USDJPYX Trading Predictions

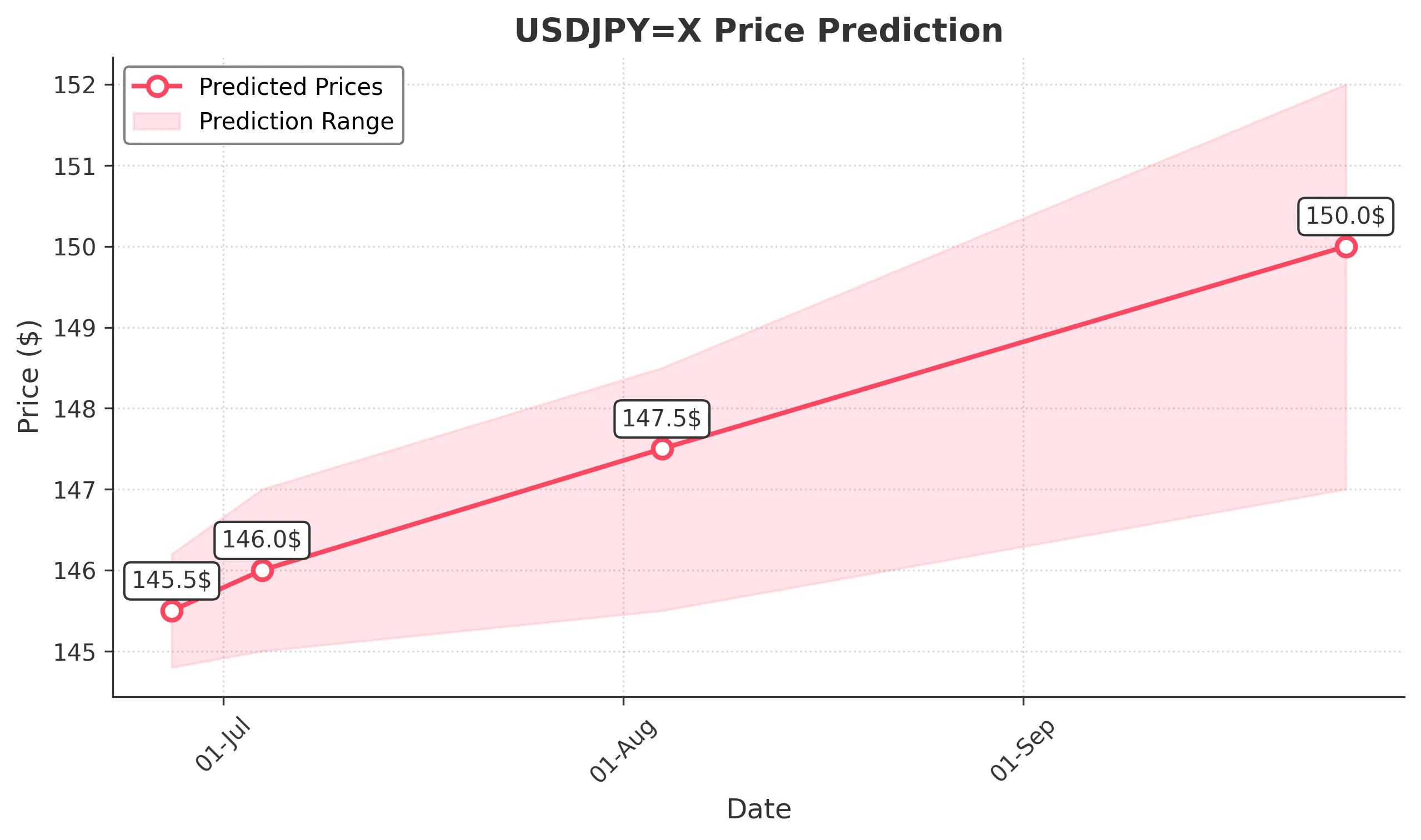

1 Day Prediction

Target: June 27, 2025$145.5

$145

$146.2

$144.8

Description

The market shows a slight bullish trend with a recent Doji pattern indicating indecision. The RSI is near 50, suggesting a potential upward move. However, MACD is flat, indicating a lack of momentum. Expect minor fluctuations.

Analysis

The past 3 months show a bearish trend with significant support around 144.0. Recent price action indicates a potential reversal, but the overall sentiment remains cautious. Volume has been low, indicating weak conviction in price movements.

Confidence Level

Potential Risks

Market volatility and external news could impact the price unexpectedly.

1 Week Prediction

Target: July 4, 2025$146

$145.5

$147

$145

Description

A bullish reversal is suggested by the recent candlestick patterns and a slight uptick in volume. The MACD shows a potential crossover, indicating upward momentum. However, resistance at 147.0 may limit gains.

Analysis

The stock has been in a bearish phase, but recent price action shows signs of recovery. Key resistance at 147.0 and support at 144.0 are critical. The RSI is approaching overbought territory, indicating caution.

Confidence Level

Potential Risks

Resistance levels and potential market corrections could hinder upward movement.

1 Month Prediction

Target: August 4, 2025$147.5

$146

$148.5

$145.5

Description

The bullish trend may continue as the price approaches Fibonacci retracement levels. The MACD indicates increasing momentum, while the RSI suggests room for growth. Watch for potential resistance at 148.0.

Analysis

The stock has shown signs of recovery with a recent bullish trend. Key support at 145.0 and resistance at 148.0 are pivotal. Volume patterns indicate increasing interest, but caution is warranted due to potential market shifts.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could introduce volatility.

3 Months Prediction

Target: September 26, 2025$150

$148.5

$152

$147

Description

If the bullish trend continues, the price could reach 150.0, supported by positive macroeconomic indicators. The RSI may indicate overbought conditions, suggesting a pullback could occur. Monitor for any bearish signals.

Analysis

The stock has shown a recovery trend, but the overall market remains volatile. Key resistance at 150.0 and support at 145.0 are crucial. The market sentiment is mixed, with potential for both upward and downward movements.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic shifts and market sentiment changes.