with volume likely decreasing as traders take profits.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements, affecting the prediction.

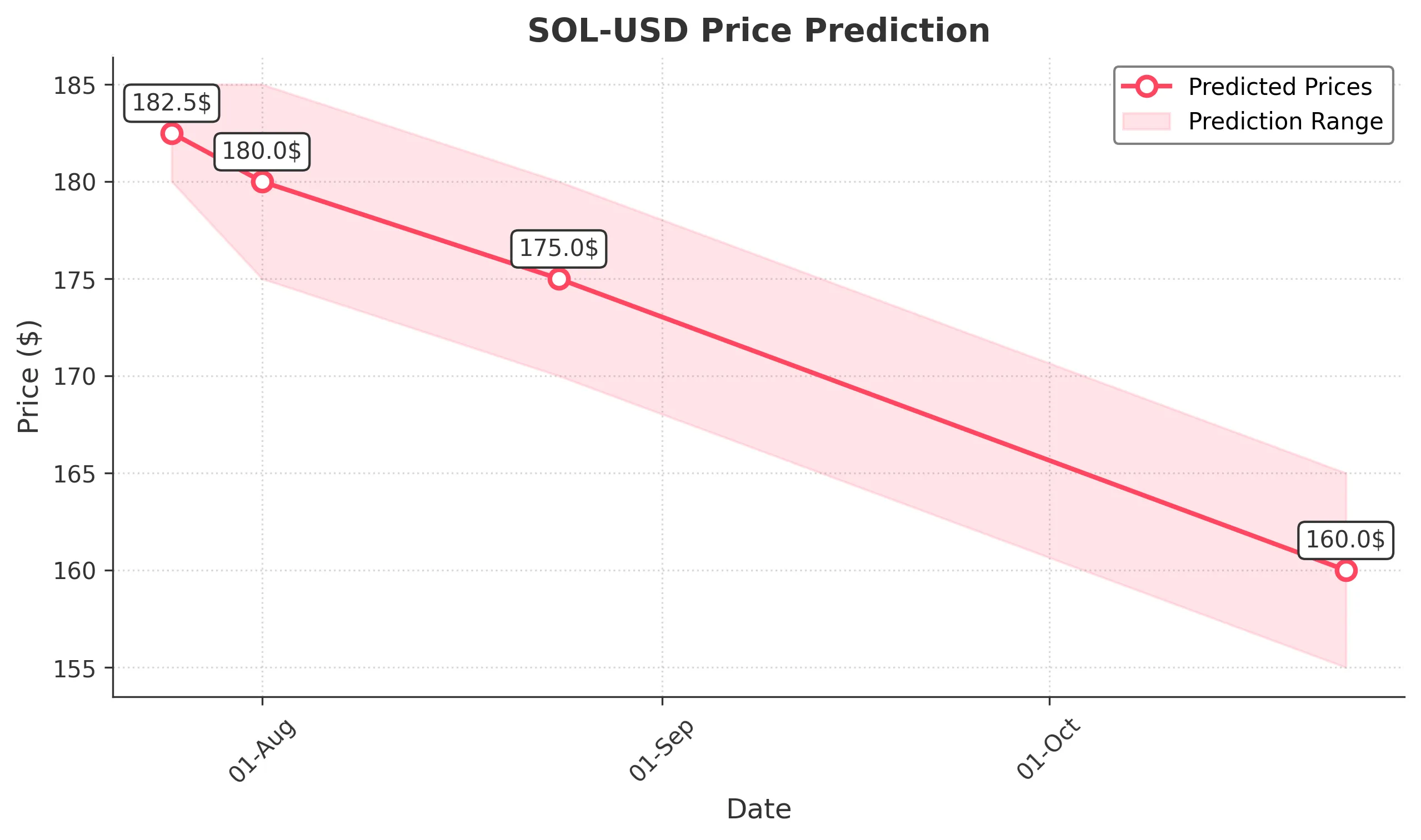

3 Months Prediction

Target: October 24, 2025$160

$162

$165

$155

Description

The stock is expected to continue its downward trend as market corrections take hold. Key support at $155 may be tested. Watch for potential rebounds if volume spikes.

Analysis

The stock has shown significant volatility with a recent peak. The overall trend appears bearish, with key support at $155. The market sentiment is cautious, and external factors could heavily influence future performance.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential macroeconomic changes and market sentiment shifts.