XRP Trading Predictions

1 Day Prediction

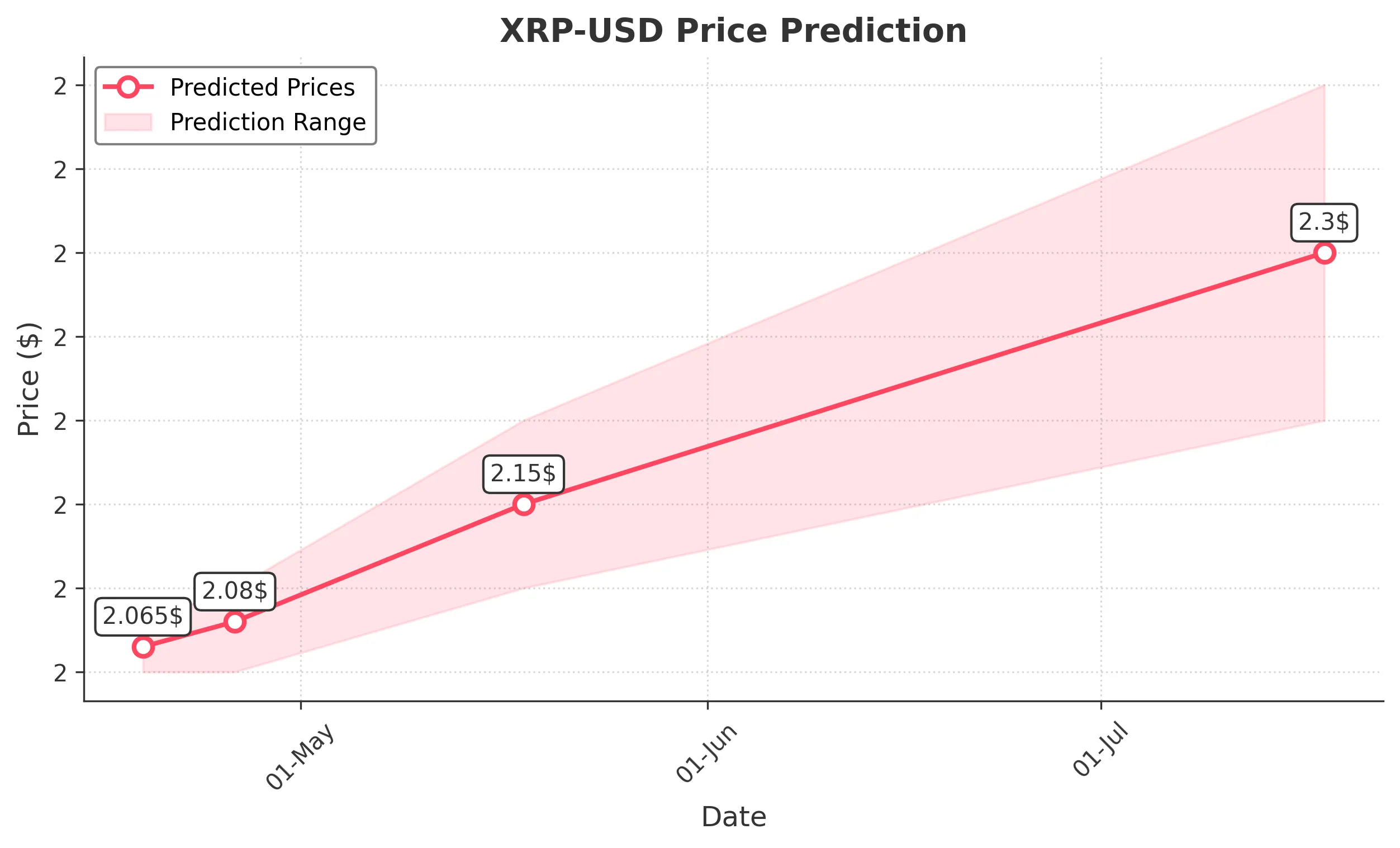

Target: April 19, 2025$2.065

$2.06

$2.08

$2.05

Description

The price is expected to remain stable with slight fluctuations. The recent candlestick patterns indicate indecision, and the RSI is neutral, suggesting a potential for a minor rebound or consolidation.

Analysis

XRP has shown a bearish trend over the past month, with significant support around 2.05. The RSI is hovering around 50, indicating a lack of momentum. Volume has decreased, suggesting lower interest.

Confidence Level

Potential Risks

Market volatility and external news could impact this prediction significantly.

1 Week Prediction

Target: April 26, 2025$2.08

$2.065

$2.1

$2.05

Description

A slight upward trend is anticipated as the market may react positively to potential news. The MACD shows a bullish crossover, indicating a possible reversal in momentum.

Analysis

The stock has been trading sideways with minor fluctuations. Key resistance is at 2.10, while support remains at 2.05. The Bollinger Bands are tightening, indicating potential volatility.

Confidence Level

Potential Risks

Unforeseen market events or regulatory news could lead to sudden price changes.

1 Month Prediction

Target: May 18, 2025$2.15

$2.08

$2.2

$2.1

Description

A gradual recovery is expected as market sentiment improves. The Fibonacci retracement levels suggest a potential bounce back towards 2.15, supported by bullish divergence in the RSI.

Analysis

XRP has been in a bearish phase, but signs of recovery are emerging. The MACD is showing potential bullish signals, and the average volume is increasing, indicating renewed interest.

Confidence Level

Potential Risks

Market sentiment can shift quickly, and external factors may hinder recovery.

3 Months Prediction

Target: July 18, 2025$2.3

$2.15

$2.4

$2.2

Description

Long-term bullish sentiment is anticipated as the market stabilizes. The moving averages suggest a potential upward trend, and positive news could further support this movement.

Analysis

The overall trend has been bearish, but a potential reversal is on the horizon. Key resistance levels are at 2.40, while support is at 2.10. The market remains sensitive to external news.

Confidence Level

Potential Risks

Long-term predictions are subject to high uncertainty due to market dynamics and regulatory changes.