USDJPYX Trading Predictions

1 Day Prediction

Target: August 6, 2025$146.5

$146.8

$147

$146

Description

The recent bullish trend suggests a slight pullback. The RSI is nearing overbought levels, indicating potential resistance. A Doji candlestick pattern indicates indecision, but overall sentiment remains bullish.

Analysis

Over the past 3 months, USDJPY has shown a bullish trend with significant resistance around 150. The RSI indicates overbought conditions, while MACD shows bullish momentum. Volume has been stable, but recent spikes suggest increased interest. Key support is at 145.

Confidence Level

Potential Risks

Market volatility and external news could impact the price direction.

1 Week Prediction

Target: August 13, 2025$145

$146

$146.5

$144.5

Description

Expect a slight decline as the market corrects from overbought conditions. The MACD is showing signs of convergence, indicating potential bearish momentum. Support at 145 may hold, but a break could lead to further declines.

Analysis

The stock has been in a bullish phase, but recent price action suggests a potential correction. Key resistance at 150 remains unbroken. The ATR indicates increasing volatility, and the market sentiment is mixed, with some bearish signals emerging.

Confidence Level

Potential Risks

Unforeseen macroeconomic events could lead to volatility.

1 Month Prediction

Target: September 5, 2025$144

$145

$145.5

$143

Description

A bearish trend is anticipated as the market corrects further. The RSI is expected to drop below 50, indicating weakening momentum. Fibonacci retracement levels suggest support around 143, which could be tested.

Analysis

The past three months have shown a strong bullish trend, but signs of exhaustion are evident. The MACD is flattening, and volume has decreased, indicating waning interest. Key support at 143 is critical for maintaining upward momentum.

Confidence Level

Potential Risks

Economic data releases could significantly impact market direction.

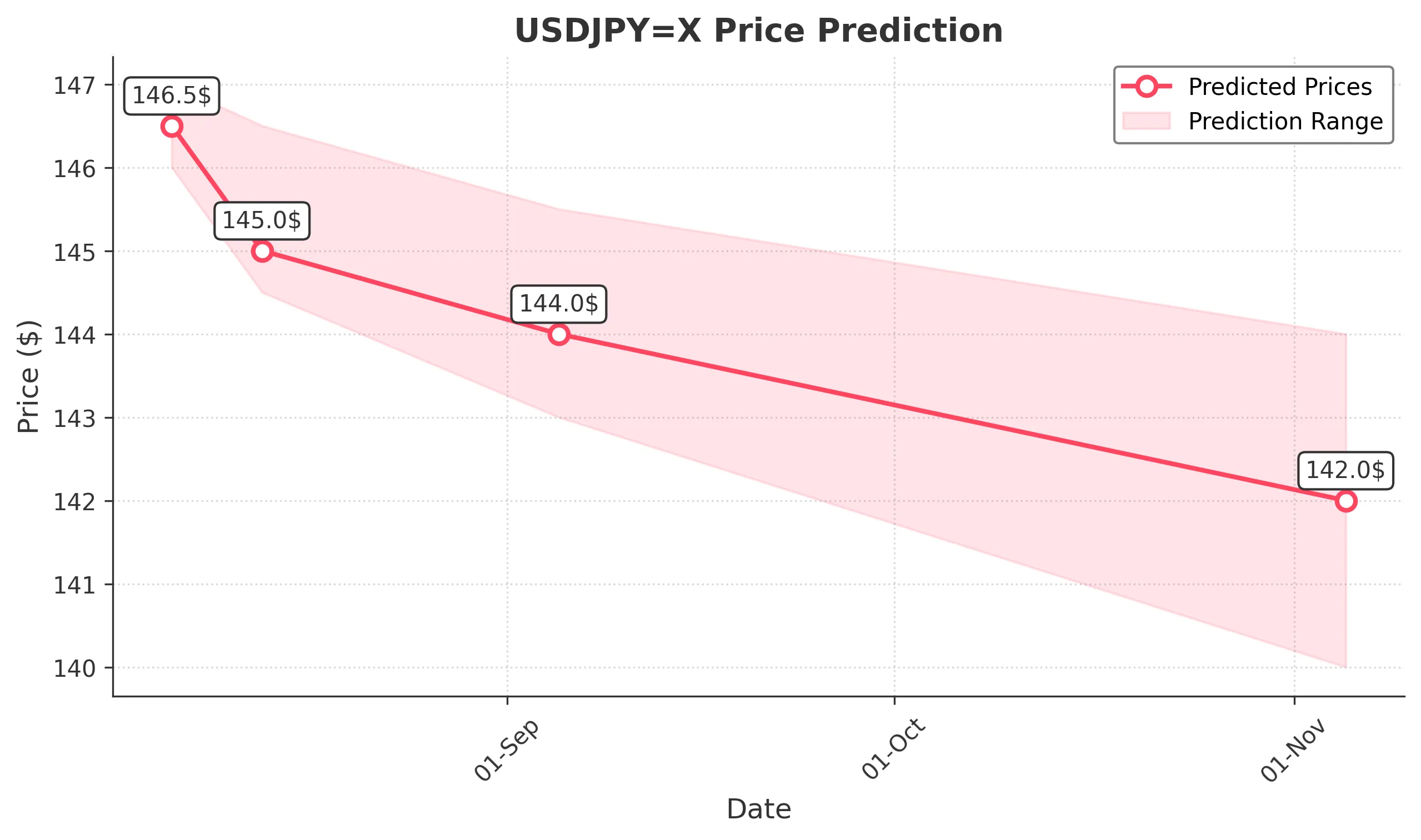

3 Months Prediction

Target: November 5, 2025$142

$143

$144

$140

Description

A bearish outlook is expected as the market continues to correct. The MACD may cross below the signal line, indicating a shift in momentum. Key support at 140 could be tested if bearish sentiment persists.

Analysis

The overall trend has shifted from bullish to bearish, with significant resistance at 150. The ATR indicates increasing volatility, and the market sentiment is cautious. Key support levels will be crucial in determining future price action.

Confidence Level

Potential Risks

Global economic conditions and geopolitical events could lead to unexpected volatility.