USDJPYX Trading Predictions

1 Day Prediction

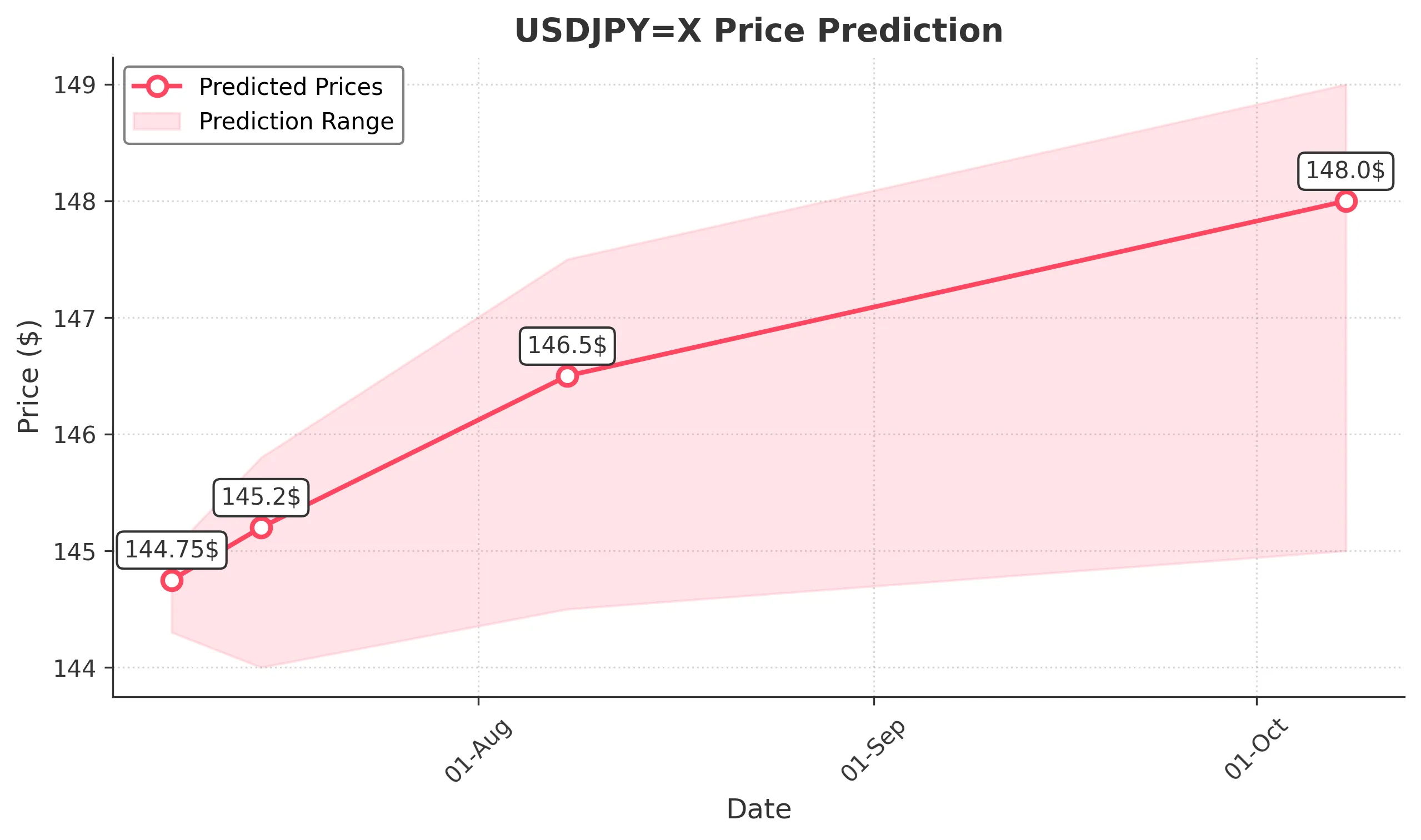

Target: July 8, 2025$144.75

$144.5

$145

$144.3

Description

The market shows a slight bullish trend with a recent Doji candlestick indicating indecision. The RSI is near 50, suggesting a neutral momentum. MACD is showing a potential bullish crossover, supporting a slight upward movement.

Analysis

Over the past 3 months, USDJPY has shown a bearish trend with significant support around 143.40. Recent price action indicates a potential reversal, but the overall sentiment remains cautious due to macroeconomic factors.

Confidence Level

Potential Risks

Market volatility and external economic news could impact this prediction.

1 Week Prediction

Target: July 15, 2025$145.2

$144.75

$145.8

$144

Description

The bullish momentum is expected to continue as the price approaches the upper Bollinger Band. The MACD remains positive, and the RSI is trending upwards, indicating increasing buying pressure.

Analysis

The stock has been fluctuating around key resistance levels, with a recent bullish engulfing pattern suggesting a possible upward trend. However, the market remains sensitive to external economic indicators.

Confidence Level

Potential Risks

Potential resistance at 145.80 could limit upward movement; geopolitical events may also introduce volatility.

1 Month Prediction

Target: August 8, 2025$146.5

$145.2

$147.5

$144.5

Description

With the current bullish trend and positive market sentiment, the price is expected to rise towards the Fibonacci retracement level of 61.8%. The MACD remains bullish, supporting this upward trajectory.

Analysis

The past three months have shown a recovery from lower levels, with key support at 144.00. The market sentiment is cautiously optimistic, but external factors could influence price movements.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could lead to unexpected volatility.

3 Months Prediction

Target: October 8, 2025$148

$146.5

$149

$145

Description

The long-term outlook remains bullish as the price is expected to break through resistance levels. The RSI indicates potential overbought conditions, but strong buying momentum could push prices higher.

Analysis

The overall trend has been bullish, with significant resistance at 148.00. The market is influenced by macroeconomic factors, and while the sentiment is positive, caution is advised due to potential reversals.

Confidence Level

Potential Risks

Market corrections and economic uncertainties could lead to price fluctuations.