USDJPYX Trading Predictions

1 Day Prediction

Target: July 3, 2025$143.2

$143.3

$143.6

$142.8

Description

The recent bearish trend suggests a potential continuation. The RSI is nearing oversold levels, indicating a possible short-term bounce. However, the MACD shows a bearish crossover, which may limit upside potential. Expect volatility around 143.00.

Analysis

The past three months show a bearish trend with significant resistance around 145.00. The MACD indicates bearish momentum, while the RSI is approaching oversold territory. Volume has been low, suggesting a lack of conviction in recent price movements.

Confidence Level

Potential Risks

Market sentiment could shift due to macroeconomic news, impacting the prediction's accuracy.

1 Week Prediction

Target: July 10, 2025$142.5

$143

$143

$142

Description

The bearish trend is expected to persist, with potential support at 142.00. The Bollinger Bands indicate tightening, suggesting a potential breakout. However, the overall sentiment remains cautious, limiting upward movement.

Analysis

The stock has been in a downtrend, with key support at 142.00. The MACD remains bearish, and the RSI is low, indicating potential for a bounce but overall bearish sentiment prevails. Volume has been declining, suggesting weak buying interest.

Confidence Level

Potential Risks

Unforeseen economic data releases could lead to volatility, impacting the accuracy of this prediction.

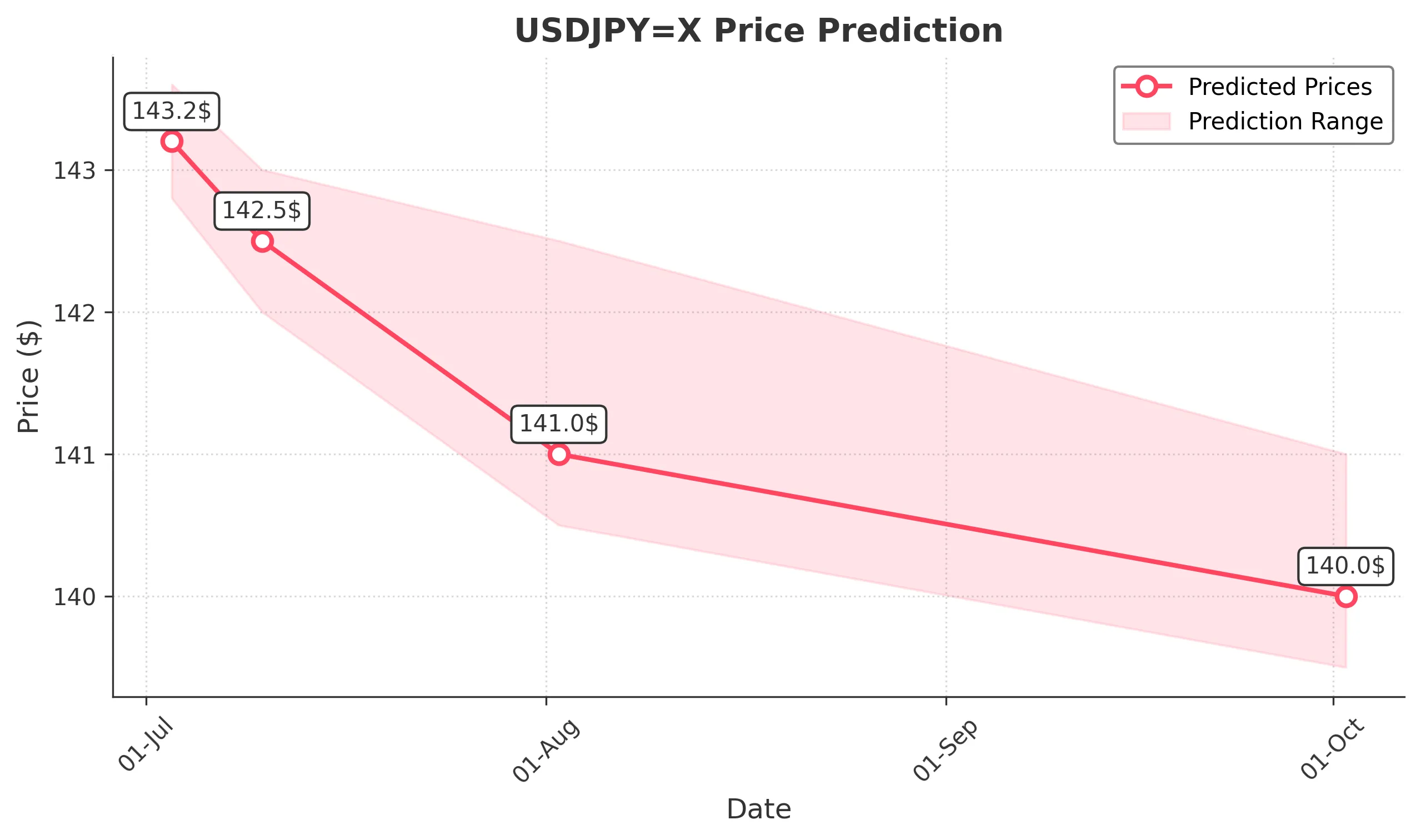

1 Month Prediction

Target: August 2, 2025$141

$142

$142.5

$140.5

Description

Continued bearish momentum is expected, with potential for further declines towards 140.00. The MACD remains in a bearish phase, and the RSI indicates oversold conditions, suggesting a possible short-term recovery but overall weakness.

Analysis

The overall trend is bearish, with significant resistance at 142.00. The stock has shown weak performance, and the MACD indicates continued bearish momentum. Volume patterns suggest a lack of strong buying interest, reinforcing the bearish outlook.

Confidence Level

Potential Risks

Market volatility and external economic factors could significantly alter this outlook.

3 Months Prediction

Target: October 2, 2025$140

$140.5

$141

$139.5

Description

The bearish trend is likely to continue, with potential for a decline towards 140.00. The market sentiment remains weak, and macroeconomic factors could further pressure prices. Watch for any reversal signals.

Analysis

The stock has been in a consistent downtrend, with key support at 140.00. The MACD indicates bearish momentum, and the RSI suggests oversold conditions. Volume has been low, indicating weak buying interest, and external factors could impact future performance.

Confidence Level

Potential Risks

Economic developments and geopolitical events could lead to unexpected price movements.