USDJPYX Trading Predictions

1 Day Prediction

Target: July 24, 2025$146.5

$146.4

$146.8

$146.2

Description

The recent bullish trend indicates a potential continuation, supported by a recent Doji candlestick pattern. The RSI is approaching overbought territory, suggesting caution. However, the MACD remains positive, indicating upward momentum.

Analysis

Over the past 3 months, USDJPY has shown a bullish trend with significant resistance around 148. The MACD and moving averages indicate upward momentum, while the RSI suggests potential overbought conditions. Volume has been stable, but spikes could indicate shifts in sentiment.

Confidence Level

Potential Risks

The market may react to external news or economic data, which could lead to volatility. A reversal is possible if bearish sentiment emerges.

1 Week Prediction

Target: July 31, 2025$147

$146.8

$147.5

$146.5

Description

The bullish trend is expected to continue, with support at 146. The MACD remains positive, and the recent price action suggests a potential breakout. However, the RSI indicates overbought conditions, which could lead to a pullback.

Analysis

The stock has been in a bullish phase, with key support at 146. The MACD and moving averages support upward movement, but the RSI indicates potential overbought conditions. Volume patterns suggest stability, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market sentiment can shift quickly, especially with upcoming economic reports. A bearish reversal could occur if resistance levels hold.

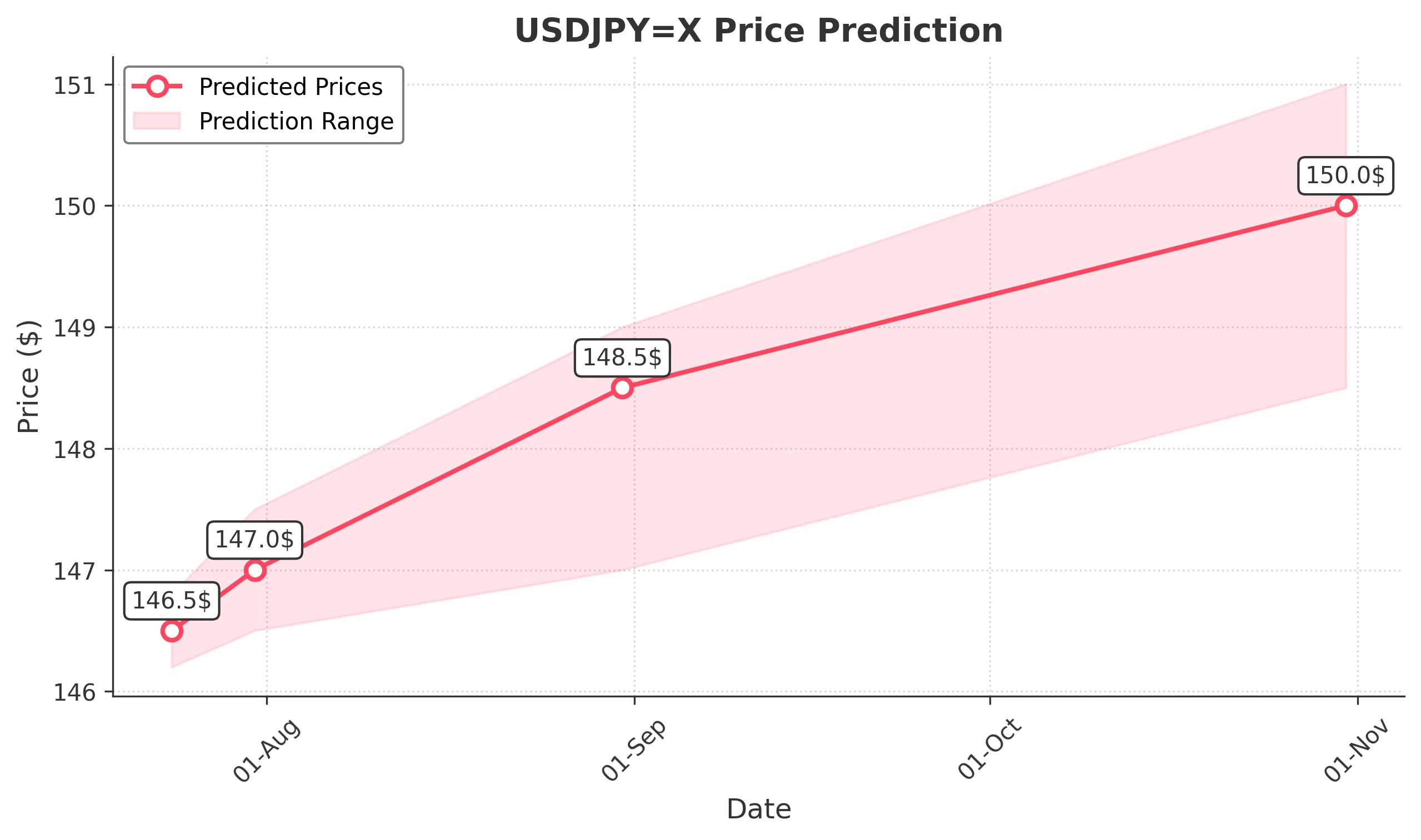

1 Month Prediction

Target: August 31, 2025$148.5

$147.8

$149

$147

Description

The bullish trend is expected to persist, with potential for a breakout above 148. The MACD remains strong, and the price action suggests upward momentum. However, the RSI indicates overbought conditions, which may lead to corrections.

Analysis

USDJPY has shown a strong bullish trend, with resistance at 148. The MACD and moving averages support this trend, while the RSI indicates potential overbought conditions. Volume has been consistent, but external factors could introduce uncertainty.

Confidence Level

Potential Risks

Economic data releases could impact market sentiment, leading to volatility. A significant reversal could occur if bearish news emerges.

3 Months Prediction

Target: October 31, 2025$150

$149

$151

$148.5

Description

The bullish trend is expected to continue, with potential for a breakout above 150. The MACD remains positive, and the price action suggests strong upward momentum. However, the RSI indicates overbought conditions, which could lead to corrections.

Analysis

Over the past 3 months, USDJPY has shown a strong bullish trend, with key resistance at 150. The MACD and moving averages support upward movement, while the RSI indicates potential overbought conditions. Volume patterns suggest stability, but external factors could introduce volatility.

Confidence Level

Potential Risks

Market volatility and economic data releases could impact the prediction. A significant reversal could occur if bearish sentiment develops.