TSLA Trading Predictions

1 Day Prediction

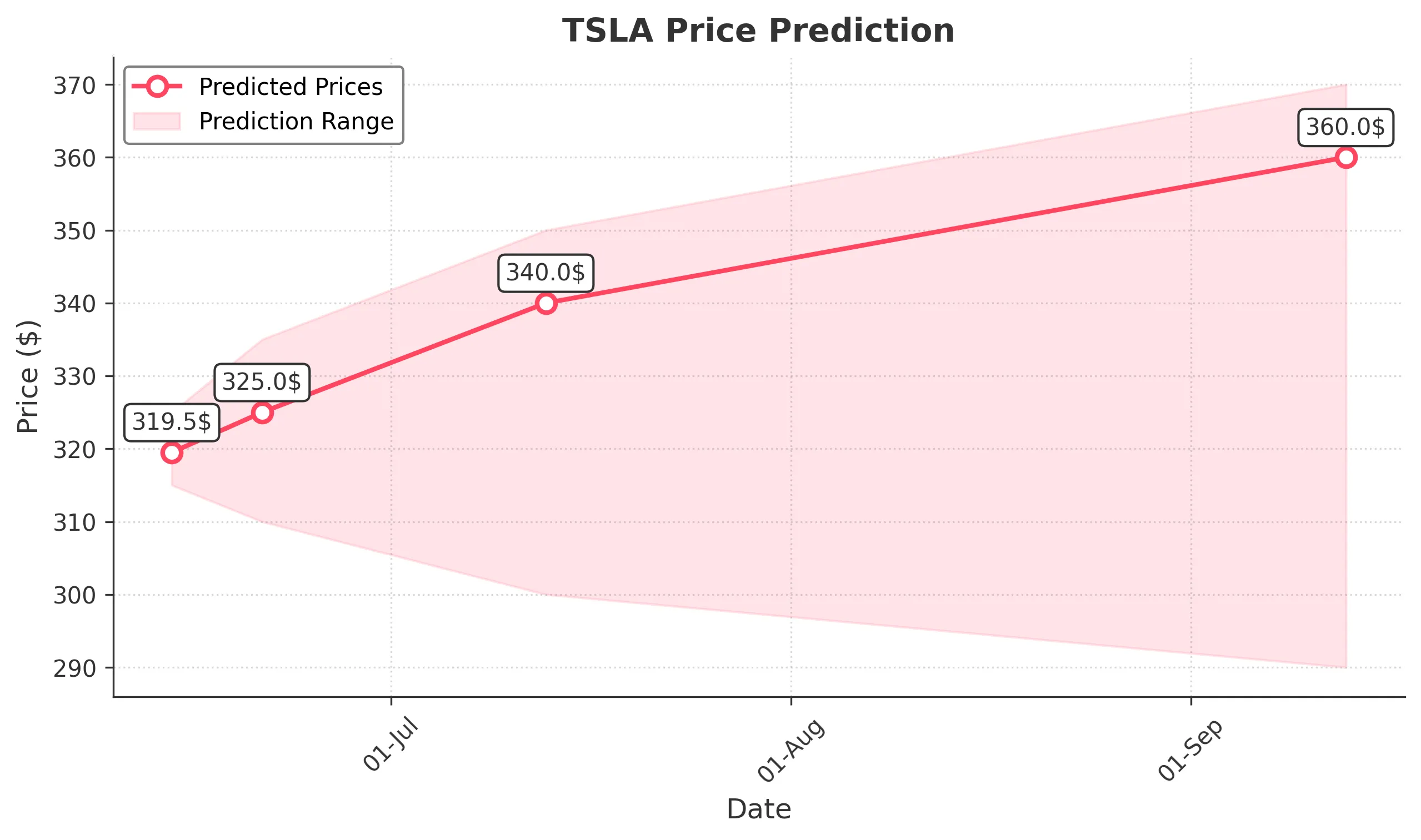

Target: June 14, 2025$319.5

$318

$325

$315

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. RSI is neutral, and MACD is close to crossing above the signal line, suggesting potential upward momentum. However, volatility remains high.

Analysis

Over the past 3 months, TSLA has shown a bullish trend with significant price fluctuations. Key support is around $315, while resistance is near $350. Volume spikes indicate strong interest, but recent volatility raises concerns about potential pullbacks.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news or earnings reports, which may impact the stock's performance.

1 Week Prediction

Target: June 21, 2025$325

$320

$335

$310

Description

The stock is expected to continue its upward trend, supported by a bullish MACD crossover and a rising 50-day moving average. However, the RSI indicates overbought conditions, which could lead to a pullback.

Analysis

TSLA has experienced significant volatility, with a recent bullish trend. Key resistance at $350 may limit upward movement, while support at $310 provides a safety net. Volume trends suggest strong investor interest, but caution is warranted.

Confidence Level

Potential Risks

Potential market corrections and external economic factors could lead to unexpected price movements.

1 Month Prediction

Target: July 13, 2025$340

$330

$350

$300

Description

Expect continued bullish momentum, with the stock potentially reaching $340. The MACD remains positive, and the 200-day moving average supports upward movement. However, overbought conditions may trigger profit-taking.

Analysis

The stock has shown a strong upward trend, but recent price action suggests potential resistance at $350. Volume patterns indicate strong buying interest, but the risk of a pullback exists if market sentiment shifts.

Confidence Level

Potential Risks

Market volatility and external economic events could lead to significant price fluctuations.

3 Months Prediction

Target: September 13, 2025$360

$350

$370

$290

Description

The stock is projected to reach $360, driven by strong fundamentals and market sentiment. However, potential resistance at $370 and macroeconomic uncertainties could lead to volatility.

Analysis

TSLA has shown a bullish trend, but the potential for market corrections exists. Key support at $290 and resistance at $370 will be critical in determining future price movements. Volume trends indicate strong interest, but caution is advised.

Confidence Level

Potential Risks

Unforeseen market events and economic indicators could significantly impact the stock's trajectory.