USDJPYX Trading Predictions

1 Day Prediction

Target: May 29, 2025$144.5

$144.2

$145.2

$143.8

Description

The recent trend shows a slight bearish sentiment with the price hovering around 144. The RSI indicates oversold conditions, suggesting a potential bounce. However, MACD is bearish, indicating caution. Expect a close around 144.500.

Analysis

Over the past 3 months, USDJPY has shown a bearish trend with significant support around 143. The recent price action indicates a potential reversal, but bearish signals from MACD and moving averages suggest caution. Volume has been low, indicating weak conviction.

Confidence Level

Potential Risks

Market volatility and external news could impact the price significantly.

1 Week Prediction

Target: June 5, 2025$145

$144.5

$146

$143.5

Description

A potential recovery is expected as the market may react positively to upcoming economic data. The Bollinger Bands suggest a squeeze, indicating a breakout could occur. However, the bearish MACD trend remains a concern.

Analysis

The stock has been in a bearish trend, but recent price action shows signs of stabilization. Key resistance is at 146, while support remains at 143. The RSI is approaching neutral, indicating potential for upward movement if bullish sentiment returns.

Confidence Level

Potential Risks

Economic data releases could lead to unexpected volatility.

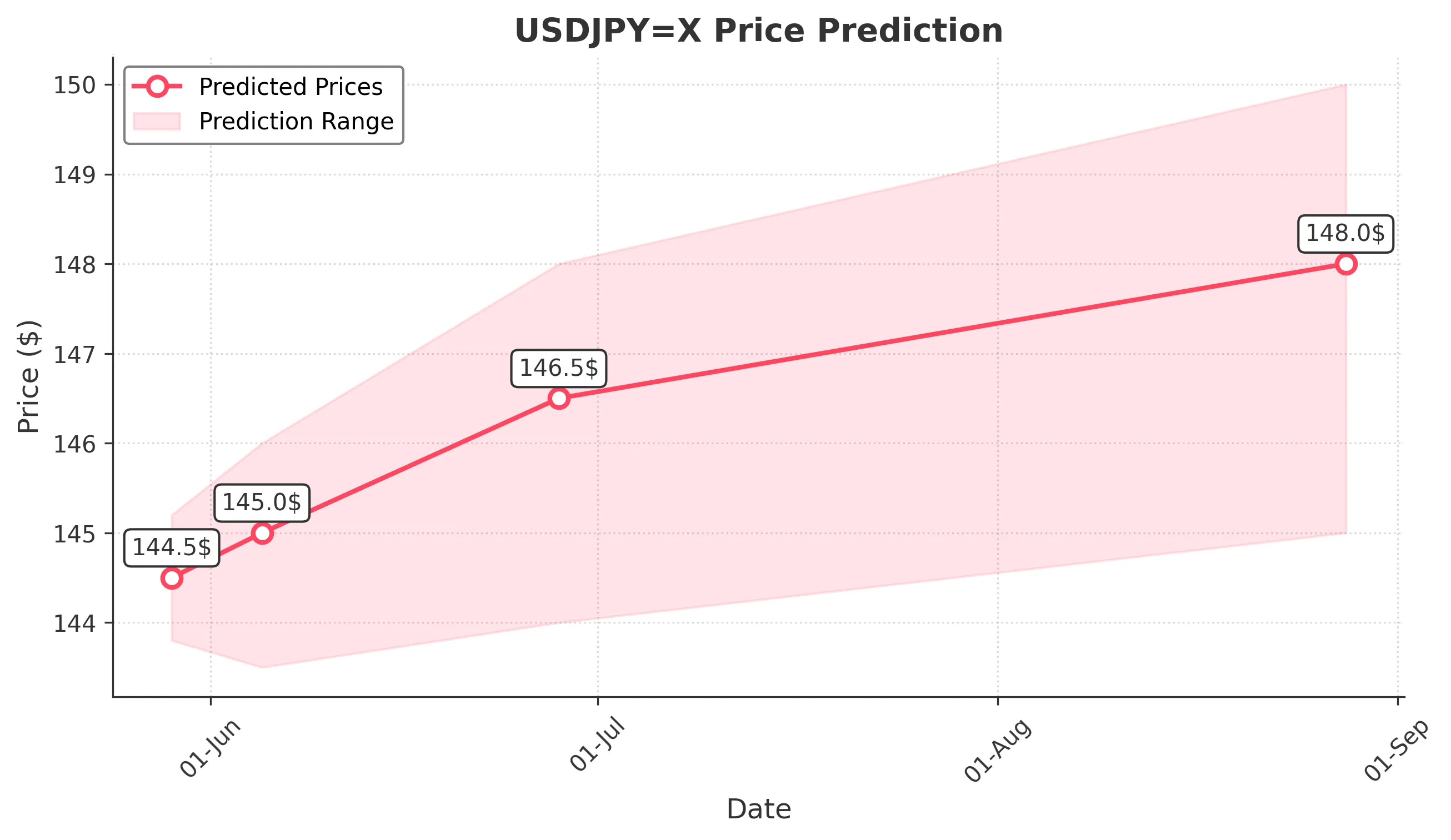

1 Month Prediction

Target: June 28, 2025$146.5

$145

$148

$144

Description

Expect a gradual recovery as market sentiment improves. The Fibonacci retracement levels suggest a target around 146.500. However, the bearish MACD trend could limit upside potential.

Analysis

The past three months have shown a bearish trend with significant fluctuations. Key support at 143 has held, but resistance at 146 remains a challenge. Volume patterns indicate low participation, suggesting caution in bullish scenarios.

Confidence Level

Potential Risks

Unforeseen geopolitical events could disrupt market stability.

3 Months Prediction

Target: August 28, 2025$148

$146.5

$150

$145

Description

If the bullish sentiment continues, a target of 148 is feasible. The market may react positively to macroeconomic developments. However, the bearish MACD trend could still pose risks.

Analysis

The overall trend has been bearish, but signs of recovery are emerging. Key resistance levels are at 150, while support remains at 145. The market's reaction to economic indicators will be crucial in determining the direction.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic shifts.