USDJPYX Trading Predictions

1 Day Prediction

Target: July 9, 2025$145.5

$145.8

$146.2

$144.8

Description

The recent bullish momentum, indicated by the upward trend in the last few days, suggests a potential close around 145.500. The RSI is nearing overbought levels, which may limit upside. Watch for any reversal signals.

Analysis

The past three months show a bullish trend with significant support at 144.00 and resistance around 146.00. The MACD is positive, and the RSI is approaching overbought territory, indicating potential for a pullback.

Confidence Level

Potential Risks

The market could react to external news or economic data, which may lead to volatility.

1 Week Prediction

Target: July 16, 2025$146

$145.8

$147

$144.5

Description

With the current bullish trend and potential for further gains, a close around 146.000 is expected. However, the RSI indicates overbought conditions, suggesting a possible pullback.

Analysis

The stock has shown a strong upward trend, with key support at 144.50 and resistance at 147.00. The Bollinger Bands are widening, indicating increased volatility, while the MACD remains bullish.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and any geopolitical or economic news could impact prices significantly.

1 Month Prediction

Target: August 8, 2025$147.5

$146.5

$148.5

$144

Description

The bullish trend is expected to continue, with a potential close around 147.500. However, the market may face resistance at 148.00, and any negative news could trigger a correction.

Analysis

The overall trend is bullish, with significant resistance at 148.00. The RSI is high, indicating potential overbought conditions. Volume has been steady, but any spikes could indicate a reversal.

Confidence Level

Potential Risks

Economic indicators and central bank policies could lead to unexpected volatility, impacting the forecast.

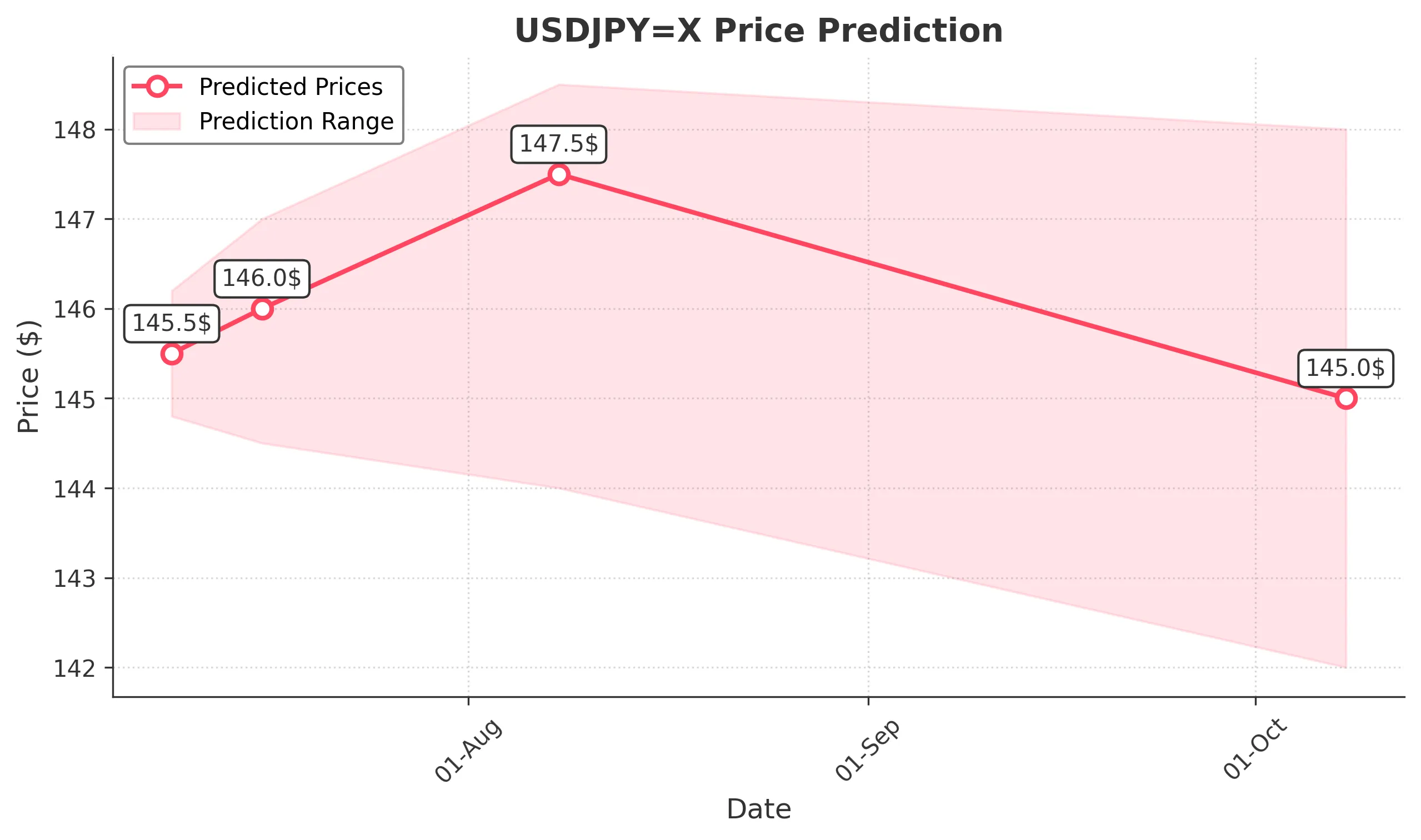

3 Months Prediction

Target: October 8, 2025$145

$146

$148

$142

Description

Expect a potential pullback to around 145.000 as the market may correct after the recent highs. The RSI suggests overbought conditions, and profit-taking could occur.

Analysis

The stock has shown volatility with a recent bullish trend. Key support is at 142.00, while resistance remains at 148.00. The market sentiment is mixed, and external factors could influence future performance.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or shifts in market sentiment could lead to significant deviations from this prediction.