USDJPYX Trading Predictions

1 Day Prediction

Target: June 20, 2025$145.2

$145.1

$145.6

$144.8

Description

The market shows a slight bullish trend with the recent close above the 50-day moving average. RSI indicates neutrality, while MACD is showing a potential bullish crossover. However, volatility remains high, suggesting caution.

Analysis

Over the past 3 months, USDJPY has shown a bearish trend with significant support around 143. The recent recovery attempts have been met with resistance near 145. Technical indicators suggest a potential reversal, but volatility remains a concern.

Confidence Level

Potential Risks

Market sentiment could shift due to external economic news or geopolitical events, which may impact the predicted price.

1 Week Prediction

Target: June 27, 2025$145.5

$145.2

$146

$144.2

Description

The bullish momentum may continue as the price approaches the upper Bollinger Band. However, the RSI is nearing overbought territory, indicating a possible pullback. Watch for volume spikes that could signal a trend change.

Analysis

The stock has been fluctuating around key resistance levels, with recent highs suggesting a bullish sentiment. However, the overall trend remains uncertain, and external factors could influence price movements significantly.

Confidence Level

Potential Risks

Potential for a reversal exists if economic data releases are unfavorable, which could lead to increased volatility.

1 Month Prediction

Target: July 19, 2025$146

$145.8

$147.5

$143.5

Description

Expect a gradual increase in price as the market stabilizes. The Fibonacci retracement levels suggest support at 144. The MACD indicates a bullish trend, but caution is advised as the RSI approaches overbought levels.

Analysis

The past three months have shown a mix of bullish and bearish signals. Key resistance at 147 remains a challenge, while support at 143 is critical. The market's reaction to macroeconomic events will be pivotal in determining future trends.

Confidence Level

Potential Risks

Economic indicators and geopolitical tensions could lead to unexpected price movements, impacting the forecast.

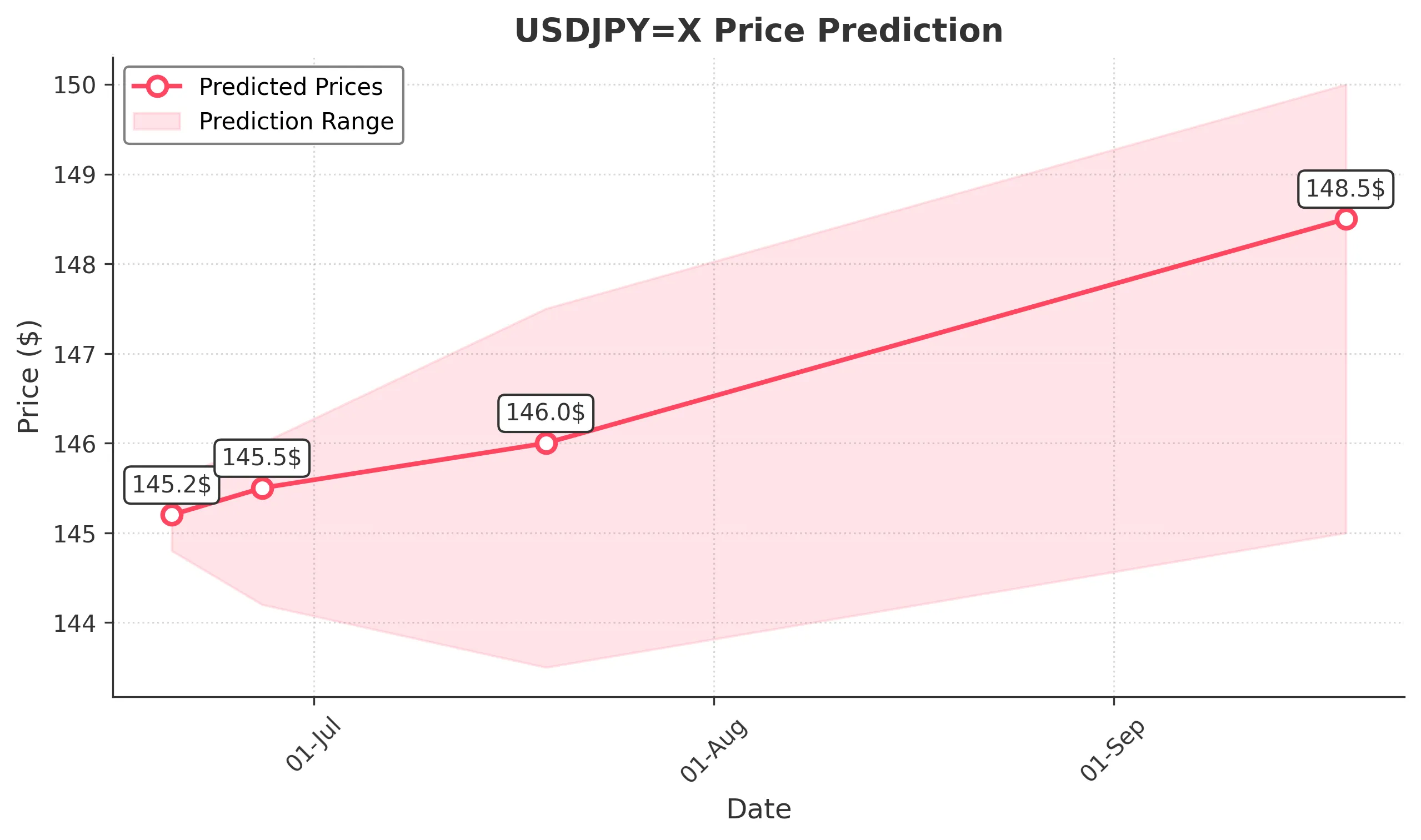

3 Months Prediction

Target: September 19, 2025$148.5

$147

$150

$145

Description

Long-term outlook remains cautiously optimistic with potential for upward movement. The market may react positively to favorable economic data, but resistance levels will need to be monitored closely.

Analysis

The overall trend has been bearish, but recent price action suggests a possible recovery. Key resistance levels will be critical in determining the sustainability of any upward movement. External economic factors will play a significant role.

Confidence Level

Potential Risks

Long-term predictions are subject to high uncertainty due to potential economic shifts and market volatility.