USDJPYX Trading Predictions

1 Day Prediction

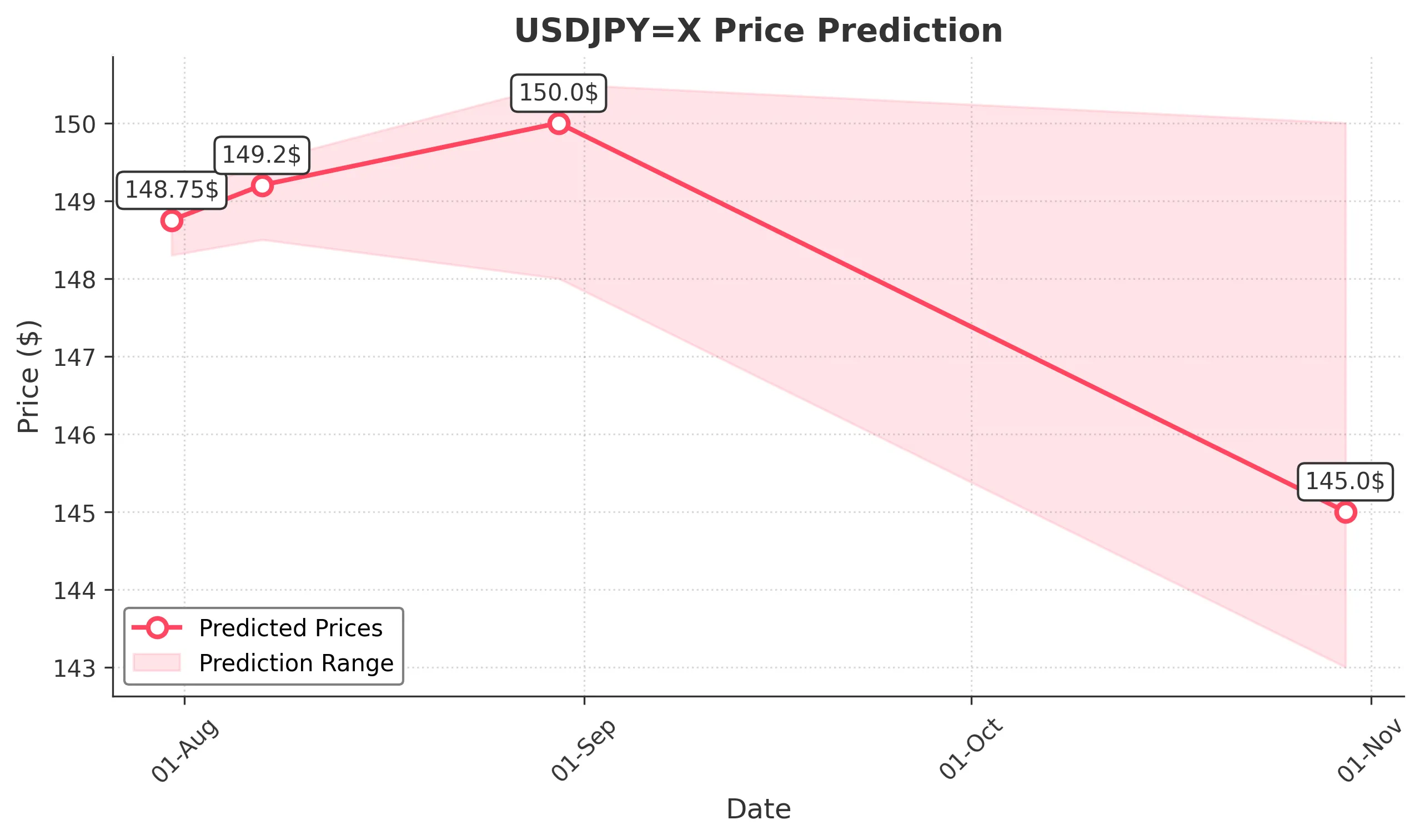

Target: July 31, 2025$148.75

$148.5

$149

$148.3

Description

The bullish trend continues with strong momentum indicated by the recent price action. The RSI is approaching overbought levels, suggesting a potential pullback, but the MACD remains positive. Expect a close around 148.75.

Analysis

The past 3 months show a bullish trend with significant upward movement. Key resistance at 149.00 and support around 146.00. Volume has been stable, indicating steady interest. Recent candlestick patterns suggest bullish continuation.

Confidence Level

Potential Risks

Potential reversal signals from overbought RSI could lead to a pullback.

1 Week Prediction

Target: August 7, 2025$149.2

$148.8

$149.5

$148.5

Description

The upward momentum is expected to persist, with the price likely to test the 149.50 resistance level. The MACD remains bullish, and the recent candlestick patterns support further gains. However, watch for potential profit-taking.

Analysis

The stock has shown strong bullish behavior, with key resistance at 149.50. The RSI is nearing overbought territory, indicating a possible correction. Volume patterns suggest healthy trading activity, but external factors could impact sentiment.

Confidence Level

Potential Risks

Market volatility and profit-taking could lead to unexpected price movements.

1 Month Prediction

Target: August 30, 2025$150

$149

$150.5

$148

Description

Expect the price to reach around 150.00 as bullish sentiment continues. The Fibonacci retracement levels support this target, and the MACD remains positive. However, watch for any macroeconomic news that could shift sentiment.

Analysis

The stock has been in a strong uptrend, with significant resistance at 150.50. The RSI indicates potential overbought conditions, and volume has been consistent. External economic factors may influence future price movements.

Confidence Level

Potential Risks

Macroeconomic events could introduce volatility, impacting the bullish trend.

3 Months Prediction

Target: October 30, 2025$145

$148

$150

$143

Description

A potential correction is anticipated as the market may react to overbought conditions and profit-taking. The price could retrace to around 145.00, testing support levels. Monitor for bearish signals in the coming weeks.

Analysis

The stock has shown strong bullish trends, but overbought conditions and potential profit-taking could lead to a correction. Key support at 143.00 and resistance at 150.00. Volume patterns indicate healthy trading, but external factors may introduce volatility.

Confidence Level

Potential Risks

Market sentiment could shift rapidly due to economic data releases or geopolitical events.