USDJPYX Trading Predictions

1 Day Prediction

Target: June 30, 2025$144.8

$144.7

$145.2

$144.5

Description

The market shows signs of consolidation around the 144.50-145.00 range. RSI indicates neutrality, while MACD suggests a potential bullish crossover. However, recent bearish candlestick patterns may limit upside momentum.

Analysis

Over the past 3 months, USDJPY has shown a bearish trend with significant support at 144.00. Technical indicators like the MACD and RSI are mixed, indicating potential for both upward and downward movements. Volume has been low, suggesting a lack of strong conviction.

Confidence Level

Potential Risks

Market volatility and external economic news could impact price movement significantly.

1 Week Prediction

Target: July 7, 2025$145.2

$144.9

$145.6

$144.8

Description

A slight bullish trend is expected as the price approaches resistance at 145.50. The recent bullish engulfing pattern supports this outlook, but the market remains sensitive to macroeconomic data releases.

Analysis

The stock has been trading sideways with a slight bullish bias. Key resistance at 145.50 and support at 144.00 are critical levels. The ATR indicates moderate volatility, and recent volume spikes suggest increased interest.

Confidence Level

Potential Risks

Potential for reversal exists if economic indicators disappoint or geopolitical tensions arise.

1 Month Prediction

Target: August 7, 2025$146.5

$145.8

$147

$145

Description

Expect a gradual upward trend as the market stabilizes. The bullish sentiment is supported by a break above the 145.50 resistance level, with potential for further gains if economic conditions remain favorable.

Analysis

The overall trend has been bullish with a recent breakout above key resistance levels. Technical indicators suggest a continuation of this trend, but external factors such as inflation data and interest rate changes could introduce volatility.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could alter the bullish outlook.

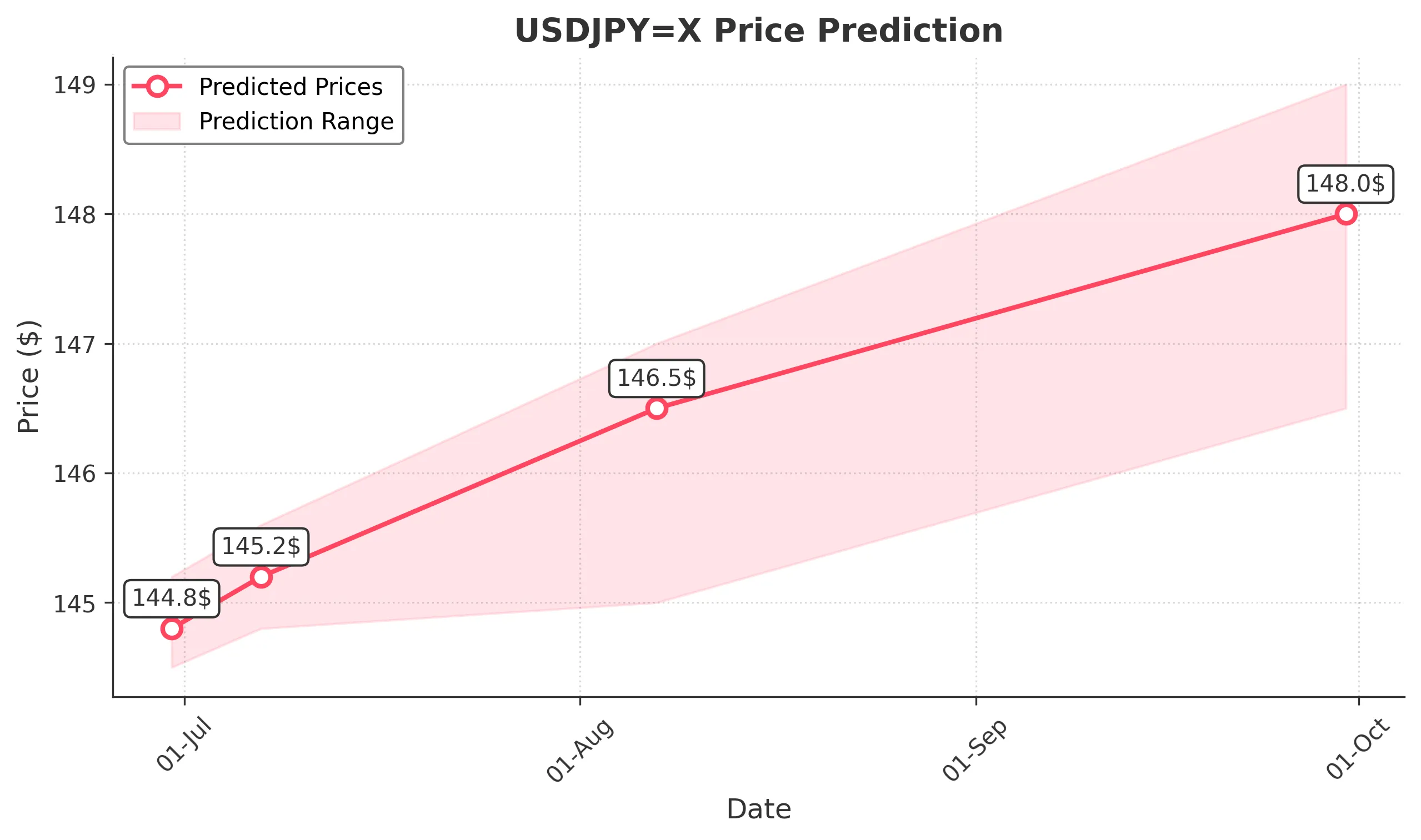

3 Months Prediction

Target: September 30, 2025$148

$147.5

$149

$146.5

Description

Long-term bullish outlook as the market is expected to rally towards 148.00. Continued economic recovery and potential interest rate hikes could support this trend, despite possible corrections along the way.

Analysis

The stock has shown resilience with a bullish trend over the past months. Key support at 146.00 and resistance at 149.00 are critical. The market sentiment is cautiously optimistic, but external shocks could introduce volatility.

Confidence Level

Potential Risks

Unforeseen geopolitical events or economic downturns could derail the bullish momentum.