USDJPYX Trading Predictions

1 Day Prediction

Target: June 19, 2025$145.5

$145.3

$146

$144.8

Description

The recent bullish momentum, indicated by the MACD crossover and RSI nearing overbought levels, suggests a potential upward move. However, the proximity to resistance at 146.00 may limit gains.

Analysis

The past three months show a bearish trend with significant support around 143.00. Recent price action indicates a potential reversal, but the overall sentiment remains cautious due to macroeconomic uncertainties.

Confidence Level

Potential Risks

Market volatility and external economic news could impact the price direction unexpectedly.

1 Week Prediction

Target: June 26, 2025$146.2

$145.8

$147.5

$145

Description

With the current bullish trend and a potential breakout above 146.00, the price may continue to rise. However, the RSI indicates overbought conditions, suggesting a possible pullback.

Analysis

The stock has shown signs of recovery, but resistance levels remain a concern. The MACD indicates bullish momentum, yet the overall trend is still uncertain due to recent volatility.

Confidence Level

Potential Risks

A reversal could occur if market sentiment shifts or if economic data releases are unfavorable.

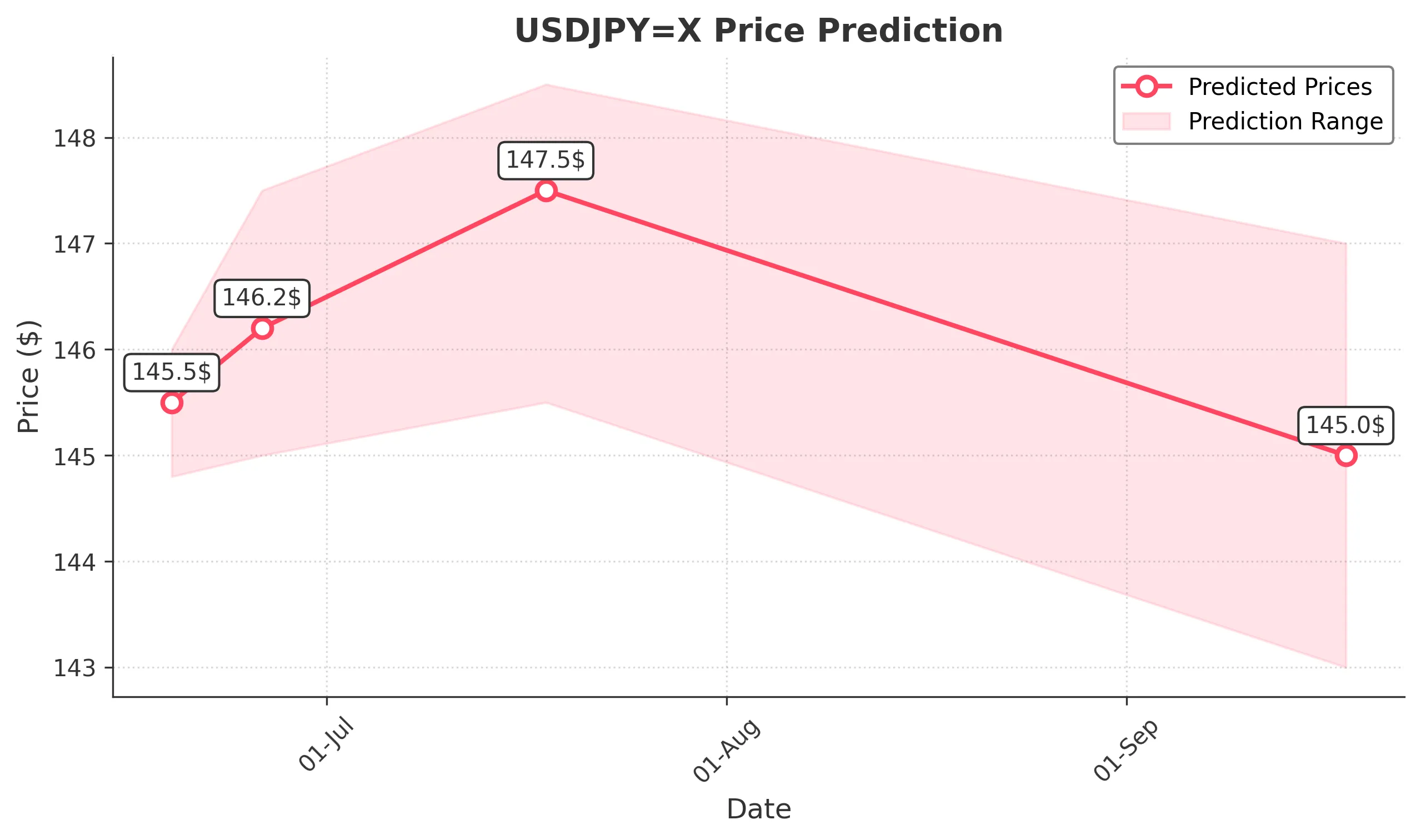

1 Month Prediction

Target: July 18, 2025$147.5

$146.8

$148.5

$145.5

Description

If the bullish trend continues, the price could reach 147.50, supported by Fibonacci retracement levels. However, the market's reaction to upcoming economic reports could introduce volatility.

Analysis

The stock has been fluctuating within a range, with key resistance at 148.00. The overall sentiment is mixed, with potential for upward movement but significant risks from external factors.

Confidence Level

Potential Risks

Economic indicators and geopolitical events may lead to unexpected price movements.

3 Months Prediction

Target: September 18, 2025$145

$144.5

$147

$143

Description

Expectations of a bearish trend may lead to a decline towards 145.00, influenced by macroeconomic factors and potential resistance at higher levels. Caution is advised as market conditions evolve.

Analysis

The stock has shown a bearish trend with significant resistance levels. The overall market sentiment is cautious, and external economic factors could lead to further declines.

Confidence Level

Potential Risks

Unforeseen economic developments could significantly alter the market landscape.