SOL-USD Trading Predictions

1 Day Prediction

Target: August 16, 2025$198

$197

$200

$195

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong volume suggests continued interest. Watch for resistance at $200.

Analysis

Over the past 3 months, SOL-USD has shown a bullish trend with significant price increases. Key support at $180 and resistance at $200. Volume spikes indicate strong buying interest. Technical indicators suggest caution as RSI nears overbought.

Confidence Level

Potential Risks

Potential for a pullback due to overbought RSI. Market sentiment could shift quickly.

1 Week Prediction

Target: August 23, 2025$195.5

$198

$200

$190

Description

Expect a slight pullback as the market consolidates after recent gains. The MACD shows signs of weakening momentum. Watch for support at $190, which could hold if selling pressure increases.

Analysis

The stock has been volatile, with significant price swings. Recent highs near $200 may attract profit-taking. Key support at $190 is critical. Technical indicators suggest a potential consolidation phase.

Confidence Level

Potential Risks

Market volatility and potential profit-taking could lead to sharper declines.

1 Month Prediction

Target: September 15, 2025$185

$195.5

$190

$180

Description

A bearish trend may develop as profit-taking continues. The stock could test support levels around $180. Watch for volume trends to confirm direction.

Analysis

The stock has shown strong bullish momentum but is now facing resistance. Key support at $180 is critical. Technical indicators suggest a potential reversal, with volume patterns indicating profit-taking.

Confidence Level

Potential Risks

Uncertain macroeconomic conditions and market sentiment could impact performance.

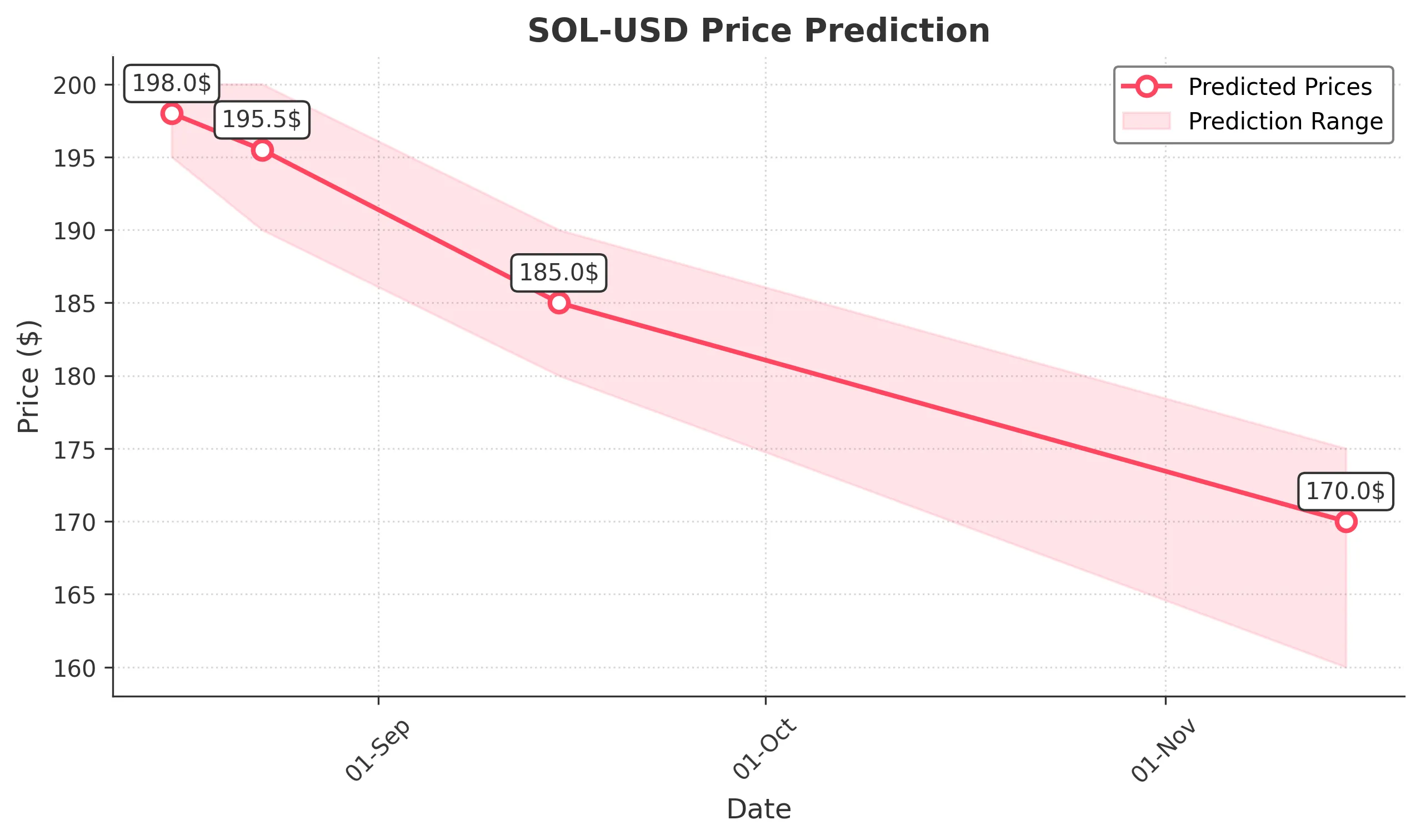

3 Months Prediction

Target: November 15, 2025$170

$185

$175

$160

Description

Longer-term bearish sentiment may prevail as market conditions shift. A test of lower support levels is likely, with potential for further declines if macroeconomic factors worsen.

Analysis

The stock has experienced significant fluctuations. A bearish trend may develop if support levels fail. Key resistance at $185 and support at $160 are critical. Technical indicators suggest caution as market sentiment shifts.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.