USDJPYX Trading Predictions

1 Day Prediction

Target: August 5, 2025$147.5

$147.3

$148.2

$146.8

Description

The market shows signs of a potential rebound after a recent dip. The RSI is approaching oversold levels, indicating a possible bullish reversal. However, resistance at 148.200 may limit upward movement.

Analysis

Over the past 3 months, USDJPY has shown a bullish trend with significant resistance around 150. The recent pullback suggests profit-taking. Key support is at 146.800, while the RSI indicates potential for a bounce. Volume has been low, indicating cautious trading.

Confidence Level

Potential Risks

Market volatility and external news could impact the prediction. A sudden shift in sentiment may lead to unexpected price movements.

1 Week Prediction

Target: August 12, 2025$148

$147.8

$149

$146.5

Description

Expecting a gradual recovery as bullish sentiment builds. The MACD shows a potential crossover, suggesting upward momentum. However, resistance at 149.000 could pose challenges.

Analysis

The stock has been in a bullish phase, with recent highs around 150. The market sentiment remains cautiously optimistic, but the potential for a pullback exists. Key support at 146.500 is critical for maintaining upward momentum.

Confidence Level

Potential Risks

Unforeseen macroeconomic events or geopolitical tensions could disrupt the expected trend, leading to increased volatility.

1 Month Prediction

Target: September 4, 2025$149.5

$148.8

$150.5

$147

Description

Anticipating a continued bullish trend as the market stabilizes. Fibonacci retracement levels suggest support at 147.000, while upward momentum could push prices towards 150.500.

Analysis

The past three months have shown a strong bullish trend, with significant resistance at 150. The market is currently consolidating, and technical indicators suggest potential for further gains. Volume patterns indicate cautious optimism among traders.

Confidence Level

Potential Risks

Economic data releases and central bank decisions could influence market direction, introducing uncertainty.

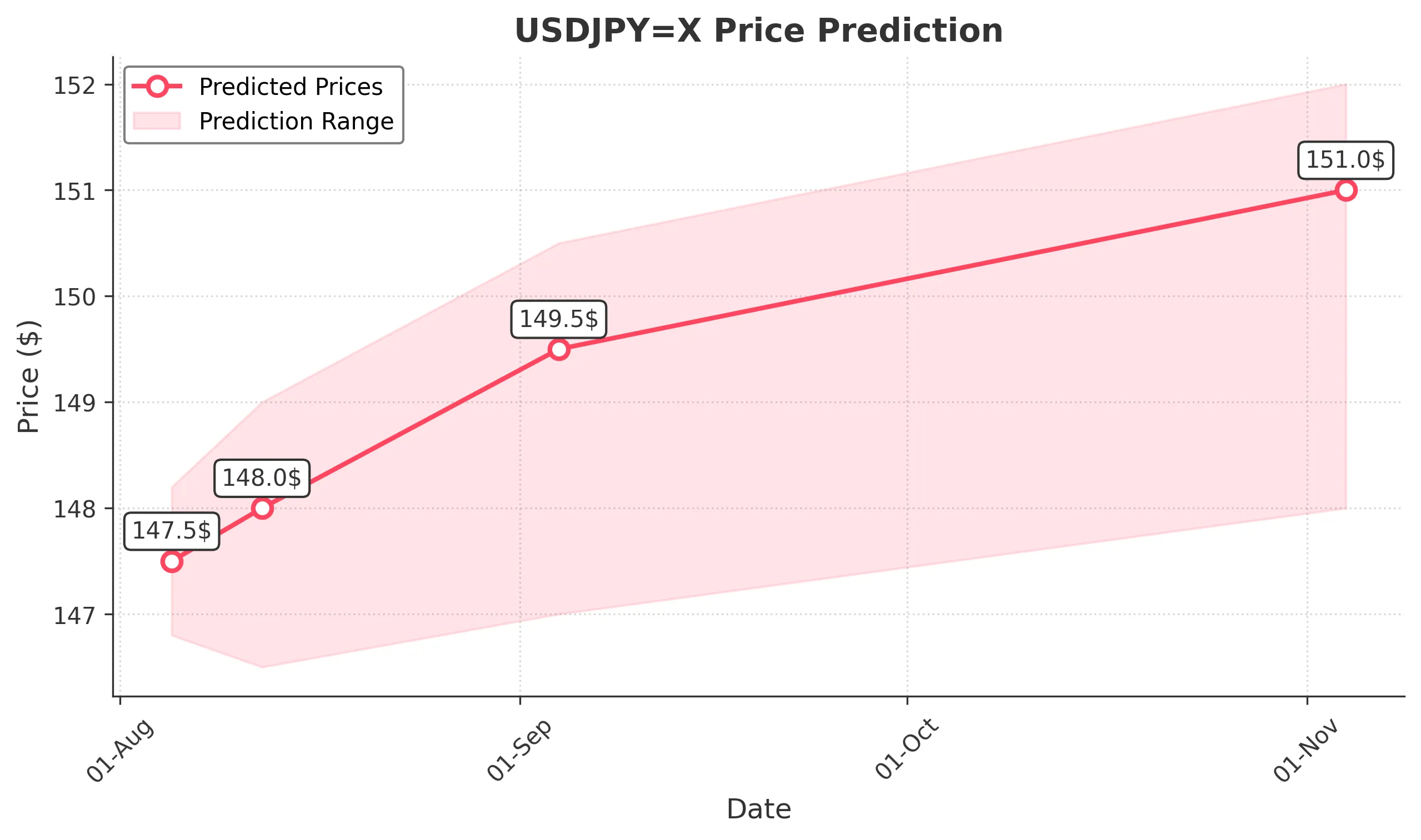

3 Months Prediction

Target: November 4, 2025$151

$150

$152

$148

Description

Long-term outlook remains bullish, with potential for prices to reach new highs. The market may react positively to macroeconomic developments, but resistance at 152.000 could limit gains.

Analysis

The overall trend has been bullish, with key support at 148.000. Technical indicators suggest a strong upward trajectory, but external factors could introduce volatility. The market sentiment is generally positive, but caution is warranted.

Confidence Level

Potential Risks

Long-term predictions are subject to greater uncertainty due to potential economic shifts and geopolitical factors.