USDJPYX Trading Predictions

1 Day Prediction

Target: June 10, 2025$144.8

$144.7

$145.3

$144.2

Description

The recent bearish trend suggests a potential continuation, with the RSI indicating oversold conditions. A Doji pattern on the last trading day hints at indecision, but the overall sentiment remains weak, leading to a predicted close around 144.800.

Analysis

Over the past 3 months, USDJPY has shown a bearish trend with significant support around 143.00. The MACD is bearish, and the RSI is nearing oversold territory. Volume has been low, indicating lack of conviction in recent moves. External factors, including economic data releases, could influence future price action.

Confidence Level

Potential Risks

Market volatility and potential news events could impact this prediction. A sudden bullish reversal is possible if market sentiment shifts.

1 Week Prediction

Target: June 17, 2025$145.2

$144.9

$145.8

$144.5

Description

A slight recovery is anticipated as the market may find support near 144.00. The Bollinger Bands suggest a potential bounce back, while the MACD shows signs of convergence. However, caution is warranted due to prevailing bearish sentiment.

Analysis

The stock has been in a bearish phase, with resistance at 146.00. The ATR indicates moderate volatility, and recent candlestick patterns suggest indecision. The market's reaction to upcoming economic indicators will be crucial in determining the direction.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to increased volatility, potentially reversing this prediction.

1 Month Prediction

Target: July 10, 2025$146.5

$145.8

$147

$145

Description

A gradual recovery is expected as the market stabilizes. The Fibonacci retracement levels indicate potential support at 145.00, and a bullish divergence in the RSI may signal a reversal. However, the overall trend remains cautious.

Analysis

The past three months have shown a bearish trend with key support at 143.00. The MACD is bearish, but the RSI indicates potential for a rebound. Volume patterns suggest a lack of strong buying interest, and external factors could lead to further fluctuations.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could significantly impact market sentiment and price direction.

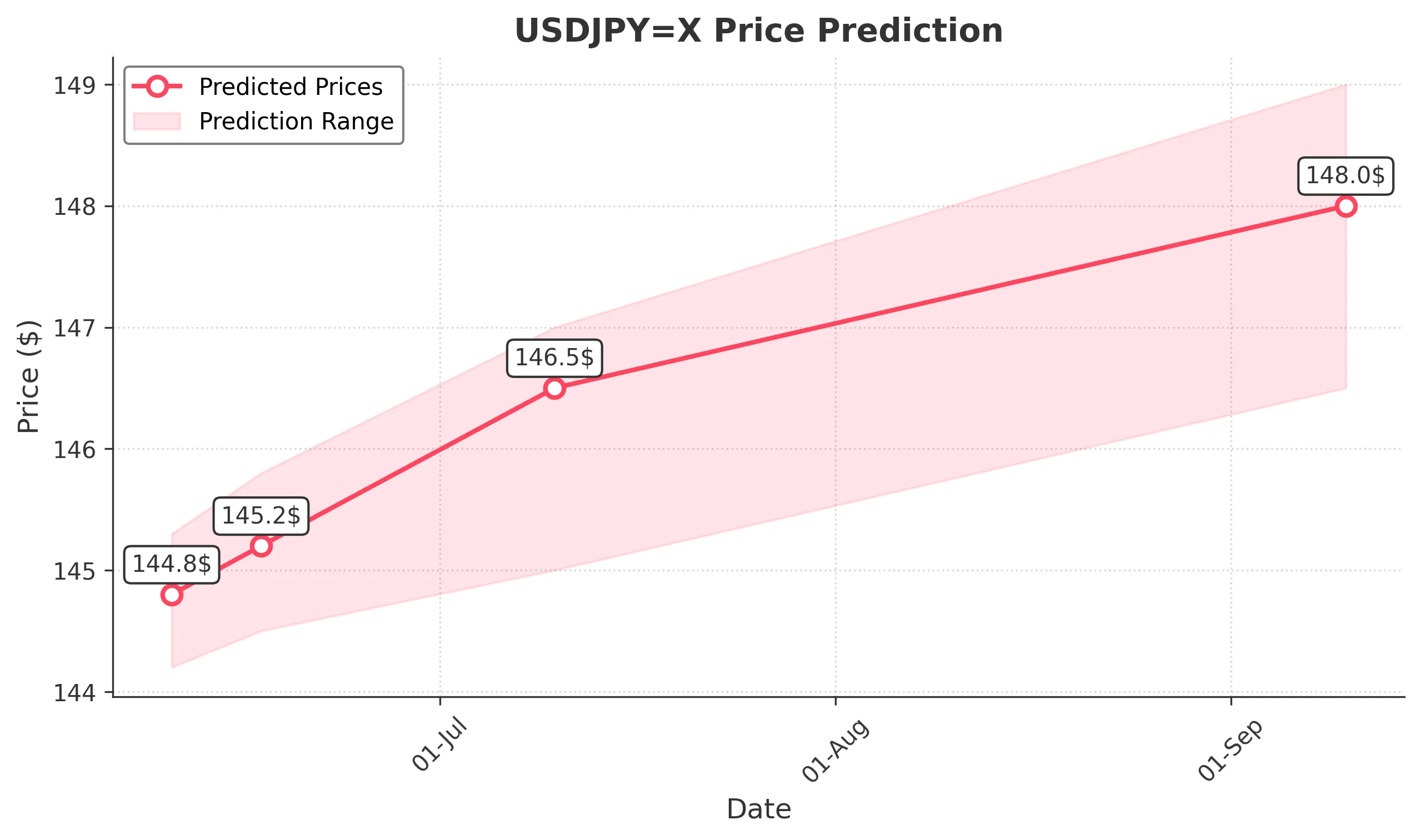

3 Months Prediction

Target: September 10, 2025$148

$147.5

$149

$146.5

Description

A bullish trend may develop as the market adjusts to economic conditions. The MACD could turn positive, and the RSI may stabilize, indicating a potential upward movement. However, caution is advised due to the prevailing bearish sentiment.

Analysis

The overall performance has been bearish, with significant resistance at 150.00. The ATR indicates increasing volatility, and recent candlestick patterns show indecision. The market's response to macroeconomic developments will be critical in shaping future trends.

Confidence Level

Potential Risks

Long-term predictions are inherently uncertain, especially with potential economic shifts and geopolitical tensions that could affect currency markets.