USDJPYX Trading Predictions

1 Day Prediction

Target: June 25, 2025$145.5

$145.8

$146.2

$144.8

Description

The market shows a slight bullish trend with a recent Doji pattern indicating indecision. The RSI is near 50, suggesting a potential upward move. However, MACD is flat, indicating a lack of momentum. Expect a close around 145.500.

Analysis

The past 3 months show a bearish trend with significant support at 143.00. Recent price action indicates a potential reversal, but the overall sentiment remains cautious. Volume has been low, indicating weak conviction in price movements.

Confidence Level

Potential Risks

Market volatility and external economic news could impact this prediction.

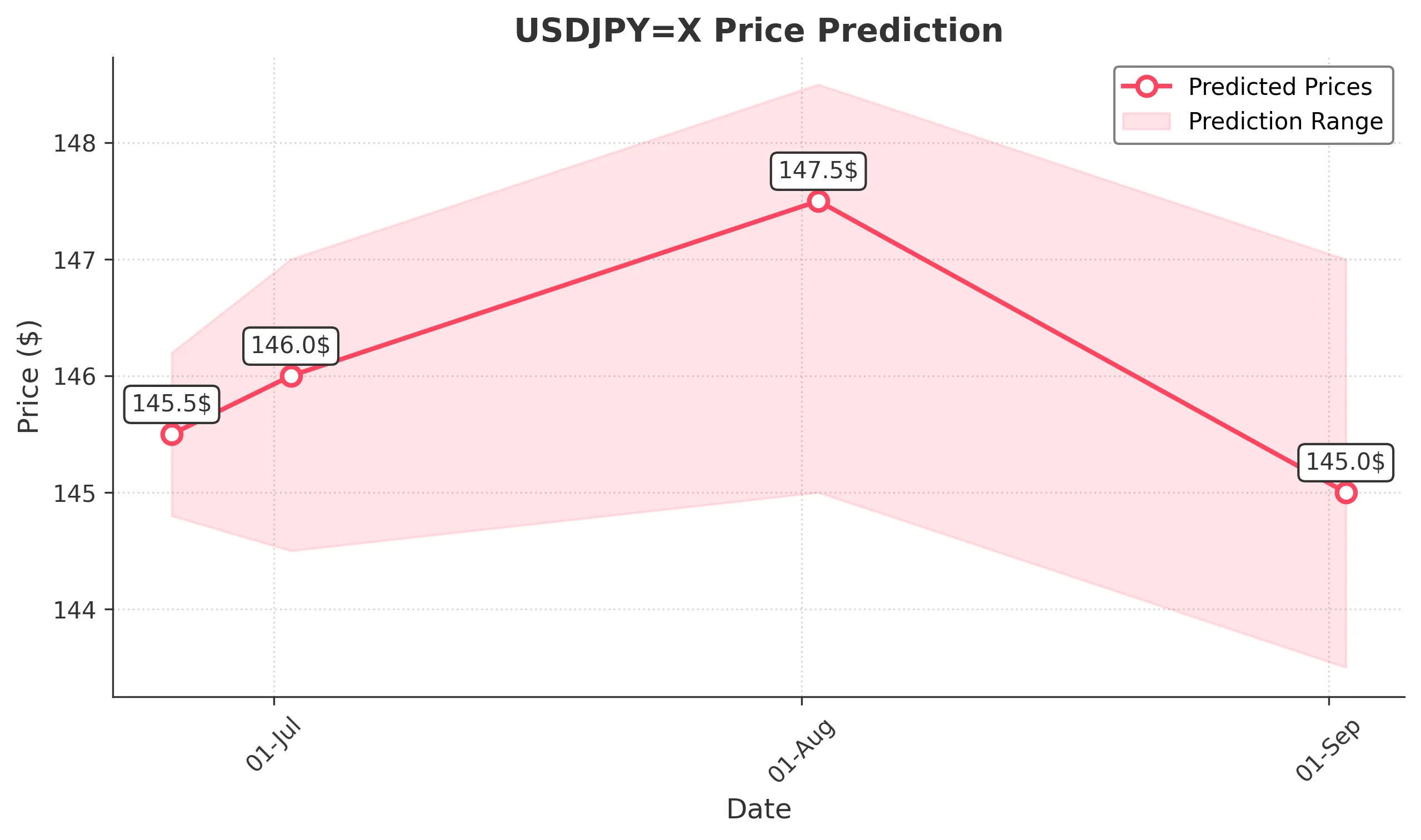

1 Week Prediction

Target: July 2, 2025$146

$145.5

$147

$144.5

Description

With the recent bullish candlestick patterns and a slight upward trend in moving averages, a close around 146.000 is expected. However, the MACD remains neutral, indicating potential resistance ahead.

Analysis

The stock has shown signs of recovery, bouncing off the support level at 143.00. The RSI is approaching overbought territory, suggesting caution. Volume spikes on upward days indicate some bullish interest, but overall market sentiment remains mixed.

Confidence Level

Potential Risks

Potential market corrections and geopolitical events could lead to unexpected price movements.

1 Month Prediction

Target: August 2, 2025$147.5

$146

$148.5

$145

Description

Expect a gradual increase towards 147.500 as bullish momentum builds. The Fibonacci retracement levels suggest resistance around 148.00, while the RSI indicates potential overbought conditions.

Analysis

The stock has been in a consolidation phase, with key resistance at 148.00. The recent price action shows a potential bullish reversal, but the overall trend remains uncertain. Volume patterns suggest a lack of strong conviction in either direction.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could significantly alter market dynamics.

3 Months Prediction

Target: September 2, 2025$145

$146.5

$147

$143.5

Description

A potential pullback to 145.000 is anticipated as the market may face resistance at higher levels. The MACD indicates weakening momentum, and the RSI suggests a possible correction.

Analysis

The overall trend remains bearish with significant resistance at 148.00. The stock has shown volatility, and the ATR indicates potential for larger price swings. Market sentiment is cautious, with external factors likely influencing future price movements.

Confidence Level

Potential Risks

Unforeseen macroeconomic events and shifts in market sentiment could lead to significant deviations from this prediction.