USDJPYX Trading Predictions

1 Day Prediction

Target: August 12, 2025$147.5

$147.3

$148

$146.8

Description

The market shows a slight bullish trend with a potential close around 147.500. The RSI indicates neutrality, while the MACD shows a bullish crossover. However, recent volatility suggests caution.

Analysis

Over the past 3 months, USDJPY has shown a bearish trend with significant support at 145. The recent price action indicates a potential reversal, but volatility remains high. Key resistance is at 150.

Confidence Level

Potential Risks

Market sentiment could shift due to external news or economic data releases, impacting the prediction.

1 Week Prediction

Target: August 19, 2025$148

$147.8

$149

$146.5

Description

A bullish sentiment is expected to prevail over the week, with a close around 148.000. The MACD is bullish, and the price is approaching the upper Bollinger Band, indicating potential upward momentum.

Analysis

The stock has been fluctuating around key levels, with resistance at 150. The RSI is nearing overbought territory, suggesting a possible pullback. Volume has been low, indicating a lack of strong conviction.

Confidence Level

Potential Risks

Unexpected economic data or geopolitical events could lead to volatility and affect the price direction.

1 Month Prediction

Target: September 12, 2025$149.5

$148

$150.5

$147

Description

Expect a gradual increase towards 149.500 as bullish momentum builds. The Fibonacci retracement levels support this upward trend, but caution is advised as the market may face resistance at 150.

Analysis

The overall trend has been bullish, with significant support at 145. The MACD and moving averages suggest upward momentum, but the RSI indicates potential overbought conditions. Volume remains a concern.

Confidence Level

Potential Risks

Market corrections are possible, especially if economic indicators do not align with bullish expectations.

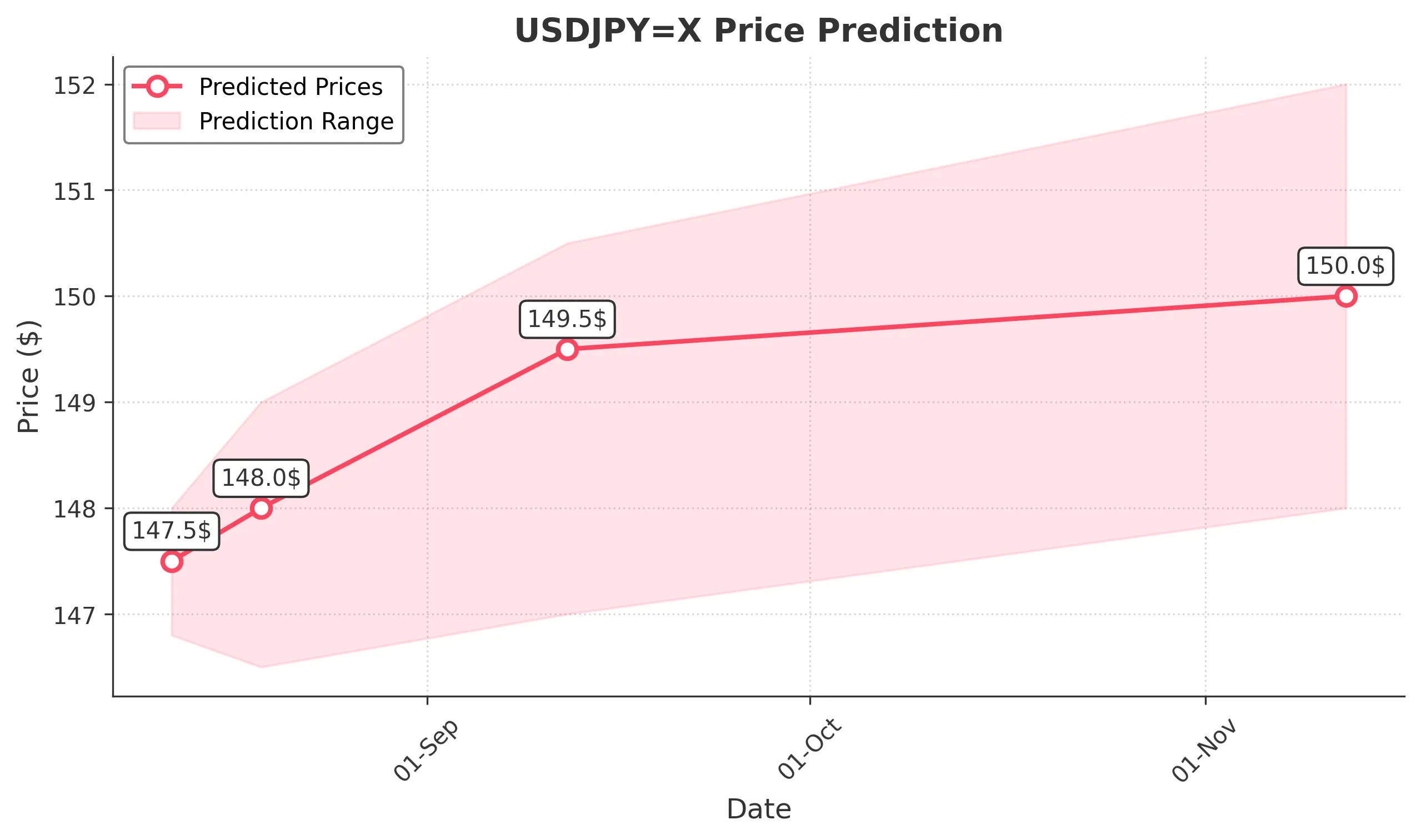

3 Months Prediction

Target: November 12, 2025$150

$149

$152

$148

Description

A target of 150.000 is anticipated as the market stabilizes. The bullish trend is supported by strong technical indicators, but external economic factors could introduce volatility.

Analysis

The stock has shown resilience with a bullish trend, but the market is sensitive to external factors. Key resistance at 150 may pose challenges, and the overall sentiment remains mixed.

Confidence Level

Potential Risks

Long-term predictions are uncertain due to potential economic shifts and geopolitical tensions that could impact currency values.