USDJPYX Trading Predictions

1 Day Prediction

Target: May 28, 2025$142.5

$142.8

$143

$142.2

Description

The recent bearish trend suggests a continuation, with the RSI indicating oversold conditions. A potential bounce could occur, but overall sentiment remains weak. Expect a close around 142.500.

Analysis

The past three months show a bearish trend with significant resistance around 145. The RSI is nearing oversold levels, indicating potential for a short-term bounce, but overall sentiment remains negative.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction significantly.

1 Week Prediction

Target: June 4, 2025$143

$142.8

$144.5

$141.5

Description

A slight recovery is expected as the market may react to oversold conditions. However, resistance at 144.500 could limit gains. Anticipate a close around 143.000.

Analysis

The stock has been in a downtrend, with key support at 142. The MACD shows bearish momentum, but a potential short-term recovery could occur as the market reacts to oversold conditions.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to increased volatility and affect the prediction.

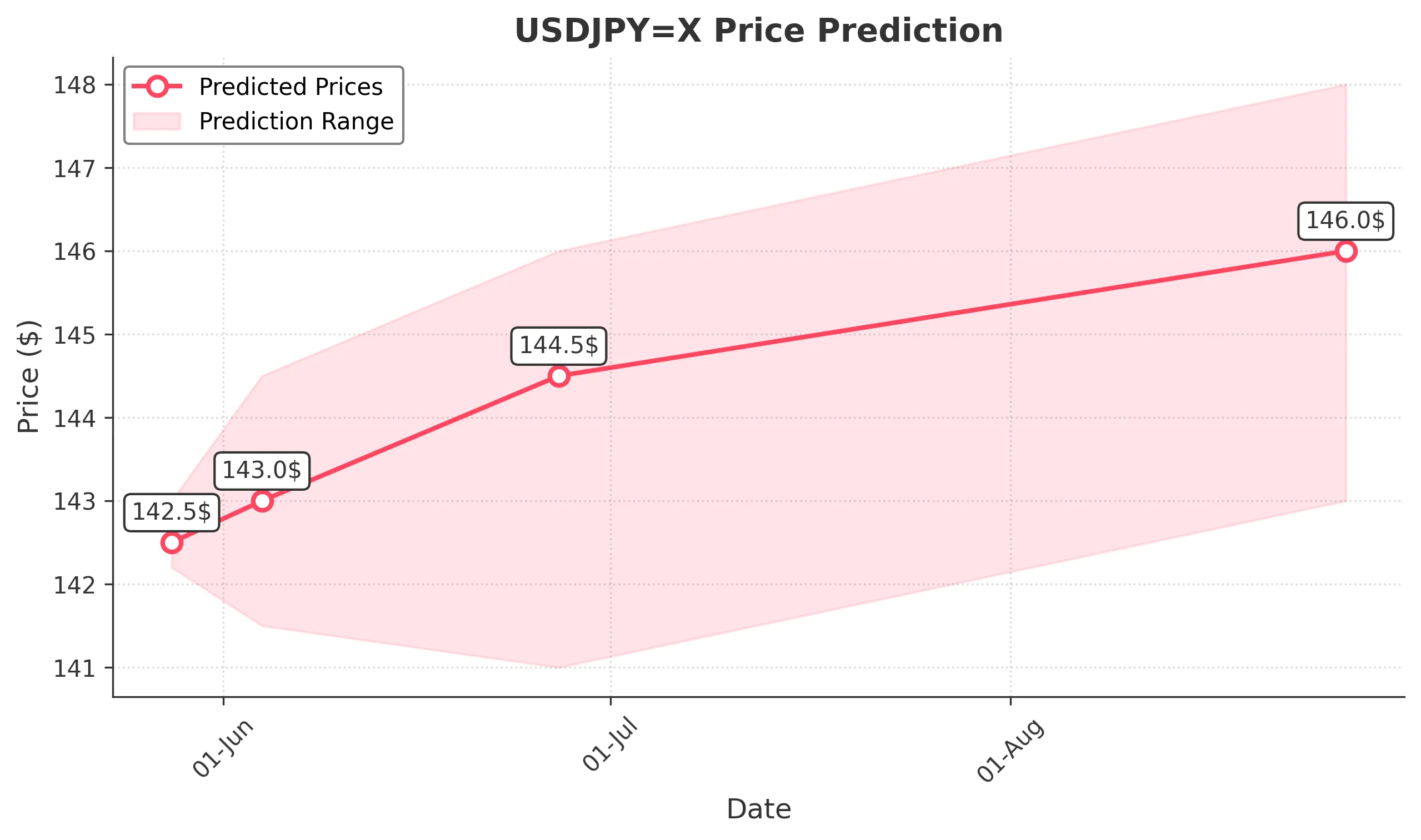

1 Month Prediction

Target: June 27, 2025$144.5

$143.5

$146

$141

Description

Expect a gradual recovery as market sentiment improves. Resistance at 146.000 may be tested, but overall bullish momentum could develop if economic indicators support it.

Analysis

The stock has shown signs of stabilization after a prolonged downtrend. Key resistance levels are at 145 and 146, while support remains around 142. The market's reaction to economic data will be crucial.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could significantly alter market sentiment.

3 Months Prediction

Target: August 27, 2025$146

$145.5

$148

$143

Description

A potential bullish reversal could occur if economic conditions improve. However, resistance at 148.000 may pose challenges. Expect a close around 146.000.

Analysis

The stock's performance over the last three months indicates a bearish trend, but signs of recovery are emerging. Key resistance levels at 146 and 148 will be critical in determining future price movements.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic shifts and market volatility.