USDJPYX Trading Predictions

1 Day Prediction

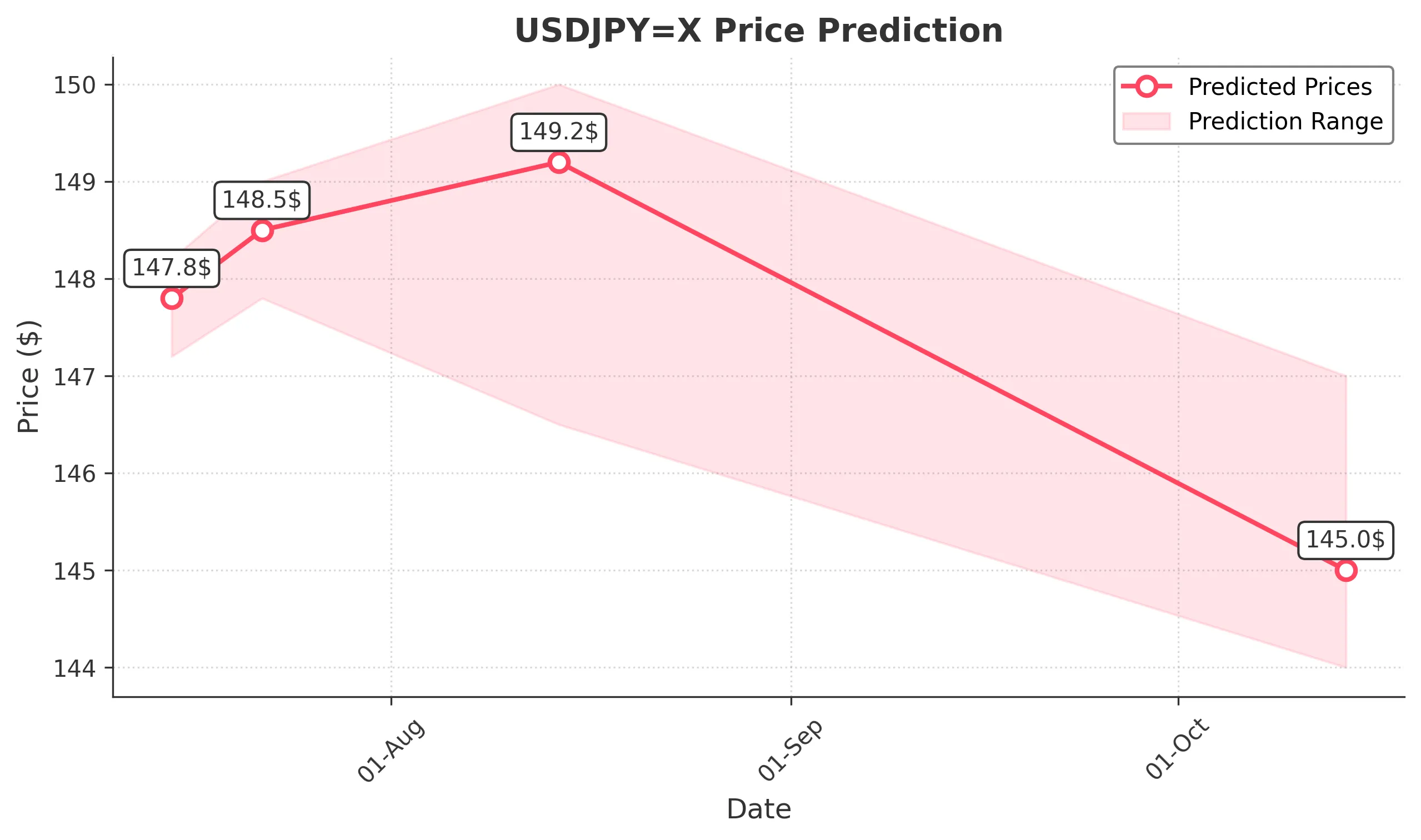

Target: July 15, 2025$147.8

$147.6

$148.2

$147.2

Description

The recent bullish trend, supported by a strong MACD crossover and RSI indicating overbought conditions, suggests a potential continuation. However, a Doji candlestick pattern indicates indecision, which could lead to volatility.

Analysis

The stock has shown a bullish trend over the past three months, with significant resistance around 148. The MACD is bullish, and RSI is nearing overbought territory. Volume has been stable, but recent spikes indicate increased interest. Key support is at 145.

Confidence Level

Potential Risks

Potential reversal signals and market sentiment shifts could impact the prediction.

1 Week Prediction

Target: July 22, 2025$148.5

$147.9

$149

$147.8

Description

The bullish momentum is expected to continue, with the price likely testing the resistance at 149. The RSI remains strong, but caution is advised as it approaches overbought levels, indicating potential pullbacks.

Analysis

The stock has maintained a bullish trend, with key resistance at 149. The MACD remains positive, and the ATR indicates moderate volatility. Recent candlestick patterns suggest bullish sentiment, but caution is warranted as the RSI approaches overbought levels.

Confidence Level

Potential Risks

Market volatility and external economic factors could lead to unexpected price movements.

1 Month Prediction

Target: August 14, 2025$149.2

$148.8

$150

$146.5

Description

The price is expected to reach new highs, driven by strong bullish sentiment and positive macroeconomic indicators. However, the RSI suggests potential overbought conditions, which could lead to corrections.

Analysis

The stock has shown a strong upward trend, with resistance at 150. The MACD is bullish, but the RSI indicates overbought conditions. Volume patterns suggest increased interest, but potential corrections should be monitored closely.

Confidence Level

Potential Risks

Economic data releases and geopolitical events could significantly impact market sentiment.

3 Months Prediction

Target: October 14, 2025$145

$146.5

$147

$144

Description

A potential bearish reversal is anticipated as the market may correct from overbought levels. The MACD may show signs of divergence, and the RSI could drop, indicating weakening momentum.

Analysis

The stock has experienced a bullish trend, but signs of potential reversal are emerging. Key support is at 144, and the MACD may indicate weakening momentum. Volume patterns suggest caution, and external factors could influence price movements.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or shifts in market sentiment could lead to volatility.