TSLA Trading Predictions

1 Day Prediction

Target: April 16, 2025$250

$251

$255

$245

Description

The stock shows signs of consolidation around the 250 level, with recent candlestick patterns indicating indecision. RSI is neutral, and MACD is flat, suggesting a potential for a slight rebound or continued range-bound trading.

Analysis

TSLA has been in a bearish trend over the past three months, with significant support around 250. Recent volume spikes indicate increased interest, but overall sentiment remains cautious. Technical indicators suggest a potential for short-term recovery.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may lead to volatility.

1 Week Prediction

Target: April 23, 2025$255

$250

$260

$240

Description

With the stock hovering around key support levels, a slight upward movement is expected. However, bearish pressure remains, and any negative news could lead to a drop below 240. Watch for volume trends for confirmation.

Analysis

The stock has shown a bearish trend with recent attempts to stabilize around 250. Key resistance is at 260, while support is at 240. Technical indicators are mixed, indicating potential for both upward and downward movements.

Confidence Level

Potential Risks

Unforeseen market events or earnings surprises could impact the stock's trajectory significantly.

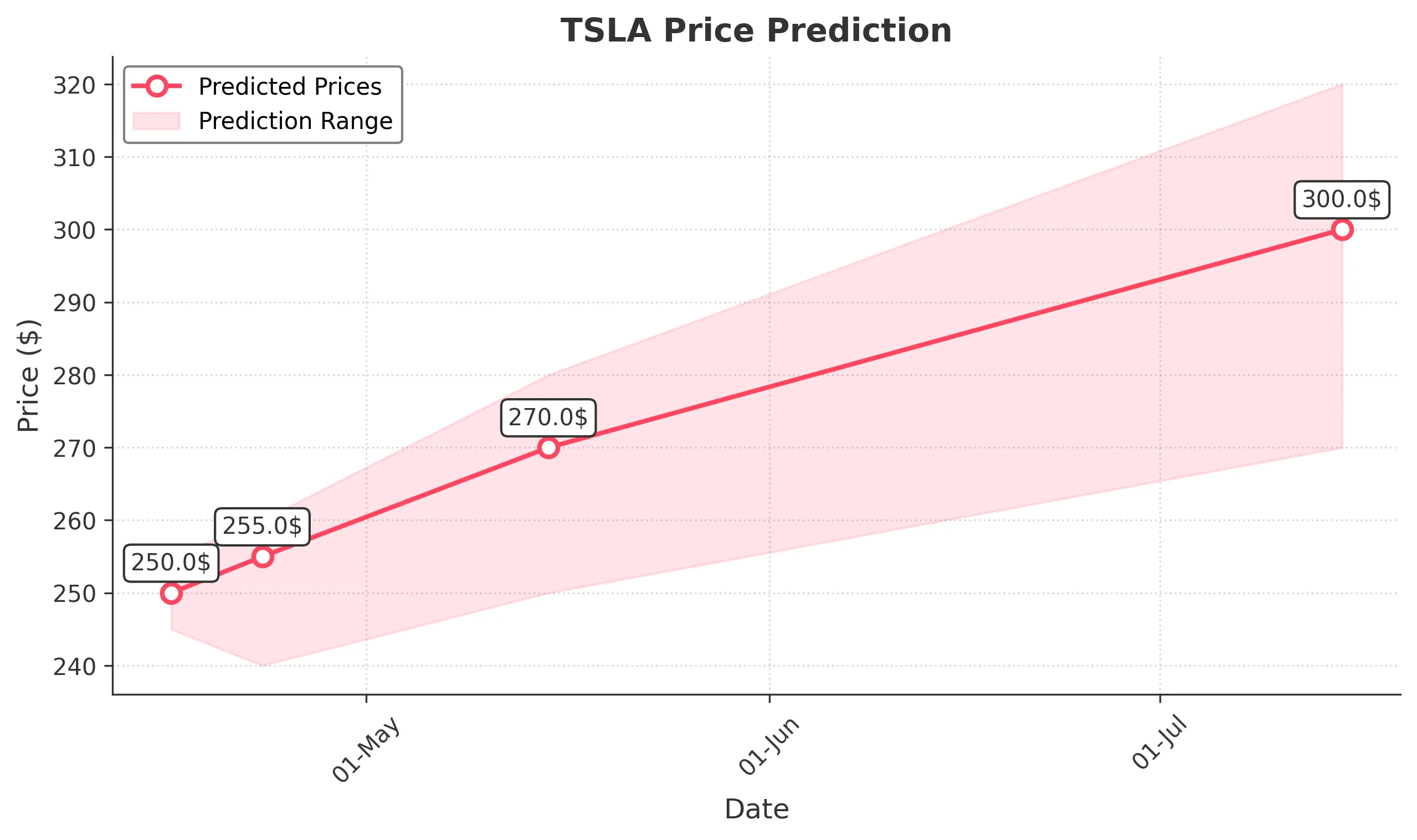

1 Month Prediction

Target: May 15, 2025$270

$255

$280

$250

Description

A gradual recovery is anticipated as the stock tests resistance levels. If it can break above 260, momentum may build. However, macroeconomic factors could still weigh heavily on performance.

Analysis

The stock has been in a bearish phase, but recent stabilization suggests potential for recovery. Key resistance at 260 and support at 250 will be crucial in determining the next move. Volume trends will be critical to watch.

Confidence Level

Potential Risks

Economic indicators and market sentiment could lead to unexpected volatility, impacting the recovery.

3 Months Prediction

Target: July 15, 2025$300

$280

$320

$270

Description

If the stock can maintain upward momentum, a target of 300 is feasible. However, external factors such as economic conditions and competition in the EV market could pose risks.

Analysis

The stock has been under pressure, but a potential recovery could be on the horizon if it breaks key resistance levels. The overall market sentiment and macroeconomic conditions will play a significant role in the stock's performance.

Confidence Level

Potential Risks

Market volatility and potential negative news could derail the recovery, leading to lower prices.