TSLA Trading Predictions

1 Day Prediction

Target: August 12, 2025$340

$339

$345

$335

Description

The stock shows bullish momentum with a recent upward trend. The RSI is approaching overbought levels, indicating potential for a pullback. However, strong support at $335 may hold, leading to a slight increase in price.

Analysis

Over the past 3 months, TSLA has shown volatility with significant price swings. Key support at $300 and resistance around $350. Recent bullish candlestick patterns suggest upward momentum, but the RSI indicates overbought conditions, warranting caution.

Confidence Level

Potential Risks

Potential for a reversal exists if market sentiment shifts or if macroeconomic news impacts investor confidence.

1 Week Prediction

Target: August 19, 2025$345

$340

$350

$330

Description

The stock is expected to continue its upward trend, supported by recent bullish patterns. However, the RSI indicates potential overbought conditions, suggesting a possible pullback. Watch for volume spikes as a signal of trend strength.

Analysis

TSLA has experienced a mix of bullish and bearish trends. The recent price action shows a recovery from lows, but the high volatility and mixed volume patterns indicate uncertainty. Key resistance at $350 may limit upside potential.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements, impacting the prediction.

1 Month Prediction

Target: September 12, 2025$360

$355

$370

$340

Description

Expect continued bullish momentum as the stock approaches key Fibonacci retracement levels. The MACD shows a bullish crossover, supporting upward movement. However, watch for potential resistance at $370.

Analysis

The past three months have shown a recovery from significant lows, with bullish patterns emerging. Key support at $300 and resistance at $370. The stock's volatility remains high, and external factors could influence future performance.

Confidence Level

Potential Risks

Economic data releases or changes in market sentiment could impact the stock's trajectory, leading to volatility.

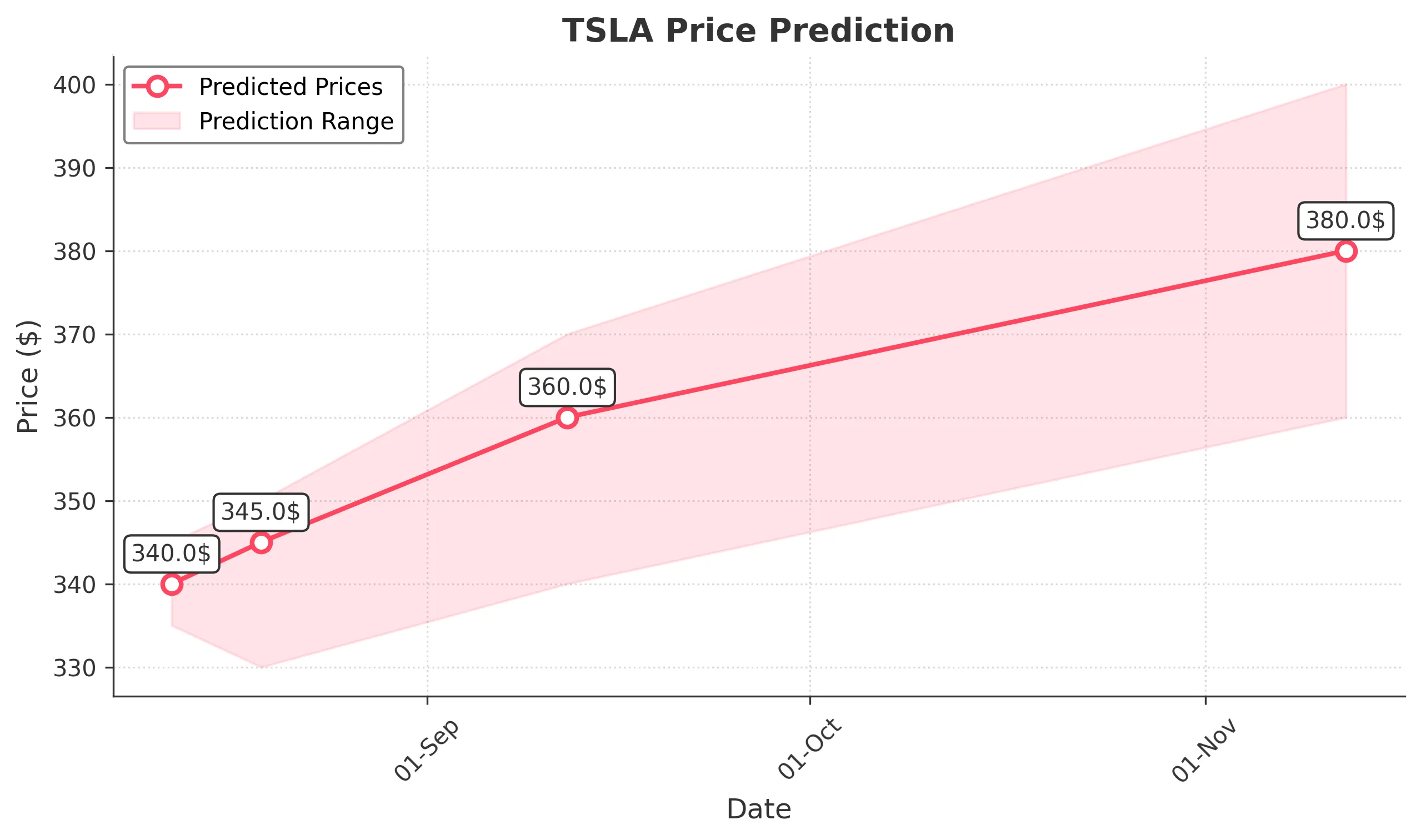

3 Months Prediction

Target: November 12, 2025$380

$375

$400

$360

Description

Long-term bullish outlook as the stock may break through resistance levels. The overall trend is positive, supported by strong fundamentals. However, macroeconomic factors could introduce volatility.

Analysis

TSLA's performance has been characterized by significant volatility and recovery from lows. The stock is currently in a bullish phase, with key support at $340 and resistance at $400. Market sentiment remains cautiously optimistic, but external factors could introduce risks.

Confidence Level

Potential Risks

Unforeseen economic events or changes in market sentiment could lead to price corrections, impacting the prediction's accuracy.