USDJPYX Trading Predictions

1 Day Prediction

Target: July 18, 2025$147.5

$147.8

$148.2

$146.8

Description

The recent bullish trend indicates a potential continuation, supported by the MACD crossover and RSI near 60. However, a Doji pattern suggests indecision, which could lead to a slight pullback. Expect volatility around 147.500.

Analysis

The past 3 months show a bullish trend with significant resistance at 148.200. The MACD is bullish, and RSI indicates strength. However, recent Doji patterns suggest potential reversals. Volume has been low, indicating caution among traders.

Confidence Level

Potential Risks

Market sentiment may shift due to external economic news, which could impact the prediction.

1 Week Prediction

Target: July 25, 2025$148

$147.5

$149

$146.5

Description

The bullish momentum is likely to continue, with the price testing the resistance at 149.00. However, the RSI nearing overbought levels may trigger profit-taking, leading to potential dips. Watch for volume spikes for confirmation.

Analysis

The stock has shown a strong upward trend, with key support at 146.500. The MACD remains bullish, but the RSI indicates overbought conditions. Volume patterns suggest traders are cautious, and any negative news could lead to a pullback.

Confidence Level

Potential Risks

Potential geopolitical events or economic data releases could create volatility, impacting the price direction.

1 Month Prediction

Target: August 25, 2025$145

$148

$149.5

$144

Description

Expect a correction as the market may react to overbought conditions. The Fibonacci retracement levels suggest a pullback towards 145.00. Watch for bearish candlestick patterns that could signal a reversal.

Analysis

The stock has been in a bullish phase, but signs of exhaustion are appearing. Key resistance at 149.500 may hold, and a correction towards 145.00 is plausible. The ATR indicates increasing volatility, and traders should be cautious.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could alter the trajectory significantly, leading to unexpected volatility.

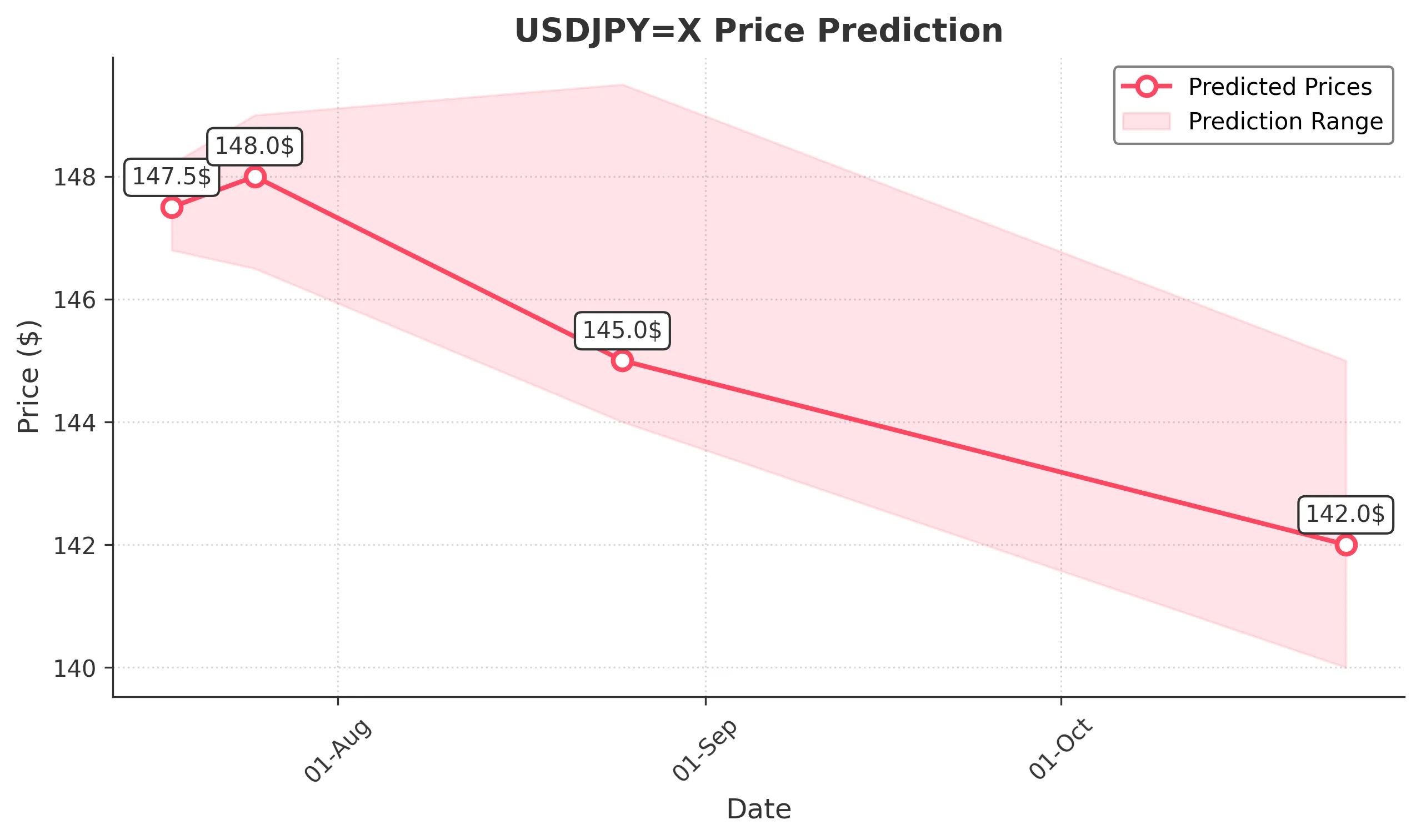

3 Months Prediction

Target: October 25, 2025$142

$144

$145

$140

Description

A bearish trend may develop as the market reacts to potential economic downturns. The support level at 140.00 is critical, and a break below could lead to further declines. Monitor for bearish signals.

Analysis

The overall trend shows signs of weakening, with key support at 140.00. The MACD is showing bearish divergence, and the RSI is declining. Volume patterns indicate a lack of conviction in the current uptrend, suggesting a potential reversal.

Confidence Level

Potential Risks

Economic indicators and central bank policies could significantly impact the currency pair, leading to unpredictable movements.