USDJPYX Trading Predictions

1 Day Prediction

Target: July 10, 2025$146.5

$146.7

$147.2

$145.8

Description

The recent bullish trend, supported by a MACD crossover and RSI nearing overbought levels, suggests a potential continuation. However, a Doji candlestick indicates indecision, warranting caution.

Analysis

Over the past 3 months, USDJPY has shown a bullish trend with significant resistance at 147.200. The MACD indicates upward momentum, while RSI suggests overbought conditions. Volume has been stable, but recent spikes indicate increased interest. Key support is at 144.500.

Confidence Level

Potential Risks

Market volatility and potential profit-taking could lead to a pullback, affecting the accuracy of this prediction.

1 Week Prediction

Target: July 17, 2025$146.8

$146.6

$148

$145.5

Description

The bullish momentum is likely to persist, with the price testing the upper Bollinger Band. However, the RSI indicates potential overbought conditions, suggesting a possible correction.

Analysis

The stock has been in a bullish phase, with key resistance at 147.200. The MACD supports upward movement, but the RSI is approaching overbought territory. Volume patterns show increased activity, indicating strong interest. Watch for potential pullbacks.

Confidence Level

Potential Risks

External economic data releases could impact market sentiment, leading to unexpected volatility.

1 Month Prediction

Target: August 9, 2025$145

$146

$147.5

$143.5

Description

A potential correction is anticipated as the market may react to overbought signals. Fibonacci retracement levels suggest support around 144.500, which could be tested.

Analysis

The past three months show a bullish trend, but signs of exhaustion are emerging. The RSI is high, and the MACD may signal a reversal. Key support at 144.500 is critical, while resistance remains at 147.200. Market sentiment is mixed.

Confidence Level

Potential Risks

Economic indicators and geopolitical events could lead to unexpected price movements, impacting the forecast.

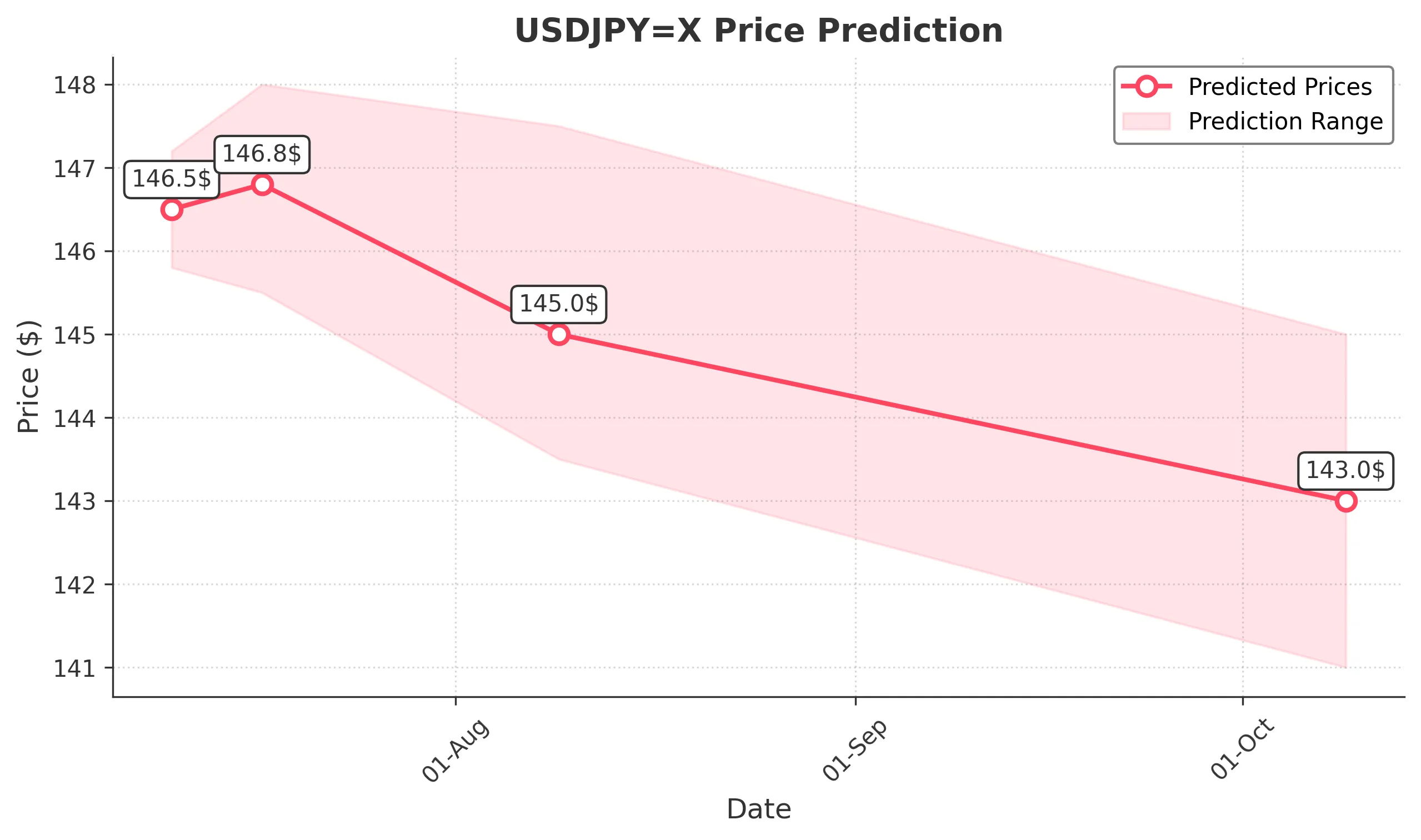

3 Months Prediction

Target: October 9, 2025$143

$144

$145

$141

Description

A bearish trend may develop as the market reacts to potential economic slowdowns. The RSI indicates a possible downward shift, and support levels will be crucial.

Analysis

The analysis indicates a potential shift to bearish sentiment as the market may react to economic data. The RSI is showing signs of weakness, and the MACD could indicate a downturn. Key support at 141.000 is critical, while resistance remains at 145.000.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could significantly alter market dynamics, leading to volatility.