USDJPYX Trading Predictions

1 Day Prediction

Target: May 1, 2025$142.5

$142.3

$143

$141.8

Description

The recent bearish trend indicates a potential continuation, with the price hovering near support levels. RSI shows oversold conditions, suggesting a possible short-term bounce. However, MACD remains bearish, indicating caution.

Analysis

Over the past 3 months, USDJPY has shown a bearish trend, with significant support around 142. The moving averages indicate a downward momentum, while volume has been low, suggesting weak buying interest. Recent candlestick patterns show indecision, and macroeconomic factors may influence future movements.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the prediction. A sudden bullish reversal is possible if sentiment shifts.

1 Week Prediction

Target: May 8, 2025$141

$142

$142

$140.5

Description

The bearish trend is expected to continue, with potential for further declines as the price approaches key support levels. The MACD remains negative, and RSI indicates continued weakness. Watch for any reversal signals.

Analysis

The stock has been in a downtrend, with resistance at 143.5. The ATR indicates increasing volatility, and recent volume spikes suggest potential selling pressure. The market sentiment is cautious, with bearish patterns dominating.

Confidence Level

Potential Risks

Unforeseen economic data releases or geopolitical events could lead to unexpected price movements.

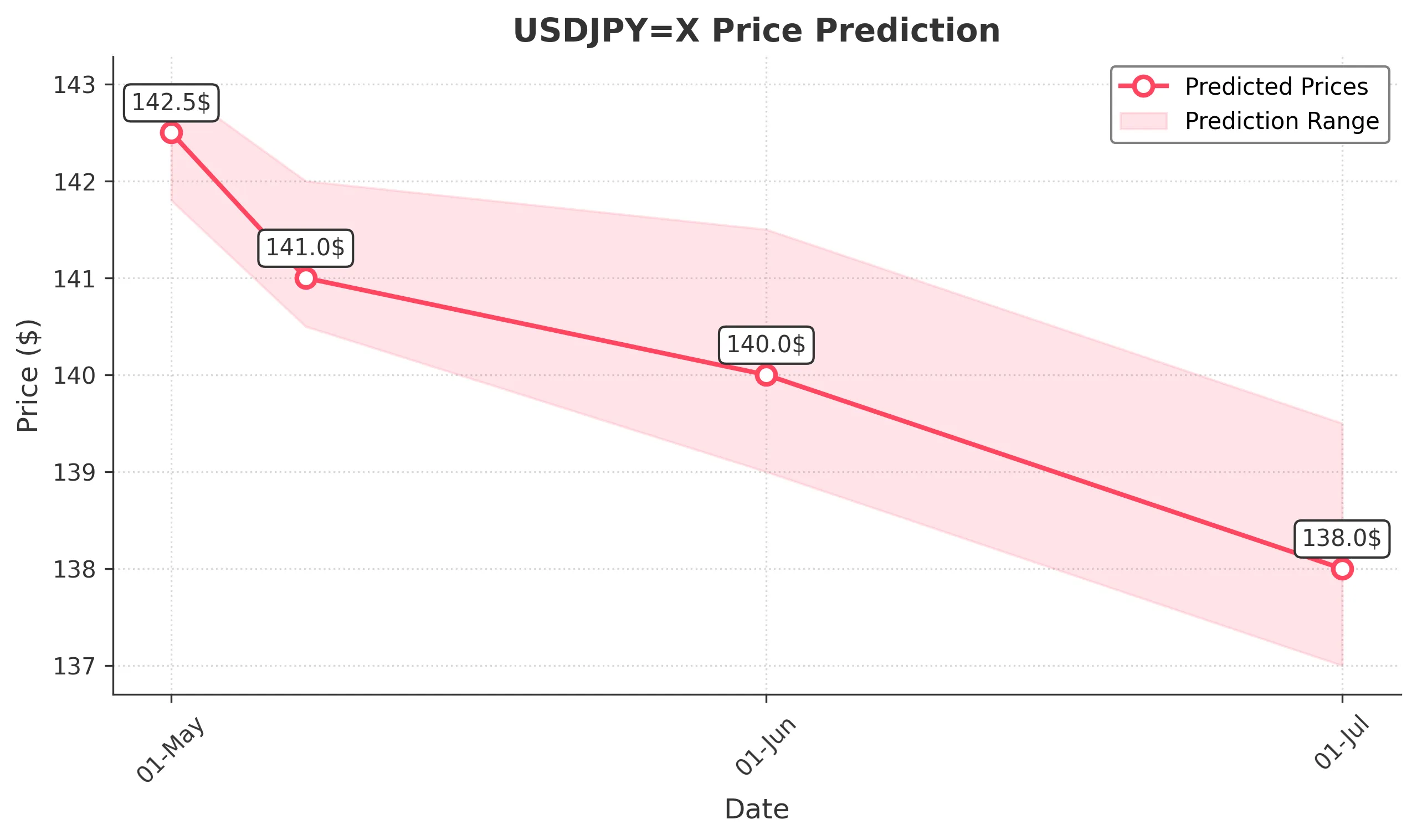

1 Month Prediction

Target: June 1, 2025$140

$141

$141.5

$139

Description

Continued bearish momentum is anticipated, with the price likely testing lower support levels. The RSI indicates oversold conditions, but the MACD suggests further downside potential. Watch for any bullish divergence.

Analysis

The overall trend remains bearish, with significant resistance at 143. The stock has shown low volume, indicating weak buying interest. Technical indicators suggest a potential for further declines, but external factors could alter this trajectory.

Confidence Level

Potential Risks

Market sentiment can shift rapidly, and any positive economic news could lead to a reversal.

3 Months Prediction

Target: July 1, 2025$138

$139

$139.5

$137

Description

A bearish outlook persists, with the potential for the price to reach lower support levels. The MACD remains negative, and RSI indicates continued weakness. A significant market event could alter this trend.

Analysis

The stock has been in a consistent downtrend, with key support at 138. The moving averages indicate a bearish crossover, and volume patterns suggest a lack of buying interest. External economic factors will be crucial in determining future price movements.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic shifts and geopolitical developments that could impact currency values.