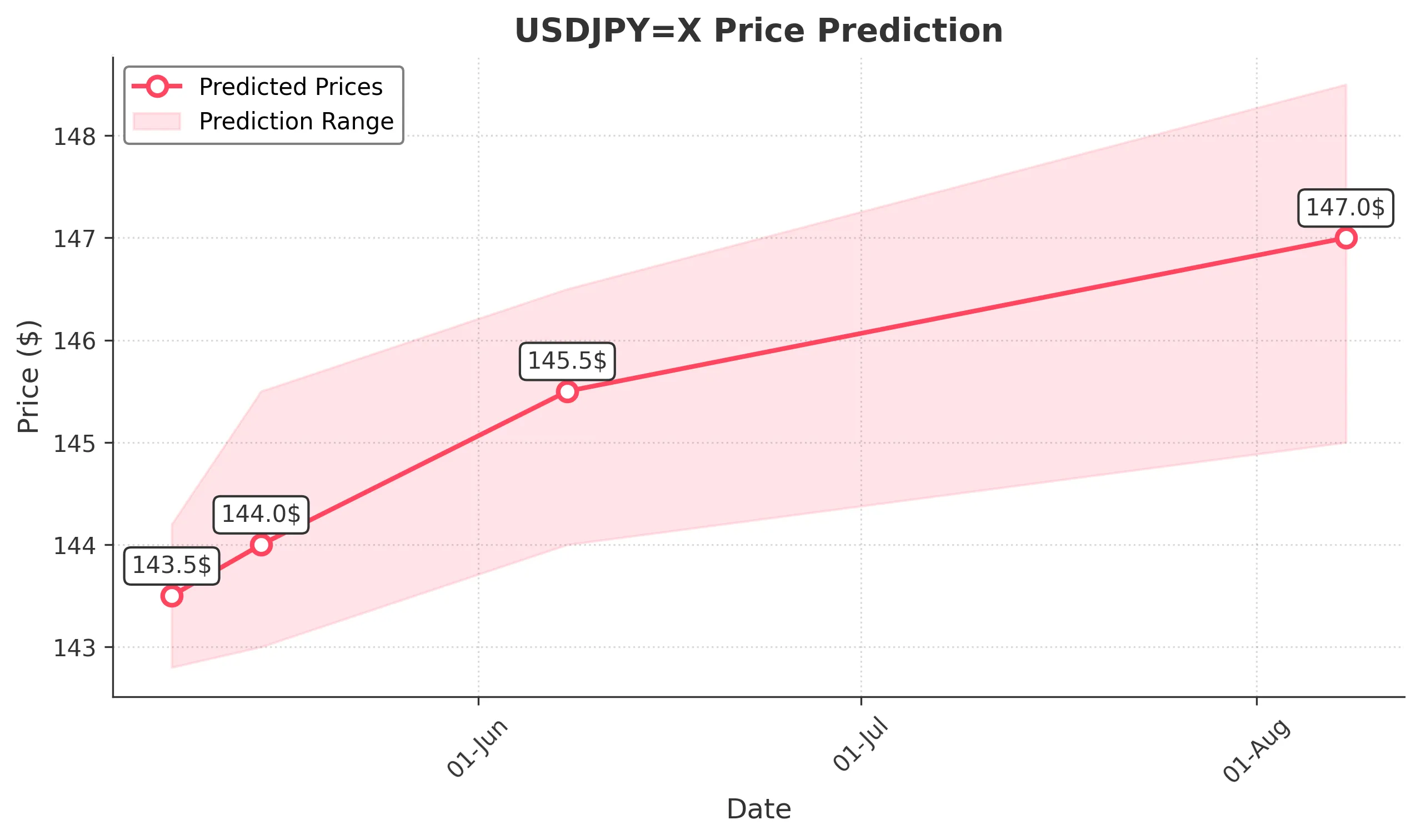

USDJPYX Trading Predictions

1 Day Prediction

Target: May 8, 2025$143.5

$143.2

$144.2

$142.8

Description

The market shows a slight bearish trend with recent lower highs and lows. RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, indicating continued downward pressure. Expect a close around 143.5.

Analysis

Over the past 3 months, USDJPY has shown a bearish trend, with significant support around 142. The recent price action indicates a struggle to maintain higher levels, with MACD and RSI suggesting bearish momentum. Volume has been low, indicating lack of conviction.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction. A sudden shift in sentiment may lead to unexpected price movements.

1 Week Prediction

Target: May 15, 2025$144

$143.5

$145.5

$143

Description

A potential short-term recovery is expected as the market may find support at 142.8. The RSI is approaching neutral, indicating a possible reversal. However, bearish sentiment remains prevalent, limiting upside potential.

Analysis

The stock has been in a bearish phase, with resistance at 145.5. Recent candlestick patterns suggest indecision, and the market is at a critical juncture. Volume has been low, indicating a lack of strong buying interest.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or geopolitical tensions could lead to increased volatility, affecting the accuracy of this prediction.

1 Month Prediction

Target: June 8, 2025$145.5

$144.5

$146.5

$144

Description

Expect a gradual recovery as the market stabilizes. The 50-day moving average is approaching the price, which may act as support. However, bearish sentiment persists, and any bullish momentum may be limited.

Analysis

The past three months have shown a bearish trend with significant resistance at 146.5. The market is currently testing support levels, and while a recovery is possible, the overall sentiment remains cautious.

Confidence Level

Potential Risks

The potential for further declines exists if economic data disappoints or if geopolitical tensions escalate, impacting market sentiment.

3 Months Prediction

Target: August 8, 2025$147

$146

$148.5

$145

Description

A potential bullish reversal could occur if the market breaks above 146.5. However, macroeconomic factors and global sentiment will play a crucial role in determining the direction. Caution is advised.

Analysis

The overall trend has been bearish, with significant resistance at 148.5. The market is at a critical point, and while a recovery is possible, external factors could lead to further declines.

Confidence Level

Potential Risks

Long-term predictions are inherently uncertain due to potential economic shifts, policy changes, and market sentiment fluctuations.