USDJPYX Trading Predictions

1 Day Prediction

Target: June 30, 2025$144.5

$144.6

$144.8

$144.2

Description

The market shows signs of consolidation around the 144.50 level, with recent candlestick patterns indicating indecision. RSI is neutral, and MACD is flat, suggesting a potential for a slight pullback. Volatility remains low, supporting a stable close.

Analysis

Over the past 3 months, USDJPY has shown a bearish trend with significant support around 144.00. Technical indicators like the MACD and RSI suggest a lack of momentum. Volume has been low, indicating reduced trader interest. The market is sensitive to macroeconomic data releases.

Confidence Level

Potential Risks

Market sentiment could shift due to external economic news or geopolitical events, which may impact trading volume and volatility.

1 Week Prediction

Target: July 7, 2025$144.8

$144.6

$145.2

$144.3

Description

A slight upward movement is anticipated as the market may react positively to upcoming economic data. The Bollinger Bands are tightening, indicating potential volatility. However, the overall trend remains cautious.

Analysis

The past three months have seen a bearish trend with key resistance at 145.00. The market is currently in a range, with support at 144.00. Technical indicators suggest a lack of strong momentum, and external factors could influence price direction.

Confidence Level

Potential Risks

Potential for reversal exists if economic data disappoints or if geopolitical tensions escalate, which could lead to increased volatility.

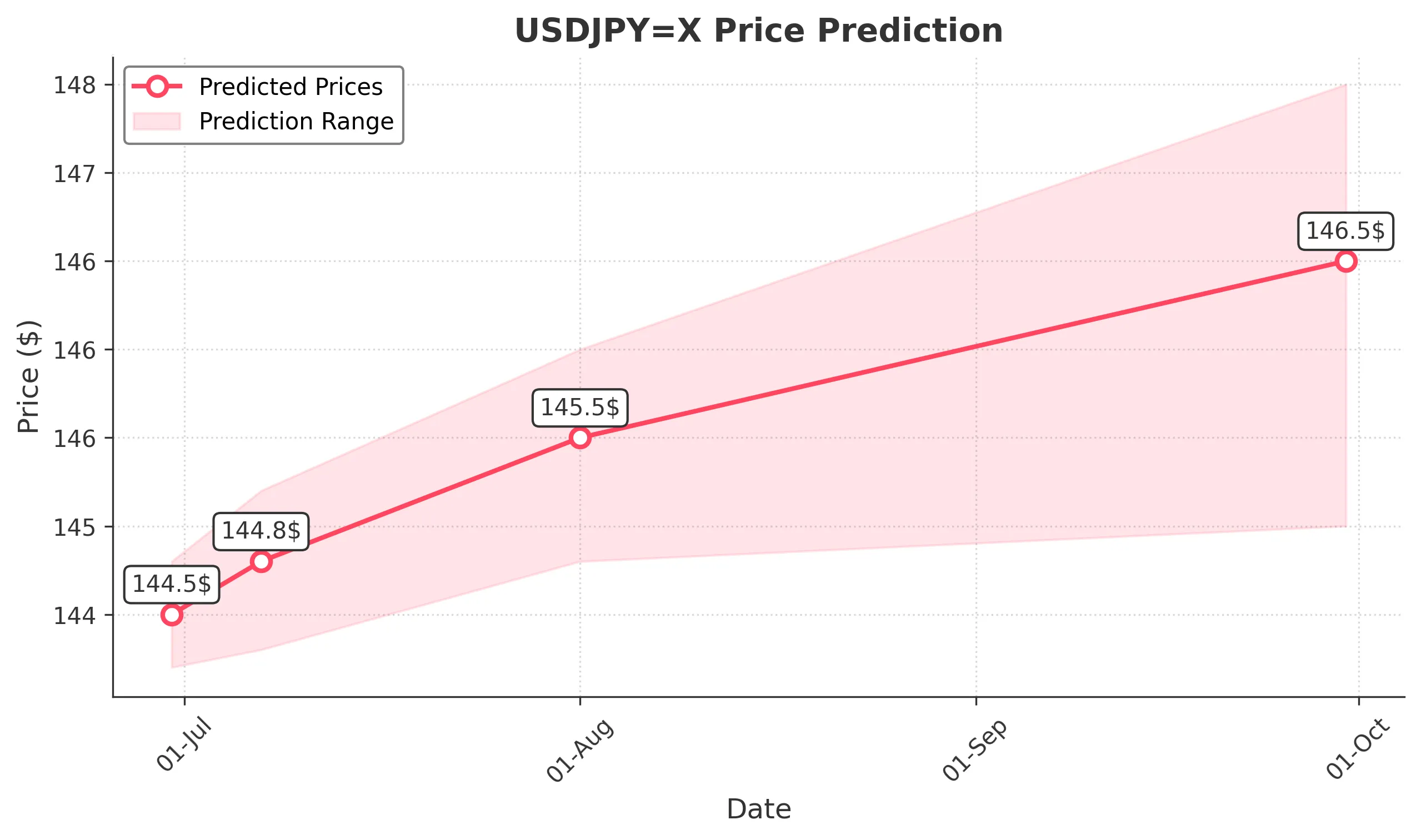

1 Month Prediction

Target: August 1, 2025$145.5

$144.8

$146

$144.8

Description

Expect a gradual increase as market sentiment improves with positive economic indicators. The Fibonacci retracement levels suggest a potential bounce back towards 145.50, but caution is advised due to overall bearish sentiment.

Analysis

The stock has been in a bearish trend, with significant resistance at 145.00. Recent price action shows consolidation, but the overall sentiment remains cautious. Technical indicators are mixed, and external economic factors could heavily influence future movements.

Confidence Level

Potential Risks

Economic data could lead to unexpected volatility, and bearish trends may resume if market sentiment shifts negatively.

3 Months Prediction

Target: September 30, 2025$146.5

$145.5

$147.5

$145

Description

A potential recovery is expected as the market adjusts to economic conditions. The MACD may indicate a bullish crossover, and if the market sentiment improves, we could see a gradual rise towards 146.50.

Analysis

The overall trend has been bearish, with significant resistance at 147.00. The market is currently in a consolidation phase, and while there are signs of potential recovery, external factors could heavily influence price movements in the coming months.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic downturns or geopolitical tensions that could reverse any upward momentum.