USDJPYX Trading Predictions

1 Day Prediction

Target: June 6, 2025$142.5

$142.8

$143

$142.2

Description

The recent bearish trend, indicated by lower highs and lower lows, suggests a continuation. The RSI is approaching oversold levels, but the MACD shows a bearish crossover. Expect a slight decline in price with potential support around 142.20.

Analysis

The past three months show a bearish trend with significant resistance at 150.00 and support around 142.00. The MACD indicates bearish momentum, while the RSI suggests potential oversold conditions. Volume has been low, indicating weak buying interest.

Confidence Level

Potential Risks

Market volatility and external economic news could impact this prediction significantly.

1 Week Prediction

Target: June 13, 2025$141.8

$142.2

$142.5

$141.5

Description

The bearish trend is expected to persist, with the price likely to test lower support levels. The Bollinger Bands indicate a squeeze, suggesting potential volatility. Watch for any reversal patterns that could signal a change.

Analysis

The stock has been in a downtrend, with key resistance at 145.00. The ATR indicates increasing volatility, and the recent candlestick patterns show bearish engulfing formations. Volume remains low, indicating a lack of strong buying pressure.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to sudden price movements contrary to this prediction.

1 Month Prediction

Target: July 5, 2025$140.5

$141

$141.5

$139.8

Description

Continued bearish sentiment is expected, with potential for further declines as the market reacts to macroeconomic data. The Fibonacci retracement levels suggest support around 140.00, which may hold temporarily.

Analysis

The overall trend is bearish, with significant resistance at 145.00 and support around 140.00. The RSI indicates oversold conditions, but the MACD remains bearish. Volume patterns suggest a lack of conviction in upward movements.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could lead to unexpected price movements.

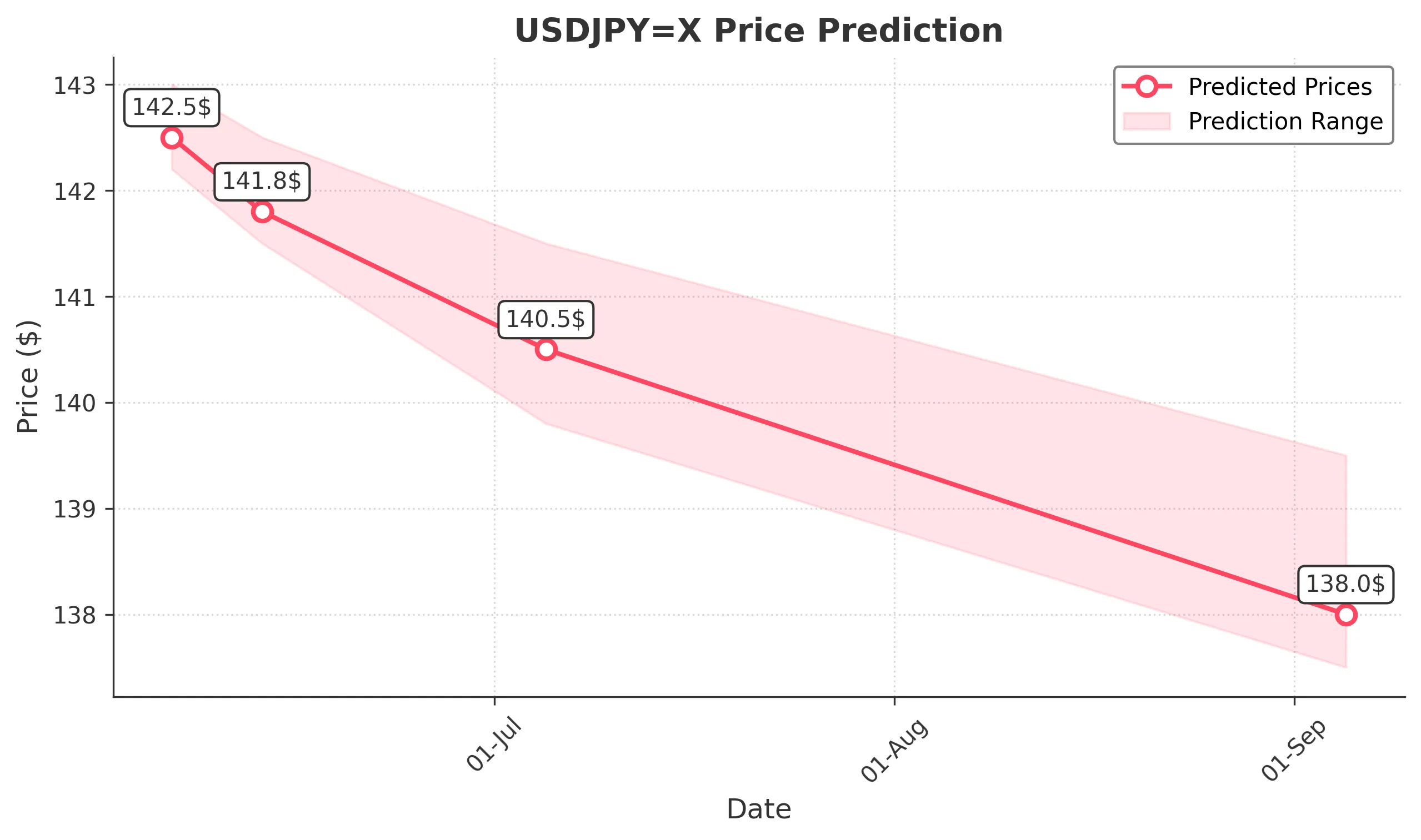

3 Months Prediction

Target: September 5, 2025$138

$139

$139.5

$137.5

Description

If the bearish trend continues, the price may reach lower support levels. The market sentiment is cautious, and any negative economic news could exacerbate the decline. Watch for potential reversal signals.

Analysis

The stock has shown a consistent downtrend, with key support at 138.00. The MACD indicates bearish momentum, and the RSI suggests oversold conditions. Volume has been low, indicating weak buying interest, which could lead to further declines.

Confidence Level

Potential Risks

Long-term predictions are highly uncertain due to potential market shifts and economic changes.