USDJPYX Trading Predictions

1 Day Prediction

Target: June 24, 2025$146.5

$146.4

$147.2

$145.8

Description

The recent bullish momentum, indicated by the upward trend in the last few days and a potential breakout above resistance at 146.00, suggests a close around 146.500. RSI is neutral, indicating no overbought conditions.

Analysis

The stock has shown a bullish trend recently, with significant support at 145.00 and resistance at 146.00. The MACD is positive, and the ATR indicates moderate volatility. Volume has been stable, suggesting steady interest.

Confidence Level

Potential Risks

Market volatility and external economic news could impact this prediction.

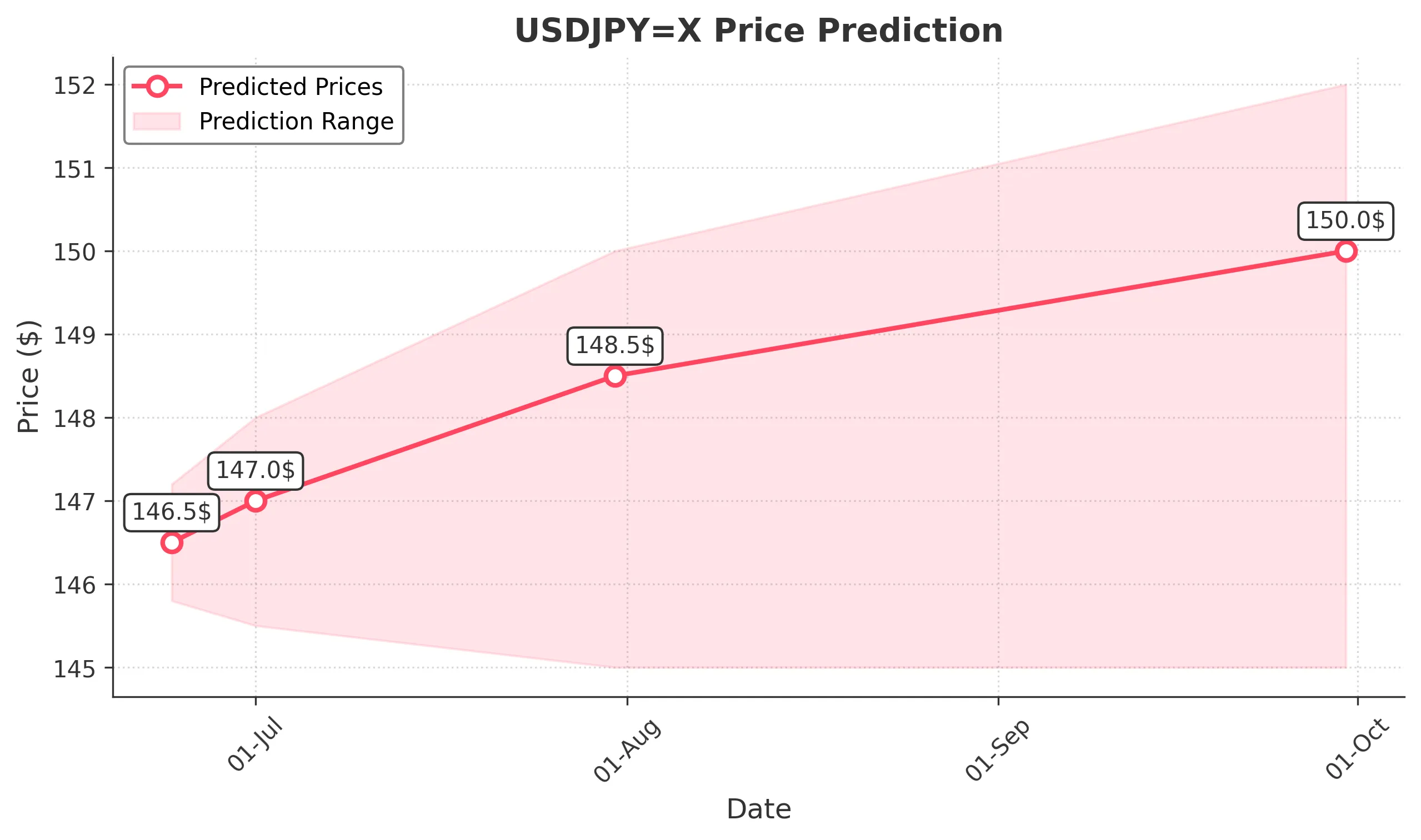

1 Week Prediction

Target: July 1, 2025$147

$146.8

$148

$145.5

Description

With the current upward trend and potential bullish patterns forming, a close around 147.000 is expected. The MACD shows increasing momentum, and the RSI is approaching overbought territory, indicating strength.

Analysis

The stock has been trending upward, with key support at 145.00 and resistance at 147.00. The Bollinger Bands are widening, indicating increased volatility. Recent volume spikes suggest heightened interest.

Confidence Level

Potential Risks

Potential market corrections or geopolitical events could lead to unexpected price movements.

1 Month Prediction

Target: July 31, 2025$148.5

$147.5

$150

$145

Description

The bullish trend is expected to continue, with a target close of 148.500. Fibonacci retracement levels support this upward movement, and the MACD remains positive, indicating sustained momentum.

Analysis

The stock has shown a strong bullish trend, with significant support at 145.00 and resistance at 150.00. The RSI is nearing overbought levels, suggesting caution. Volume patterns indicate strong buying interest.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could introduce volatility.

3 Months Prediction

Target: September 30, 2025$150

$149

$152

$145

Description

Long-term bullish sentiment suggests a close around 150.000, supported by strong technical indicators. However, potential economic shifts could impact this trajectory.

Analysis

The stock has been on a bullish trajectory, with key support at 145.00 and resistance at 152.00. The MACD is positive, but the RSI indicates potential overbought conditions. Market sentiment remains cautiously optimistic.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or shifts in market sentiment could lead to significant price corrections.