TSLA Trading Predictions

1 Day Prediction

Target: May 30, 2025$367.5

$365.5

$370

$364

Description

The bullish momentum from recent highs suggests a continuation. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong volume and positive market sentiment support upward movement.

Analysis

TSLA has shown a bullish trend over the past 3 months, with significant support at $340 and resistance around $370. The recent price action indicates strong buying interest, but caution is warranted due to high RSI levels.

Confidence Level

Potential Risks

Potential for a short-term pullback due to overbought RSI conditions.

1 Week Prediction

Target: June 6, 2025$375

$370

$380

$360

Description

The upward trend is supported by bullish candlestick patterns and strong volume. However, the MACD shows signs of divergence, which could indicate a potential reversal. Market sentiment remains positive.

Analysis

The stock has been in a bullish phase, with key support at $350. The MACD is bullish, but divergence suggests caution. Volume spikes indicate strong interest, but overbought conditions may lead to volatility.

Confidence Level

Potential Risks

Possible market corrections or profit-taking could impact the price.

1 Month Prediction

Target: June 30, 2025$390

$375

$400

$370

Description

Continued bullish momentum is expected, driven by strong fundamentals and market sentiment. Fibonacci retracement levels suggest potential resistance at $400, but the overall trend remains positive.

Analysis

TSLA has shown resilience with a bullish trend. Key support at $360 and resistance at $400. The RSI is high, indicating potential for a pullback, but overall sentiment remains strong.

Confidence Level

Potential Risks

External market factors or economic data releases could impact performance.

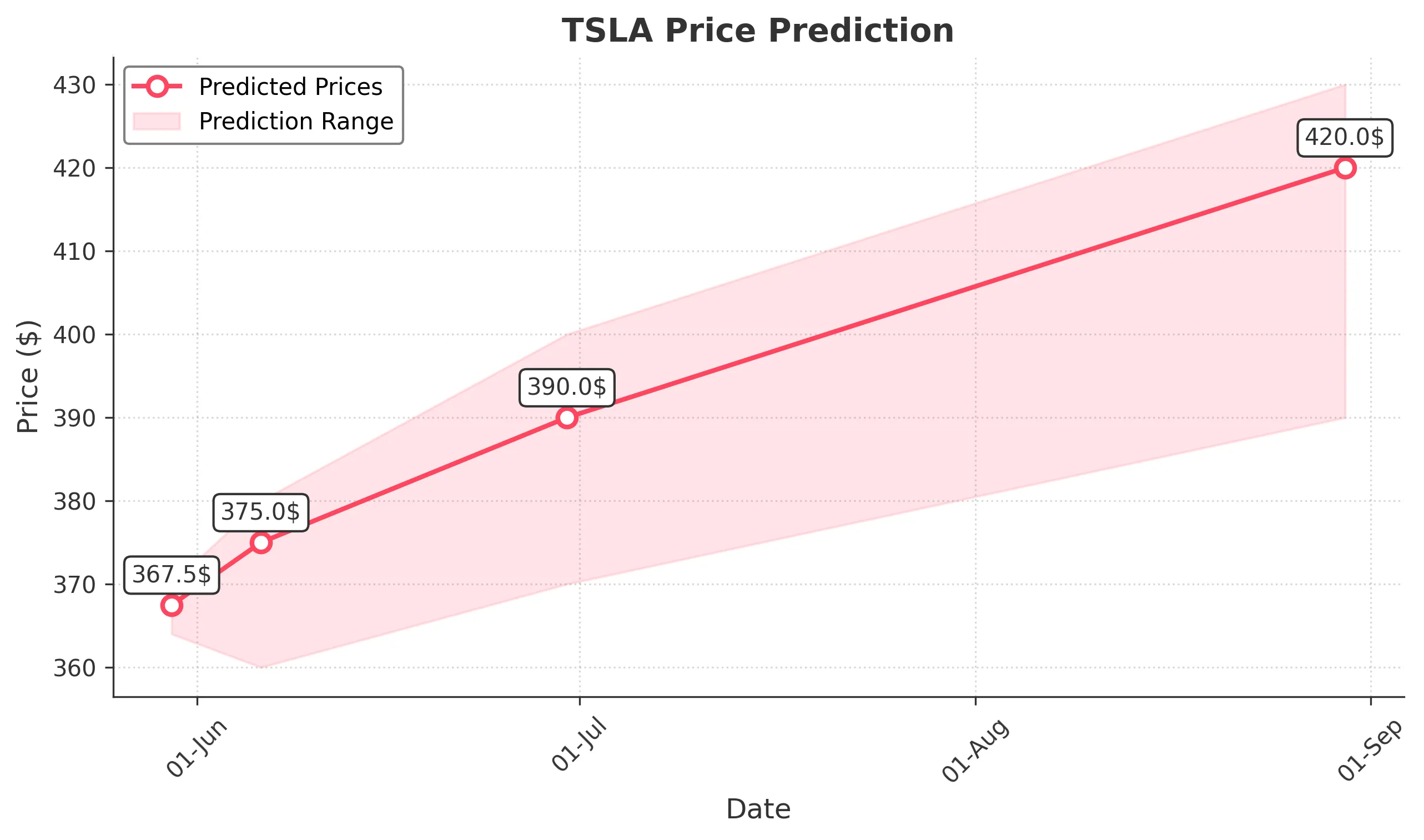

3 Months Prediction

Target: August 30, 2025$420

$400

$430

$390

Description

Long-term bullish outlook supported by strong fundamentals and market trends. However, potential economic headwinds could create volatility. Watch for key resistance at $430.

Analysis

The stock has been on a bullish trajectory, with significant support at $380. The market sentiment is positive, but external factors could introduce volatility. The potential for a correction exists if economic conditions change.

Confidence Level

Potential Risks

Macroeconomic factors and market corrections could lead to unexpected price movements.