USDJPYX Trading Predictions

1 Day Prediction

Target: May 30, 2025$145.5

$145.2

$146.2

$144.8

Description

The recent bullish momentum, indicated by the RSI nearing 60 and a potential MACD crossover, suggests a slight upward movement. However, resistance at 146.00 may limit gains.

Analysis

The past 3 months show a bearish trend with significant support at 142.00. Recent price action indicates a potential reversal, but resistance levels remain strong. Volume has been low, indicating cautious trading.

Confidence Level

Potential Risks

Market volatility and external economic news could impact this prediction.

1 Week Prediction

Target: June 6, 2025$146

$145.8

$147

$144.5

Description

With the current bullish trend and a potential breakout above 146.00, the price may stabilize around this level. However, the market sentiment remains cautious due to macroeconomic factors.

Analysis

The stock has shown signs of recovery, but the overall trend remains bearish. Key resistance at 146.00 and support at 142.00 are critical. The MACD indicates potential upward momentum, but caution is warranted.

Confidence Level

Potential Risks

Unforeseen economic data releases could lead to volatility.

1 Month Prediction

Target: June 29, 2025$147.5

$146.8

$148.5

$145

Description

If the bullish trend continues, the price may reach 147.50, supported by a favorable RSI and MACD. However, resistance at 148.00 could pose challenges.

Analysis

The stock has been fluctuating with a slight bullish bias. Key resistance at 148.00 and support at 142.00 are pivotal. The ATR indicates increasing volatility, suggesting potential price swings.

Confidence Level

Potential Risks

Market sentiment and economic indicators could shift, impacting the forecast.

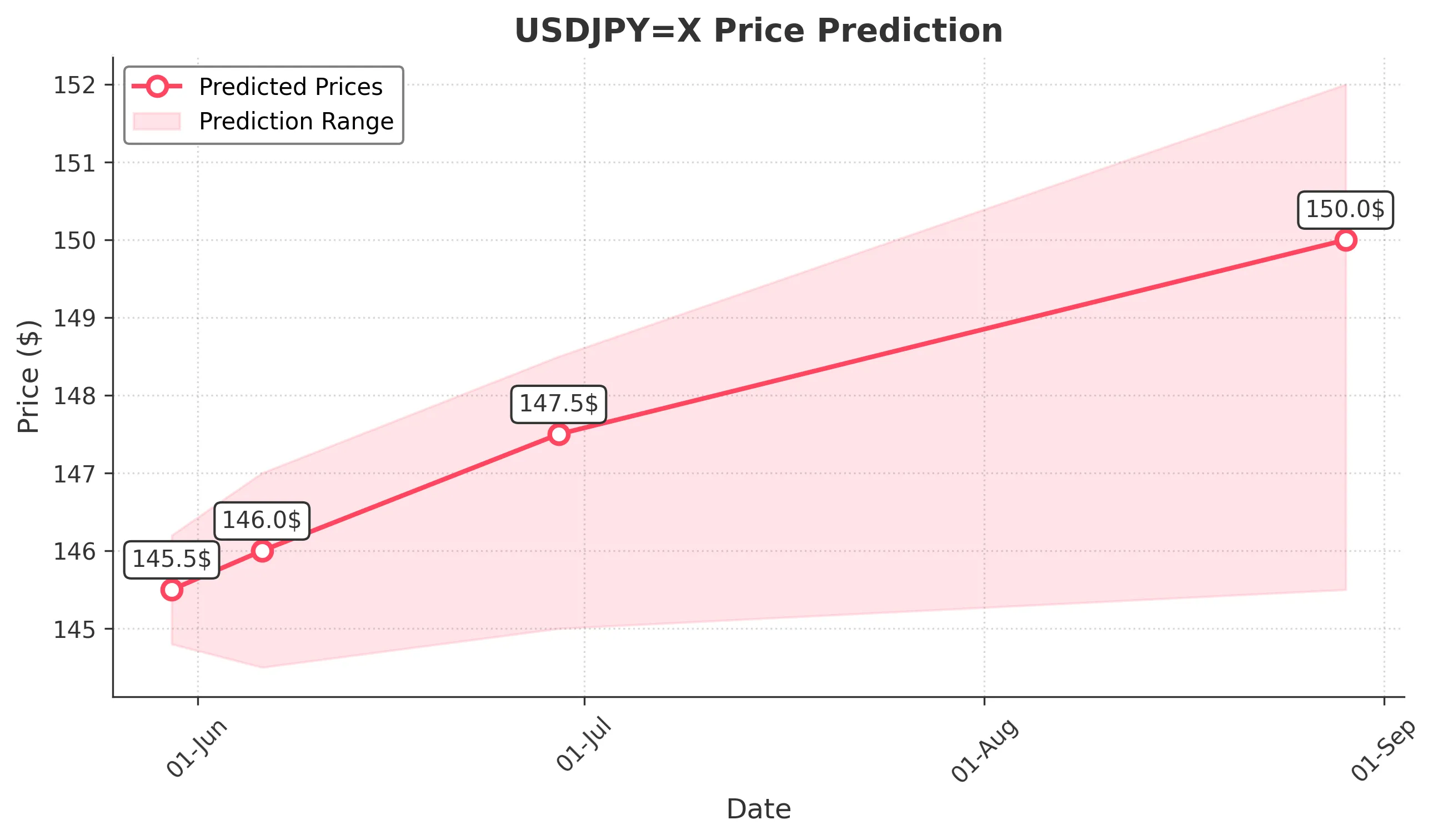

3 Months Prediction

Target: August 29, 2025$150

$149.5

$152

$145.5

Description

If the bullish trend persists, the price could reach 150.00, driven by positive market sentiment and potential economic recovery. However, external factors may introduce volatility.

Analysis

The stock has shown signs of recovery, but the overall trend remains uncertain. Key resistance at 150.00 and support at 142.00 are critical. The market sentiment is mixed, with potential for both upward and downward movements.

Confidence Level

Potential Risks

Economic uncertainties and geopolitical events could lead to unexpected price movements.