TSLA Trading Predictions

1 Day Prediction

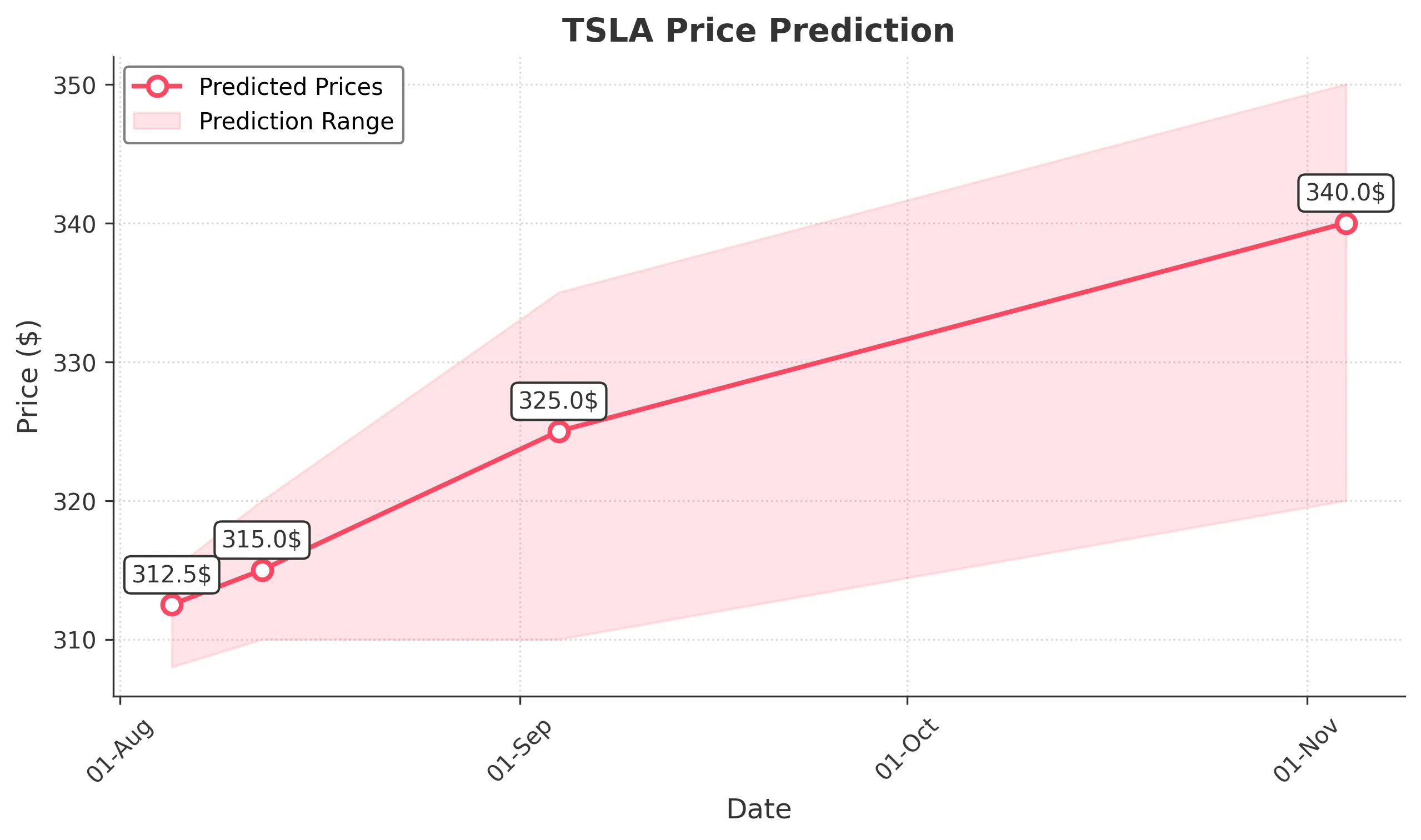

Target: August 5, 2025$312.5

$310

$315

$308

Description

The stock shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is near 50, suggesting a potential upward move. However, the MACD is flattening, indicating possible resistance ahead.

Analysis

Over the past 3 months, TSLA has shown significant volatility with a recent bullish trend. Key support is around $300, while resistance is near $350. The RSI indicates a neutral stance, and volume spikes suggest strong interest. Overall, the market sentiment remains mixed.

Confidence Level

Potential Risks

Market volatility and external news could impact the price. A bearish reversal is possible if the price fails to break above recent highs.

1 Week Prediction

Target: August 12, 2025$315

$312

$320

$310

Description

The stock is expected to continue its upward momentum, supported by a bullish MACD crossover. The recent price action suggests a potential breakout above resistance levels, but caution is advised due to overbought conditions.

Analysis

TSLA has experienced a bullish trend with significant price movements. The recent highs indicate strong buying interest, but the RSI suggests overbought conditions. Key support is at $310, while resistance is at $320. Market sentiment remains cautiously optimistic.

Confidence Level

Potential Risks

Potential market corrections and external economic factors could lead to price fluctuations. A failure to maintain momentum could result in a pullback.

1 Month Prediction

Target: September 4, 2025$325

$320

$335

$310

Description

The stock is likely to trend upwards, supported by strong fundamentals and positive market sentiment. However, the RSI indicates potential overbought conditions, which could lead to short-term corrections.

Analysis

In the last three months, TSLA has shown a bullish trend with significant price increases. Key support is at $310, while resistance is at $335. The MACD indicates bullish momentum, but the RSI suggests caution due to overbought conditions.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could impact market sentiment. A significant pullback could occur if the stock fails to maintain upward momentum.

3 Months Prediction

Target: November 4, 2025$340

$330

$350

$320

Description

The stock is expected to maintain a bullish trend, driven by strong earnings and market sentiment. However, potential resistance at $350 may lead to volatility and corrections.

Analysis

TSLA has shown a strong upward trend over the past three months, with significant price increases. Key support is at $320, while resistance is at $350. The MACD indicates bullish momentum, but the RSI suggests caution due to potential overbought conditions.

Confidence Level

Potential Risks

Market conditions and external factors could lead to unexpected price movements. A bearish reversal is possible if resistance levels hold.